How Do I Sign Up For Mtd Vat

Your VAT registration. Making Tax Digital for VAT will apply to all VAT-registered businesses so those classed as voluntary with a taxable turnover below the VAT threshold will need to ensure they are MTD ready.

Stay Ahead Of Upcoming Changes To Uk Vat Submissions Xu Hub

Stay Ahead Of Upcoming Changes To Uk Vat Submissions Xu Hub

Businesses that currently pay VAT by Direct Debit cannot sign up in the 7 working days leading up to or the 5 working days after their VAT Return is due.

How do i sign up for mtd vat. If you would like to check whether you are already registered for MTD you can do this here. Dont forget to check your spam folder. Before you can set QuickBooks up for MTD you first need to have signed up for MTD with HMRC.

VitalTax gets all of your VAT information directly from HMRC putting you in control of your data. Sign up for MTD for VAT with HMRC and wait for confirmation by email that youve been moved to the MTD service. This may take a few days.

Therefore in my mind accountants are wasting their time with the new digital authorisation as they will additionally have to apply for the old 64-8 in addition if they want to be the VAT. Click File VAT Accountants You will. Sign up for Making Tax Digital for VAT.

Hence if you want to phone up HMRC on behalf of your client you will also have to do the other system. From 1 April 2022 all VAT registered businesses must sign up whatever they earn. Be sure to agree with your VAT agent who will be responsible for this process.

Your business email address. In order to submit a VAT return to HMRC for MTD follow these steps below. You can choose to sign up to Making Tax Digital for VAT if your business earns less than 85000.

Are you ready to submit your next VAT Return using software compatible with Making Tax Digital. Want to check your VAT liabilities and payments without leaving Excel. HMRC has now clarified that an existing client of a tax agent wont need to access their BTA as the agent can sign them up for MTD for VAT.

Install VitalTax from within Excel. Click on Start now. The MTD service for VAT is open to VAT businesses and their agents mandated to use it.

Watch this video to learn How to sign up for Making Tax Digital MTD for VAT ReturnsHMRCs new mandate comes into effect 1 April 2019. If you are impacted by the changes or need to check if they will affect you dont worry - were here to help. Yes that is my understanding too.

The process will work like this. You will then be prompted to type in your Government Gateway user ID and password. Visit the MTD sign up page.

Confirm you have signed up for MTD. Have your Government Gateway login details ready. I did not wish to sign up for MTD early I had not reason to sign up to it to make the March return.

How do I register my business for MTD. Unfortunately I could find no way to get back to the original VAT report. The process to sign up for MTD with HMRC can be completed by either a business or by their VAT agent advisor or accountant such as Menzies.

Youll receive an email confirmation from them when its been completed. Link your non-MTD client s to your Agent Services Account by clicking here. Check the VAT number in financial settings is correct.

Register for MTD for VAT with HMRC allow around seven working days While Wednesday 7th August 2019 is the first hard deadline for some quarterly VAT filers the amount of time it takes to sign up and register for MTD for VAT with HMRC means youll have to. Businesses with a taxable turnover below the VAT threshold can also sign up for MTD for VAT voluntarily. Go to VAT at the top of the menu.

It took me to a Making Tax Digital for VAT sign up page. I did not wish to sign up to MTD as it was too early for compulsory sign up. To sign up you need.

Complete step-by-step MTD registration process for taxpayers or agents. I just wanted to file a VAT return. Link your MTD software to your ASA.

Check if you need to follow HMRCs rules for Making Tax Digital for VAT find software and sign up. You will then be asked a question. Set up your Agent Services Account ASA.

A Government Gateway user ID and password - if you do not have a user ID you can create one when you use the service. To sign up for MTD please follow the below steps. This article is for small businesses and accountants who are eligible for Making Tax Digital MTD or signed up to MTD voluntarily.

It promises to revol. Sign up each of your clients to MTD for VAT by clicking here. After youve signed up your client s youll receive a confirmation email from email protected within 72 hours.

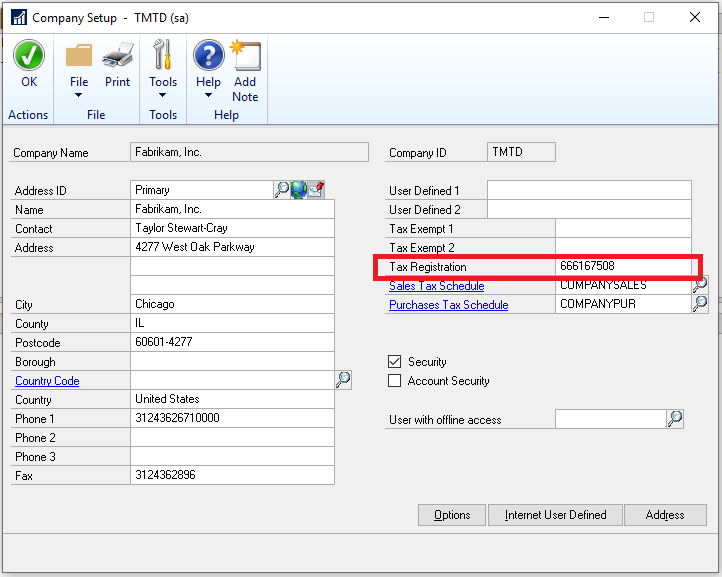

Mtd Vat Tax Entry Not Picking Vat Registration Number Sage X3 General Discussion Sage X3 Sage City Community

