How To Establish A Payment Plan With The Irs

In order to apply online you need to create an account on the IRS website. Youre applying for a long-term payment plan you owe 50000 or less in.

Instructions For Form 9465 10 2020 Internal Revenue Service

Instructions For Form 9465 10 2020 Internal Revenue Service

Change the bank routing and account number.

How to establish a payment plan with the irs. All you have to do is hire the company and provide the information they request. Setting up a payment plan with the IRS could give you a little more time to pay off your tax debts. For example you could give.

Calculate your monthly payment. 2 The payback time frame was previously 120 days but the IRS extended it by 60 days to help taxpayers struggling due to COVID-19. Click on Make a Payment When asked for the Reason of Payment choose Tax Return or Notice When prompted in the Apply Payment To section choose 1040 1040A 1040EZ Choose the tax year you owe in the Tax Period for Payment and continue.

You can learn more about creating an account here. In order to mitigate some of these collection measures an individual taxpayer should consider requesting a payment plan from the IRS for the balance they owe. Change your monthly payment amount.

To some degree you get to choose how much you want to pay every month. If you move let the IRS know your new address by mailing Form 8822 Change of Address. If you need to set up a payment plan to eliminate your tax debt follow these steps.

Once you have created an account you can set up payment plans and pay your tax bill online. A payment plan can be set up online through INtax Pay or by contacting our Payment Services Division at 317 232-2240. The best way to apply for an IRS payment plan is online.

Determine your total unpaid tax debt. Even so you are still required to make all scheduled payments under your payment plan. You must file all back tax returns to determine your total tax balance before you.

CP523 or Letter 2975. You dont need to call the IRS to get on a payment plan. People who owe less than 100000 can apply for a short-term plan online at IRSgovOPA.

Change your monthly payment due date. You can use the Online Payment Agreement tool to make the following changes. The IRS offers multiple types of.

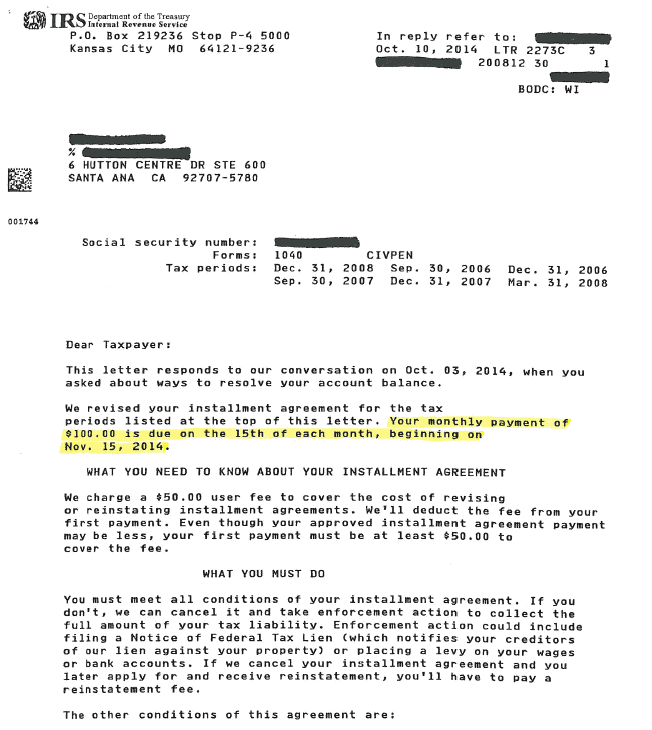

If you can afford to pay off your balance in 180 days or fewer you can set up a short-term payment plan. When you miss a payment file another balance due return without payment or fail to comply with the terms of the payment plan the IRS ultimately sends you one of two notices. If you want to change the terms of your payment plan you can do so online by signing onto the Online Payment Agreement tool and clicking on the ApplyRevise button.

The IRS will ask you what you can afford to pay per month encouraging you to pay as much as possible to reduce your interest and penalties. Tax relief companies negotiate with the IRS on your behalf. Unfortunately interest will continue to build on your tax debts.

To apply online use the Online Payment Agreement Application OPA on the IRSs website. If the IRS grants the request the agency will establish a payment plan so that you can make monthly payments on your back taxes. Convert an existing agreement to a Direct Debit agreement.

