Business Tax For Sole Proprietorship Philippines

The total share of a foreigner in a firm can be 40 while the remaining will be of. The 8 withholding tax rate replaces the two-tier rate of 10 for self-employed and professionals earning less than 720000 income every year or 15 for those earning more than 720000 per year.

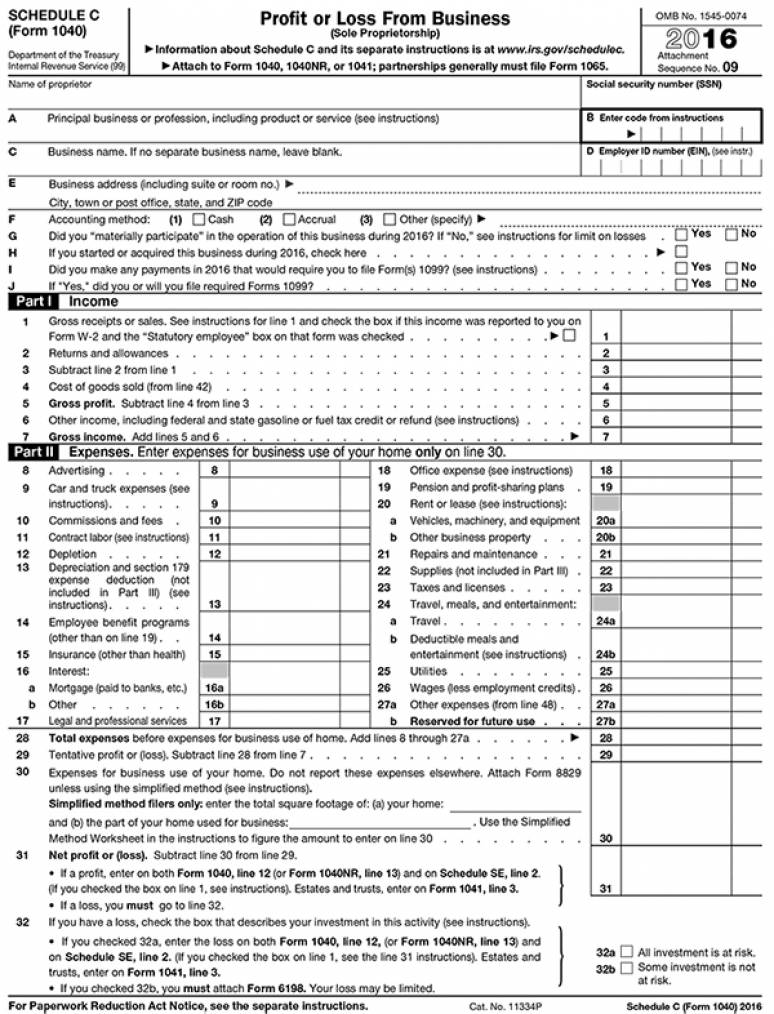

Profit Or Loss From Business Sole Proprietorship Irs Tax Form 1040 Schedule C 2016 Package Of 100 U S Government Bookstore

Profit Or Loss From Business Sole Proprietorship Irs Tax Form 1040 Schedule C 2016 Package Of 100 U S Government Bookstore

If you are a sole proprietor use the information in the chart below to help you determine some of the forms that you may be required to file.

Business tax for sole proprietorship philippines. How to Start a Business in the Philippines. Under both the tax due would be P2250000. A sole proprietor is someone who owns an unincorporated business by himself or herself.

I am planning to register my business as a sole proprietorship just to have a Official Receipt purposes. It is also very fast to put up. Its easy to set up a Sole Proprietorship in the Philippines at least as compared to a Corporation or a Partnership.

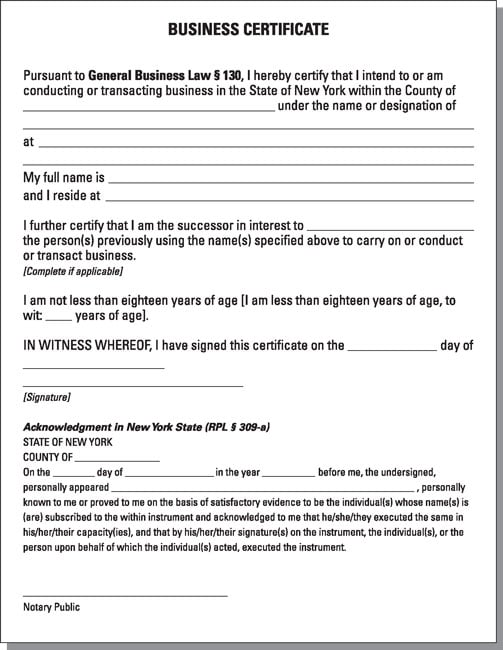

My business is like i am an agent or a middleman. The large majority of businesses in the Philippines are sole proprietorships. Those who plan to establish a sole proprietorship in the Philippines need to register with the Department of Trade and Industry and must apply for a business trade name.

It is a progressive tax which the tax rate increases as the taxable base amount increases. This is his taxable business income. What are the Taxes a Small Business Needs To Pay.

Percentage tax is a business tax imposed on persons entities or transactions specified under Sections 116 to 127 of the National Internal Revenue Code of 1997 also known as Tax Code as amended and as required under special laws. If the small business is owned by a corporation the 8 tax will not apply. No clear-cut definition between personal and business income because the sole proprietor is personally liable for the income tax of the business.

The main taxes for sole proprietors will be. 2202500 35 of the excess over 5000000. Info Plus Forms And Deadlines.