Mtd Vat Tax Entry Not Picking Vat Registration Number Sage X3 General Discussion Sage X3 Sage City Community

Submit A Vat Return To Hmrc Mtd For Small Busine

Submit A Vat Return To Hmrc Mtd For Small Busine

Submit A Vat Return In A Making Tax Digital Mtd Compliant Way In Quickbooks Youtube

Submit A Vat Return In A Making Tax Digital Mtd Compliant Way In Quickbooks Youtube

Vat Return Services Bookkeeping Peterborough Business

Vat Return Services Bookkeeping Peterborough Business

Hmrc Integration For Making Tax Digital Mtd Brightpearl Help Center

Hmrc Integration For Making Tax Digital Mtd Brightpearl Help Center

Hmrc Integration For Making Tax Digital Mtd Brightpearl Help Center

Hmrc Integration For Making Tax Digital Mtd Brightpearl Help Center

Hmrc Integration For Making Tax Digital Mtd Brightpearl Help Center

Hmrc Integration For Making Tax Digital Mtd Brightpearl Help Center

Vat And Make Tax Digital Dynamics Gp Microsoft Docs

Vat And Make Tax Digital Dynamics Gp Microsoft Docs

How To Set Up Vat Online Read Tutorial Quickbooks Uk

How To Set Up Vat Online Read Tutorial Quickbooks Uk

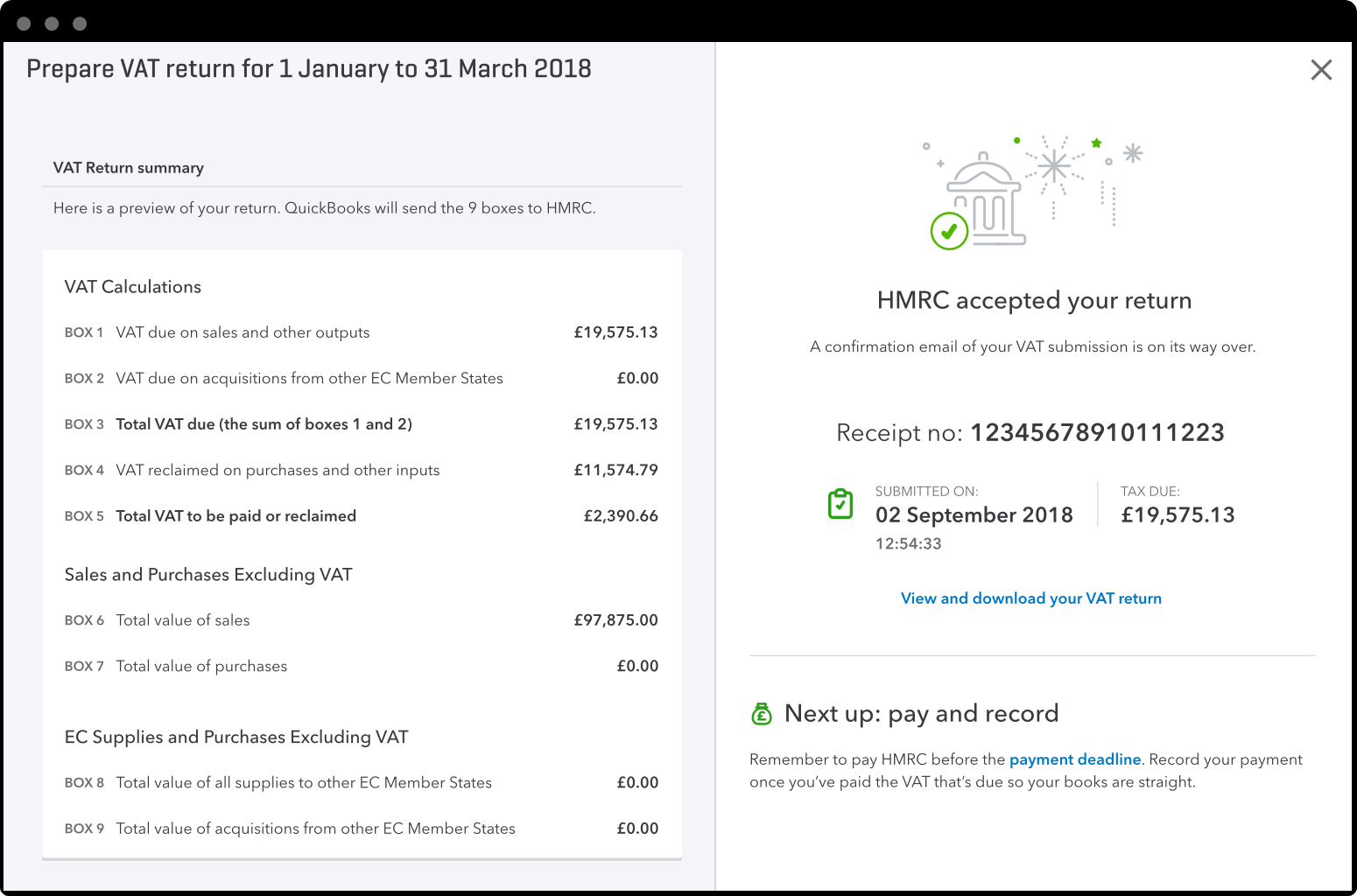

How To Do An Online Vat Return With Hmrc Quickbooks Uk

How To Do An Online Vat Return With Hmrc Quickbooks Uk

Making Tax Digital Explained What You Need To Know Ecosio

Making Tax Digital Explained What You Need To Know Ecosio

What Is Making Tax Digital Mtd Freshbooks

What Is Making Tax Digital Mtd Freshbooks