Yes your debt may be slowly paid off in manageable increments but interest will still be charged heavily on your outstanding balance. If you owe 50000 or less and need more time to pay you can apply for an Online Payment Agreement on IRSgov. These notices do not terminate your agreement but they do put you on notice that you have 30 days to take action or the agreement will be.

A direct debit payment plan is your best option. This plan is the lower-cost hassle-free way to pay. When applying through the mail complete Form 9465 Installment Agreement Request or Form 433-D Installment Agreement.

Theyll handle things like figuring out the best payment plan negotiating to settle your debt for less than you owe and filing paperwork with the IRS. Online Payment Agreement Application Internal Revenue Service Apply Online for a Payment Plan If you are a qualified taxpayer or authorized representative Power of Attorney you can apply for a payment plan including installment agreement online to pay off your balance over time. You can apply online if either of these situations apply to you.

You can apply for an installment agreement online over the phone or via various IRS forms. If you cant pay your taxes on time in the United States you may file a so-called installment agreement with the Internal Revenue Service IRS. Apply for a monthly payment plan.

Don T Make These Mistakes When Reporting 529 Plan Withdrawals Tax Day Filing Taxes Tax Season

Don T Make These Mistakes When Reporting 529 Plan Withdrawals Tax Day Filing Taxes Tax Season