If you have very limited capital then this may be your only option. This means if a business has more than P7500000 in taxable income it will be paying less tax as a corporation than as a. Sole proprietor is subject to unlimited personal liability for the debts losses and liabilities of the business.

It is the most simple and inexpensive alternative. On the other hand if you are a self-employed professional or an owner of a single proprietorship business your income tax expense is computed using a graduated tax rate. He must pay self-employment tax of 153 on this income or 1530.

Now for a foreigner it might be a challenging task to start a business in the Philippines as legally a foreigner cannot have a business license in their name. How to Set Up a Sole Proprietorship in the Philippines. The 8 tax is applicable only to self-employed individuals sole proprietors and professionals whose gross receipts or gross sales and other non-operating income for the year do not exceed the three million pesos P3000000 value-added tax VAT threshold and are not subject to other types of percentage tax.

However if you are the sole member of a domestic limited liability company LLC you are not a sole proprietor if you elect to treat the LLC as a corporation. DTI LGU or Municipal Hall and Baranggay and the Revenue District Office of BIR in the city of your business address. 8 withholding tax for self-employed and professionals.

Sole Proprietorship This is when only one person owns and controls the business. He completes his Schedule C which shows a net business income as 10000. Accomplished Business Name Registration Form Single Proprietorship Tax Identification Number TIN List of five business names ranked according to preference.

Register Your Business Name at the Department of Trade Industry DTI First search whether the name that you have decided is similar to the. Sole proprietor cannot raise capital by selling an interest in the business or obtain capital funding through established channels. In the Philippines sole proprietors and their businesses are considered as a single taxpayer sharing the same Tax Identification Number TIN for tax purposes.

Register with the Barangay. Taxable corporations may be taxed using a fixed income tax rate. You can either opt for the Graduated Income Tax rate or the 8 Flat Income Tax Rate.

Terry is a sole proprietor a single tax filer. Example of my business is that I have a customer that needs various furnitures and i have these furnitures manufacture to a certain factory. Register the Business with the Mayors Office.

Quarterly Income Tax BIR Form 1701Q - Under the new Train Law those who earn less than P250000 annually are exempt from paying income tax return. Under the current tax regime the CIT and PIT dues will be equivalent at the taxable income of P7500000. Percentage Tax Monthly and Quarterly This is a business tax imposed on persons or entities and or transactions who 1 sells or lease goods.

NationalP2000 RegionalP1000 CityMunicipalityP500 BarangayP200Total fees to include Php 15 documentary stamp tax DST 2. International airshipping carriers doing business in the Philippines on their gross receipts derived from. To set up a Sole Proprietoship in the Philippines it requires going to 3 government agencies.

New Income Tax Table 2020 Philippines Tax Table Income Tax Income

New Income Tax Table 2020 Philippines Tax Table Income Tax Income

Affidavit Of No Income Elegant 10 In E Affidavit Form Free Sample Example Format Peterainsworth In 2021 Formal Letter Template Income List Of Jobs

Affidavit Of No Income Elegant 10 In E Affidavit Form Free Sample Example Format Peterainsworth In 2021 Formal Letter Template Income List Of Jobs

Taxes For Small Businesses Quickstart Guide Ebook Small Business Tax Small Business Bookkeeping Small Business Accounting

Taxes For Small Businesses Quickstart Guide Ebook Small Business Tax Small Business Bookkeeping Small Business Accounting

Corporation Or Sole Proprietorship A Tax Perspective Businessworld

Corporation Or Sole Proprietorship A Tax Perspective Businessworld

Corporation Or Sole Proprietorship A Tax Perspective Businessworld

Corporation Or Sole Proprietorship A Tax Perspective Businessworld

Sole Proprietorship Business Do You Have Any 10 Questions Based On A Sole Proprietorship Business Sole Proprietorship Sole Proprietor Sole

Sole Proprietorship Business Do You Have Any 10 Questions Based On A Sole Proprietorship Business Sole Proprietorship Sole Proprietor Sole

Sole Proprietorship And Your Import Export Business Dummies

Sole Proprietorship And Your Import Export Business Dummies

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Image Result For Train Tax Table Income Tax Income Tax Guide

Image Result For Train Tax Table Income Tax Income Tax Guide

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes

3 Major Differences Between Sole Proprietorship One Person Corporation Opc Cg Singh Cpa Associates

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

How To File Your Small Business Taxes Free Checklist Gusto

How To File Your Small Business Taxes Free Checklist Gusto

How To Establish An Llc Yourself The Ultimate Guide Starting A Business Business Tips Home Based Business

How To Establish An Llc Yourself The Ultimate Guide Starting A Business Business Tips Home Based Business

How To Register As A One Time Taxpayer With Bir Form 1904 Business Help Map Activities Business Names

How To Register As A One Time Taxpayer With Bir Form 1904 Business Help Map Activities Business Names

Sole Proprietorship Form Page 1 Line 17qq Com

Sole Proprietorship Form Page 1 Line 17qq Com

Calculate Your Self Employment Taxes Sole Proprietorship Sole Proprietor Self

Calculate Your Self Employment Taxes Sole Proprietorship Sole Proprietor Self

How To Register A Business In Bir Easy Step By Step Guide Register A Business In Bir For Sole Proprietorship Bir For Step Guide Sole Proprietorship Business

How To Register A Business In Bir Easy Step By Step Guide Register A Business In Bir For Sole Proprietorship Bir For Step Guide Sole Proprietorship Business