Does A Llc Company Get A 1099

In general Form 1099-Misc must be issued to any business or person to whom your LLC made payments totaling 600 or more for rents services prizes or awards or other payments of income. You are required to send Form 1099-NEC to vendors or sub-contractors during the normal course of business you paid more than 600 and that includes any individual partnership Limited Liability Company LLC Limited Partnership LP or Estate.

But not an LLC thats treated as an S-Corporation or C-Corporation.

Does a llc company get a 1099. Who are considered Vendors or Sub-Contractors. Some payments do not have to be reported on Form 1099-MISC although they may be taxable to the recipient. The limited liability company LLC is a peculiar form of business type and a recent addition to the types of businesses.

A Limited Liability Company LLC is an entity created by state statute. This includes S-Corporations and C-Corporations -- they also dont receive 1099 1099-MISCs. The IRS has a form for businesses to use when they retain the services of an LLC that may trigger a 1099 filing requirement.

The payee keeps the 1099 for his records while reporting the income on his tax return. An LLC that is taxed as a corporation files different forms that replace the use of Form 1099-MISC. If their LLC is taxed as an S- or a C-Corp you do not unless an exception applies as described above.

A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832. Payments for which a Form 1099-MISC is not required include all of the following. When your business engages an LLC contractor send the company a Request for Taxpayer Identification Number and Certification which requires the LLC to disclose its EIN or the Social Security number of its sole owner and whether its taxed as a corporation or partnership.

The statement gets replaced when working with Type C LLCs because these businesses have specific rigid rules and forms required for reporting income to the Internal Revenue Service. So LLCs can and will receive 1099s when they are either a single-member LLC or taxed as a partnership. For tax purposes theyre treated as corporations so in general they dont get a 1099.

Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation. The IRS uses Form 1099-MISC to keep track of how much money or other benefits the LLC has paid an independent contractor subcontractor or other nonemployee. If the LLC has multiple members and is not taxed as a corporation the LLC is taxed as a partnership.

However if an it is taxed as a partnership the IRS requires it to issue Form 1099-MISC. 1099-MISCs should be sent to single-member limited liability company or LLCs or a one-person Ltd. If they write P for partnership you issue a 1099-MISC with their EIN on it.

A limited liability company that has elected to keep corporation status does not need a 1099. Heres another way to remember. In this case a manager or member of a company can file a 1099 for that person since for tax purposes the LLC is treated as a person For contractors that operate and file taxes as corporations such as a C-corp.

The PDF version of the form is fillable so both you and the contractor can. Sole proprietor Do send 1099-MISC. Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity.

An LLC will not receive a 1099 if taxed as an s-corporation. Any business including an LLC must issue a 1099 to any independent contractor who is paid more than 600. Basically you do not have to issue a 1099 MISC to a LLC that has elected to be taxed as a corporation.

In addition the form must be issued to anyone to whom the LLC made royalty payments of 10 or more. The funny part about this is that if you are the one issuing a Form 1099-MISC you will have no way to tell if the vendor you are issuing to is an s-corporation since the business name will only include LLC in the title. There are two types of LLCs - a single owner LLC called a single-member LLC and a multiple-owner multiple-member LLC.

If established as a single-member LLC they file their taxes as an individual so you will provide them with the Form 1099. Few businesses may still give a limited liability company a 1099. If the W-9 indicates they are an LLC that is taxed as a sole proprietorship you need to send a 1099.

The LLC owners are called membersEach member is paid from the business as an owner not as an employee. If they are a single-member LLC that is not taxed as a corporation they would check the Individualsole proprietor or single-member LLC box. You do need to issue the LLC a 1099 MISC.

It will essentially boil down to what type of LLC they are. Unfortunately if your contractor has their own LLC by which they do business it is not so easy. If taxed as a corporation they would have to enter C or S near the Limited liability company box on line 3 of the W-9.

When your total rent payments require a 1099-MISC you will first need to request a W-9 form from the LLC that leases the property to you. A W-9 form is necessary because it allows you to collect.