2021 Annual Compensation And Contribution Limits Retirement Plans Retirement Planning How To Plan Retirement

2021 Annual Compensation And Contribution Limits Retirement Plans Retirement Planning How To Plan Retirement

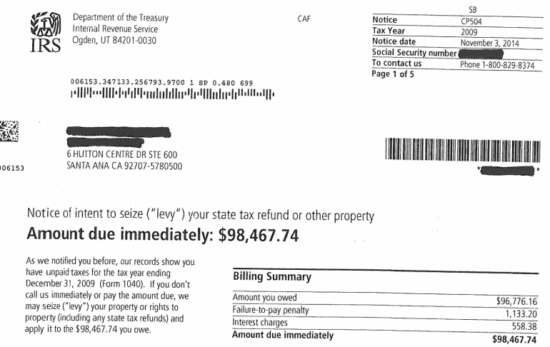

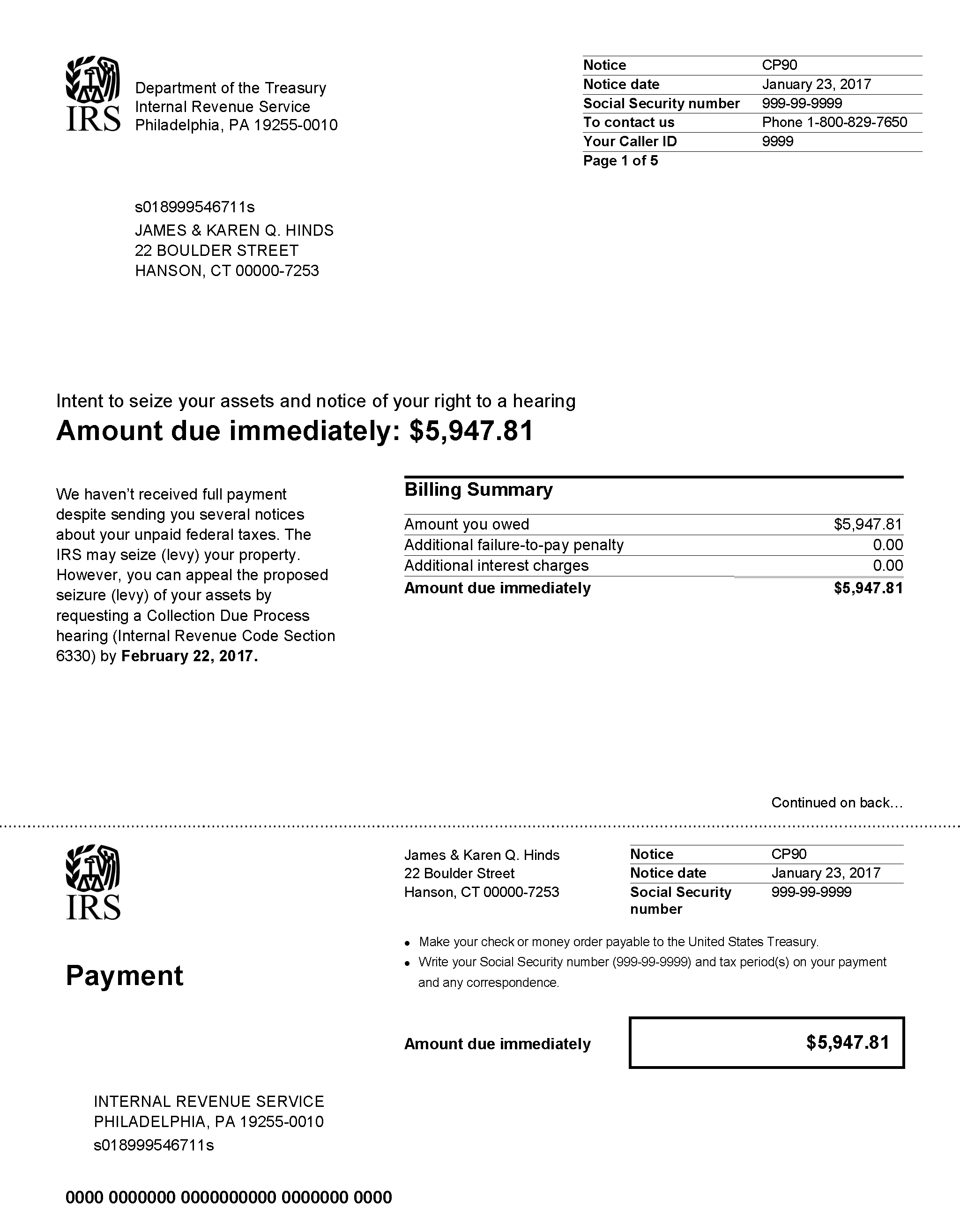

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Supremecapitalgroup On Twitter Irs Private Foundation Cafeteria Plan

Supremecapitalgroup On Twitter Irs Private Foundation Cafeteria Plan

When Are Taxes Due For 2021 Tax Year Dates You Need To Know Debt Management Finance Budgeting

When Are Taxes Due For 2021 Tax Year Dates You Need To Know Debt Management Finance Budgeting

The Achieving A Better Life Experience Able Act Permits A State To Establish And Maintain A New Type Of Tax Advantaged Sav Types Of Taxes Better Life Revenue

The Achieving A Better Life Experience Able Act Permits A State To Establish And Maintain A New Type Of Tax Advantaged Sav Types Of Taxes Better Life Revenue

How To File Your Monthly Taxes Taxtime Bookkeeping Business Small Business Bookkeeping Business Tax

How To File Your Monthly Taxes Taxtime Bookkeeping Business Small Business Bookkeeping Business Tax

Track Your Irs Stimulus Check Status Now With The Get My Payment Tool Tax Refund Irs Prepaid Debit Cards

Track Your Irs Stimulus Check Status Now With The Get My Payment Tool Tax Refund Irs Prepaid Debit Cards

/9465-700bb91065234917b8d2866f2306afe9.jpg) Form 9465 Installment Agreement Request Definition

Form 9465 Installment Agreement Request Definition

Pin On Cat S Small Business Success Tips

Pin On Cat S Small Business Success Tips

Advice On How To Reduce Taxes Tax Time Expat Tax Tax Credits

Advice On How To Reduce Taxes Tax Time Expat Tax Tax Credits

1040 Income Tax Cheat Sheet For Kids Consumer Math Consumer Math High School Teaching Teens

1040 Income Tax Cheat Sheet For Kids Consumer Math Consumer Math High School Teaching Teens

Https Www Irs Gov Pub Irs Utl Oc Tax Account Payments Online Pdf

3 8 45 Manual Deposit Process Internal Revenue Service

3 8 45 Manual Deposit Process Internal Revenue Service

The Difference Between Sales Tax And Use Tax Affordable Bookkeeping Payroll Sales Tax Tax Bookkeeping

The Difference Between Sales Tax And Use Tax Affordable Bookkeeping Payroll Sales Tax Tax Bookkeeping

Instructions For Form 8995 2019 Internal Revenue Service Workbook Federal Income Tax Internal Revenue Service

Instructions For Form 8995 2019 Internal Revenue Service Workbook Federal Income Tax Internal Revenue Service