How To Do An Online Vat Return With Hmrc Quickbooks Uk

How To Do An Online Vat Return With Hmrc Quickbooks Uk

How To Set Up Vat Online Read Tutorial Quickbooks Uk

How To Set Up Vat Online Read Tutorial Quickbooks Uk

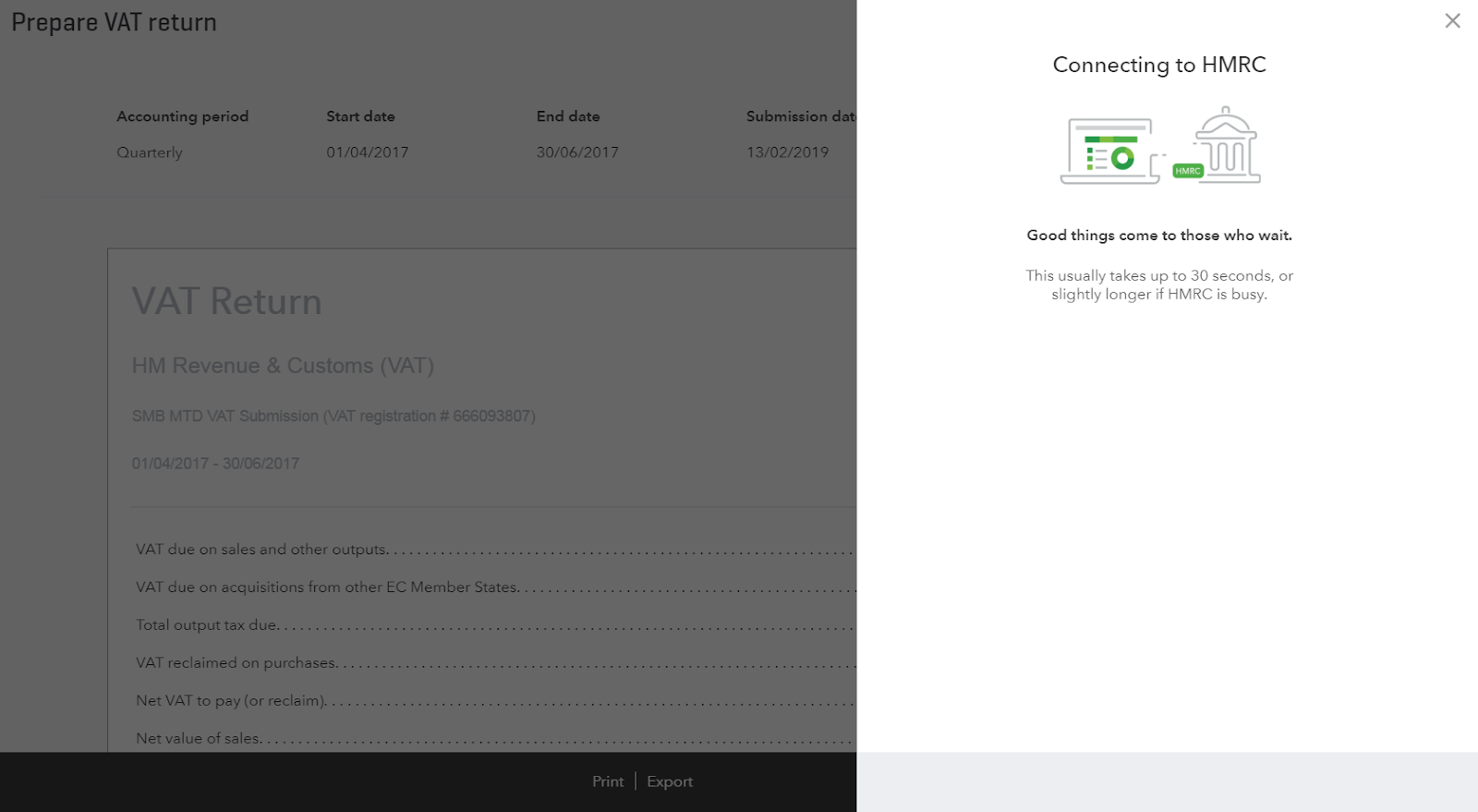

Uk Prepare Your Vat Return Help Center

Uk Prepare Your Vat Return Help Center

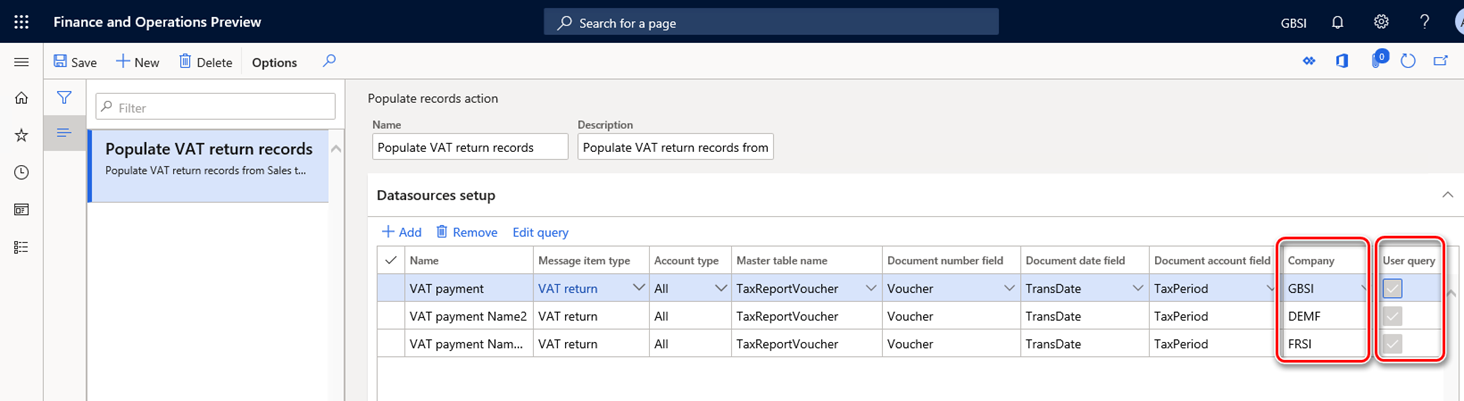

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

Making Tax Digital Vat Returns How To Make Sure You Comply Quickbooks Uk Blog

Making Tax Digital Vat Returns How To Make Sure You Comply Quickbooks Uk Blog

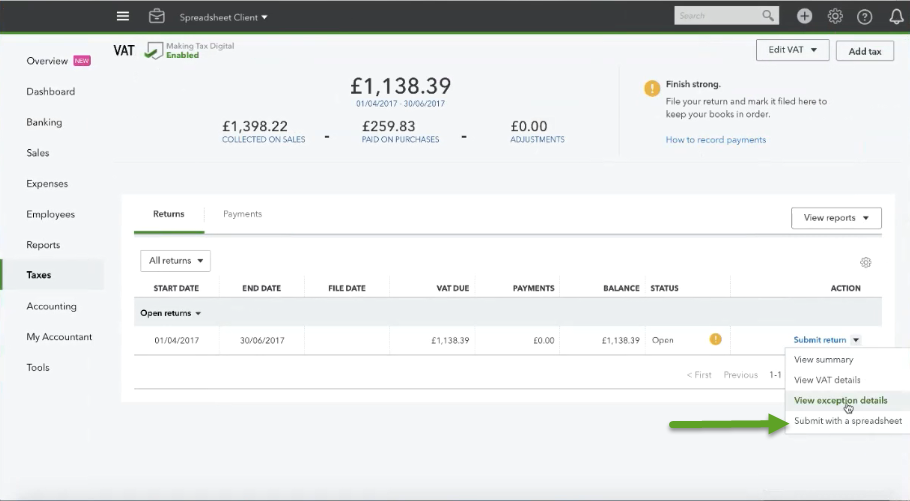

Submit A Vat Return Through Bridging Software In Q

Submit A Vat Return Through Bridging Software In Q