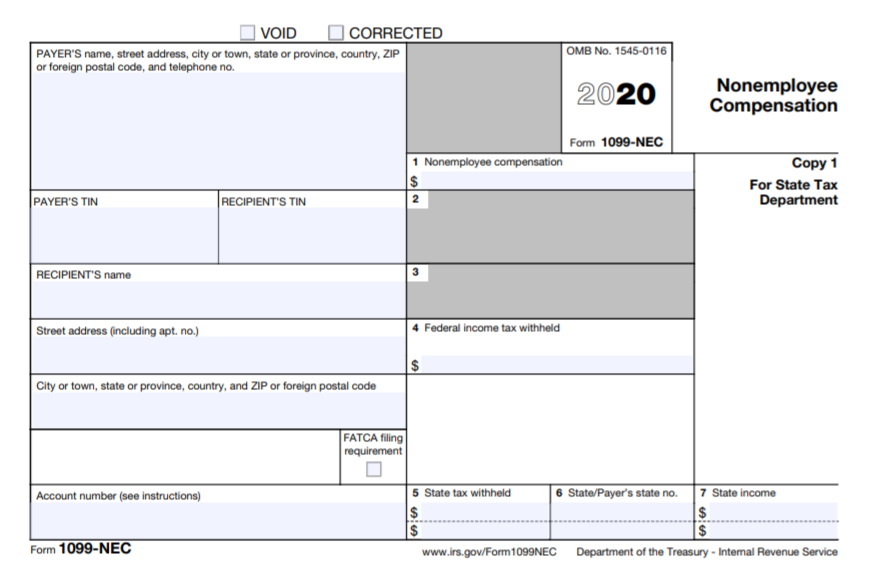

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Do Llcs Get A 1099 During Tax Time Incfile

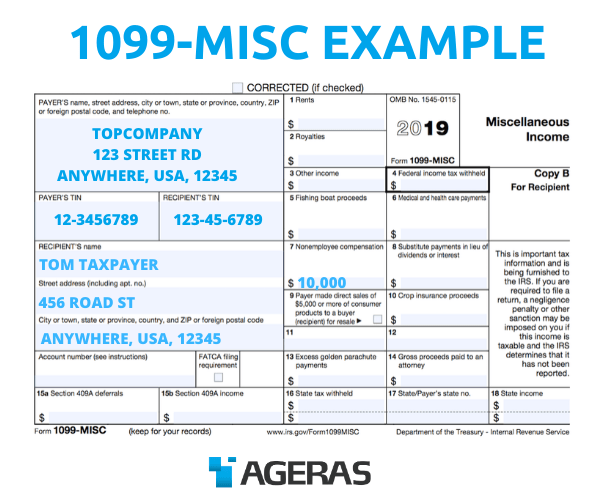

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Choosing 1099 Box Types 1099 Nec And 1099 Misc

