Can An Llc File A Tax Extension

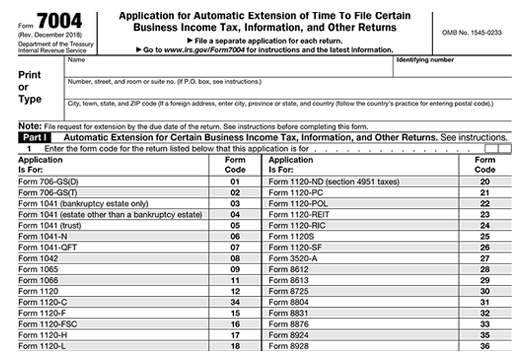

To extend the LLCs filing date by six 6 months file a Business Online Tax Extension or the paper version of IRS Form 7004 and mail it via the US. 15 to file a return.

E File An Irs Tax Extension E File Com

E File An Irs Tax Extension E File Com

An extension request filed after the filing deadline for your return will be invalid.

Can an llc file a tax extension. The IRS must receive an e-filed extension request by midnight on the day of the filing deadline. Pay the amount you owe by May 15 to avoid penalties and interest. To get the extension you must estimate your tax liability on this form and should also pay any amount due.

Calendar year partnership filers can no longer request a 2020 extension since the filing deadline has passed. For certain Employment Tax and Excise Tax requirements discussed below the EIN of the LLC must be used. Taxpayers can access Free File to prepare and e.

However you will need to find out how much you expect to owe in taxes and submit payment for at least 90 of your balance due by May 17 2021 in order to avoid IRS penalties and interest. The Form 7004 does not extend the time for payment of tax. In 2021 most taxpayers must make their tax payment by the original filing deadline of May 17even if they file for an extension.

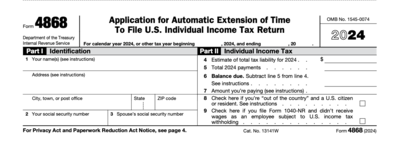

For taxpayers unable to file a federal tax return for 2020 with the due date as April 15 2021 are to file an extension with IRS. See Form 7004 instructions for exceptions pertaining to foreign corporations with no office or place of business in the United States for foreign and certain domestic corporations and for certain partnerships. 15 with Form 4868.

To file for an LLC extension file Form 7004. Requesting a Tax Extension If you know you will not be able to file your LLCs taxes on time you have the option of filing for an extension by filling out form 4868. So if you owe taxes for 2020 you have until May 17 2021 to pay them without interest or penalties.

Most business tax returns can be extended by filing Form 7004. For busy people finding less time need to file a tax extension. If you do not have enough tax information or all your tax records to start and e-file a tax return by Tax Day - in 2021 it is May 17 2021 - you should eFile an IRS extension by that date.

There are special filing deadlines in certain instances. Due dates for corporations If your business is organized as an S corporation the income tax return or extension is due by the 15th day of the 3rd month after the end of your tax year. We give you an automatic 6-month extension to file your return.

Form 4868 is filed by individuals who. Individual tax filers regardless of income can use Free File to electronically request an automatic tax-filing extension. As with Form 4868 the IRS will never acknowledge receipt of approval of your LLC tax extension.

An extension to file your tax return is not an extension to pay. While taxpayers can use IRS Free File to prepare and e-file their taxes for free they can also use it to e-file a free extension request. The six-month extension is due September 15.

This extension is automatic and applies to filing and payments. You must file your extension request on or before the filing deadline of your return. An LLC will need an EIN if it has any employees or if it will be required to file any of the excise tax forms listed below.

You must file by the deadline to avoid a late filing penalty. Once youve filed your extension the same late penalties will apply when the extended period ends. Most businesses can use Form 7004 to request an extension of time to file various tax and information returns.

This can be a common mistake people encounter but the tax. Filing this form gives you until Oct. This extension will give you an extra six months to file.

When you request partnership extension your LLC will get an automatic five-month extension to file Form 1065. For a partnership Form 1065 is submitted instead of Form 1120S. Information on e-filing Form 7004 Information about Form 7004 Application for Automatic Extension of Time To File Certain Business Income Tax Information and Other Returns including recent updates related forms and instructions on how to file.

BY filing an IRS taxpayers avoid late payment penalties or late filings. Single-member LLCs that are taxed as sole proprietorships dont file any tax return since all business earnings are reported on the sole members personal 1040 which is why Form 4868 the. The form serves as an extension application for corporations S corporations partnerships and multiple-member LLCs filing as partnerships.

Most new single-member LLCs classified as disregarded entities will need to. As an example a corporation with a December 31 year-end must file corporate taxes by March 15. Application for Automatic Extension of Time to File Certain Business Income Tax Information and Other Returns.

Application for Automatic Extension of Time to File by the original due date of the return. If you need more time though you can file for an extension to Oct. Use Form 7004 to request an automatic 6-month extension of time to file certain business income tax information and other returns.

The deadline is October 15 2021. All the returns shown on Form 7004 are eligible for an automatic extension of time to file from the due date of the return. Sole proprietorship or single-member LLC filing as a sole proprietorship extensions are for six months so.

How To File A Business Tax Extension Daveramsey Com

How To File A Business Tax Extension Daveramsey Com

File An Extension For Your Federal Tax Return Raleigh Cpa

File An Extension For Your Federal Tax Return Raleigh Cpa

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

How To Apply For A Tax Extension For An S Corporation Legalzoom Com

How To Apply For A Tax Extension For An S Corporation Legalzoom Com

What If You Can T File Your Income Taxes By April 15 The Irs Gives Extensions To Anyone Cpa Practice Advisor

What If You Can T File Your Income Taxes By April 15 The Irs Gives Extensions To Anyone Cpa Practice Advisor

E File An Irs Tax Extension E File Com

E File An Irs Tax Extension E File Com

Do I Need To File An Extension For My Business Taxes Mark J Kohler

Do I Need To File An Extension For My Business Taxes Mark J Kohler

How To File An Extension For Taxes Form 4868 H R Block

How To File An Extension For Taxes Form 4868 H R Block

File Llc Tax Extension Form Online Single Multi Member Llc Extension

File Llc Tax Extension Form Online Single Multi Member Llc Extension

When Are 2018 Tax Returns Due Every Date You Need To File Business Taxes In 2019

When Are 2018 Tax Returns Due Every Date You Need To File Business Taxes In 2019

If You Re Running A Business Filing An Extension For Your Business Taxes Is Really Easy It S A Few Questions A Quic Tax Extension Business Tax Irs Extension

If You Re Running A Business Filing An Extension For Your Business Taxes Is Really Easy It S A Few Questions A Quic Tax Extension Business Tax Irs Extension

Panicked About Tax Season Here S How To File For Extension In 2020

Panicked About Tax Season Here S How To File For Extension In 2020

How To File For A Tax Extension

How To File For A Tax Extension

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

October Tax Deadline Nears For Extension Filers H R Block Newsroom

October Tax Deadline Nears For Extension Filers H R Block Newsroom

Not Ready To File How To Request A U S Tax Extension Based On Your Business Structure Freshbooks Blog

Not Ready To File How To Request A U S Tax Extension Based On Your Business Structure Freshbooks Blog

How Do I File A Business Tax Extension 2020 Forms And Tips

How Do I File A Business Tax Extension 2020 Forms And Tips