Choosing 1099 Box Types 1099 Nec And 1099 Misc

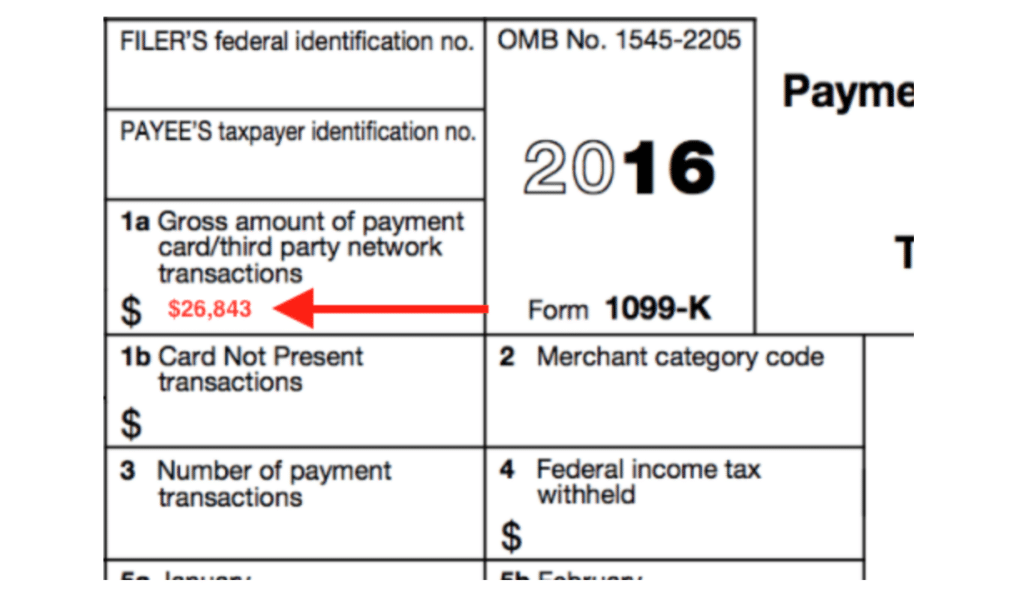

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

What Does It Mean When You Get A 1099

What Does It Mean When You Get A 1099

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

1099 Misc Forms Q A For Commission Paid In 2016 Berkshirerealtors

1099 Misc Forms Q A For Commission Paid In 2016 Berkshirerealtors

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

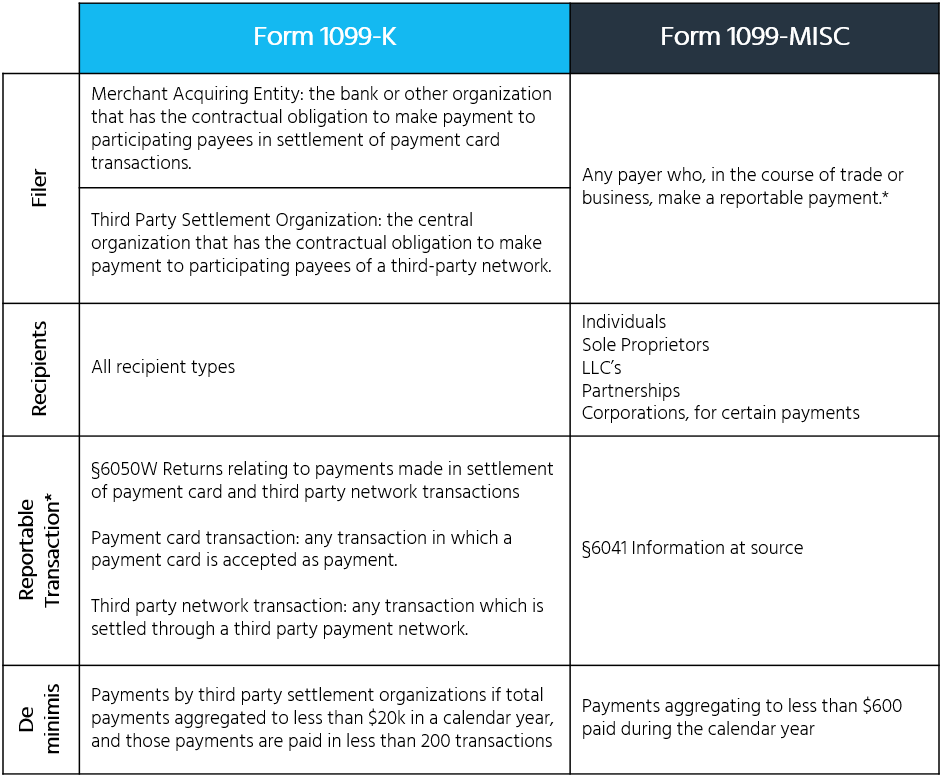

Irs Forms 1099 Misc Vs 1099 K States Close Tax Reporting Gap Sovos

Irs Forms 1099 Misc Vs 1099 K States Close Tax Reporting Gap Sovos