What Is Payroll Register File

It saves you time. Payroll records are documents with any information about a companys payroll including data about employees paychecks and taxes.

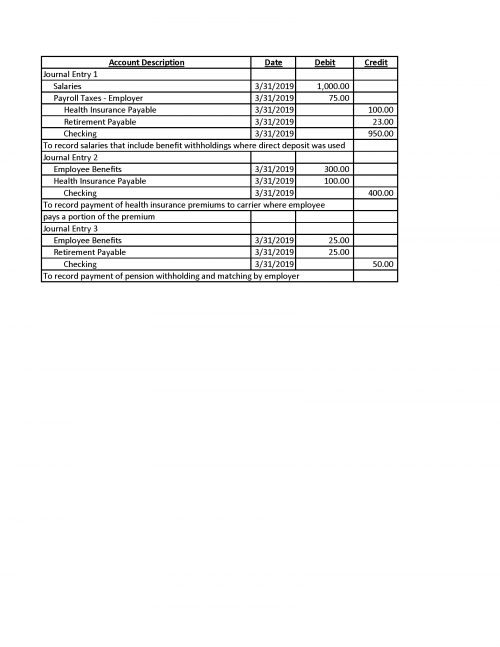

Payroll Nonprofit Accounting Basics

Payroll Nonprofit Accounting Basics

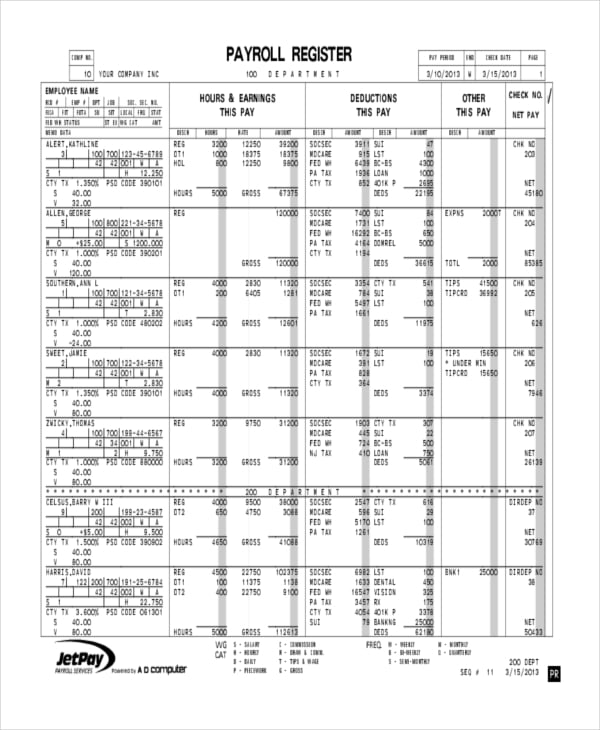

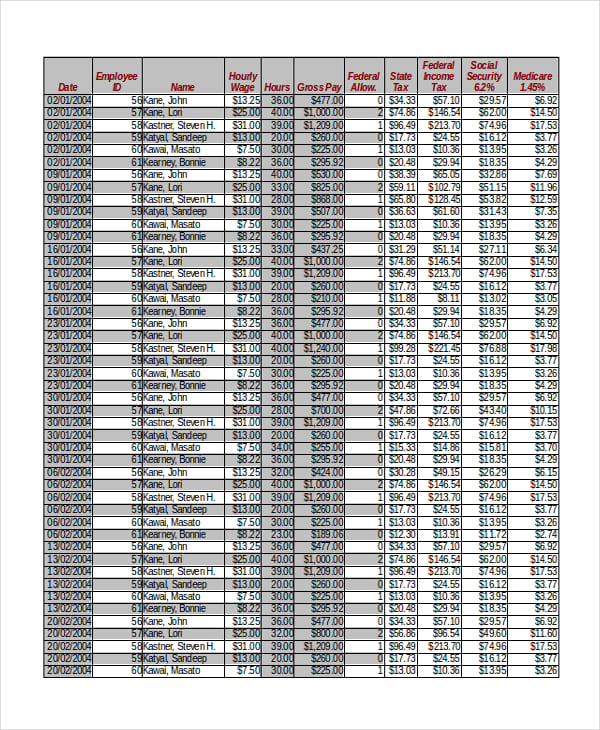

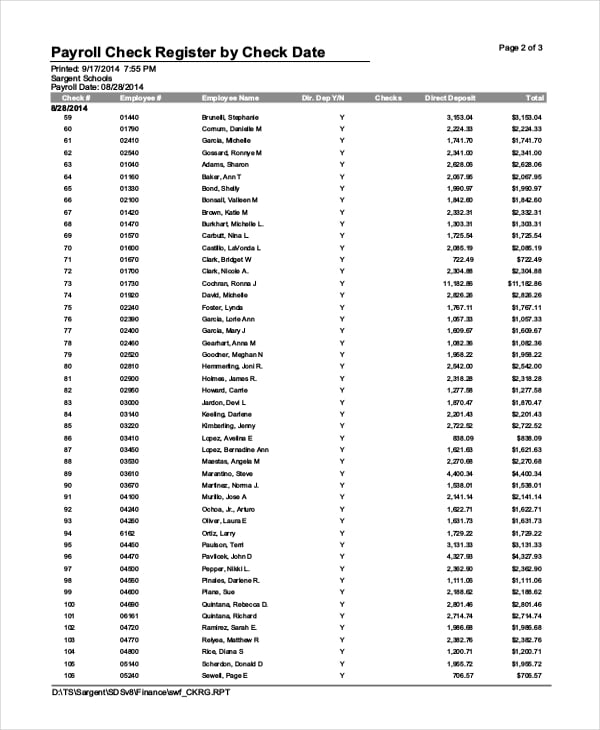

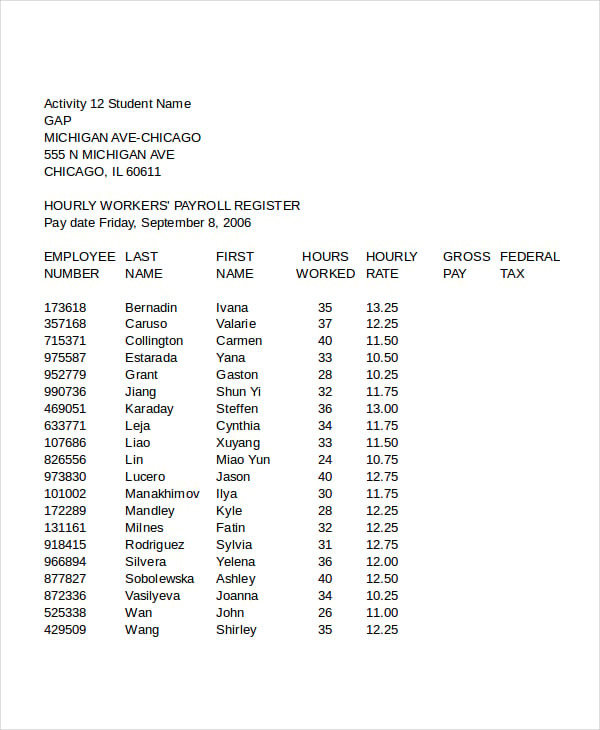

The payroll register lists information about each employee for things such as gross pay net pay and deductions.

What is payroll register file. 940 941 943 944 and 945. This sample payroll register will help you follow along with the examples in the article Instant payroll totals for quarterly tax reporting The article explains how to use the Excel 2003 List feature and AutoFilter feature to get customized totals from a payroll register. The information stated in a payroll register can include the following.

Thats where your payroll register comes in. The payroll register report is created at the end of the payroll process. Employees earnings records contain YTD gross pay which reflects when employees reach tax bases.

A debit increases which of the following types of accounts. Depending on how you are keeping your records you may want to add information to the payroll register or remove it. It shows the gross and net pay for each employee and each of the payroll.

Sokolow said the payroll records must identify the employee as a tipped employee and employers must keep. You can use the payroll register to run payroll each pay period file your payroll taxes throughout the year and reconcile payroll as needed. Employees earnings records contain details of payroll tax reporting and may be considered as source documents.

You can think of it as a summary of all the payroll activity during a period. File Form 941. In instances where payroll and accounting are outsourced this is an even more recommended practice for the employees payroll records.

A payroll register is a report that summarizes the payments made to employees as part of a payroll. You can choose to pay your workers on an hourly daily weekly bi-monthly or monthly basis. Prepared necessary journal entry for preparation of payroll and payments of deductions to concerned party ANSWER Saba Stones PLC Payroll Register Sheet For The Month of Ginbot 30 2007 SN o.

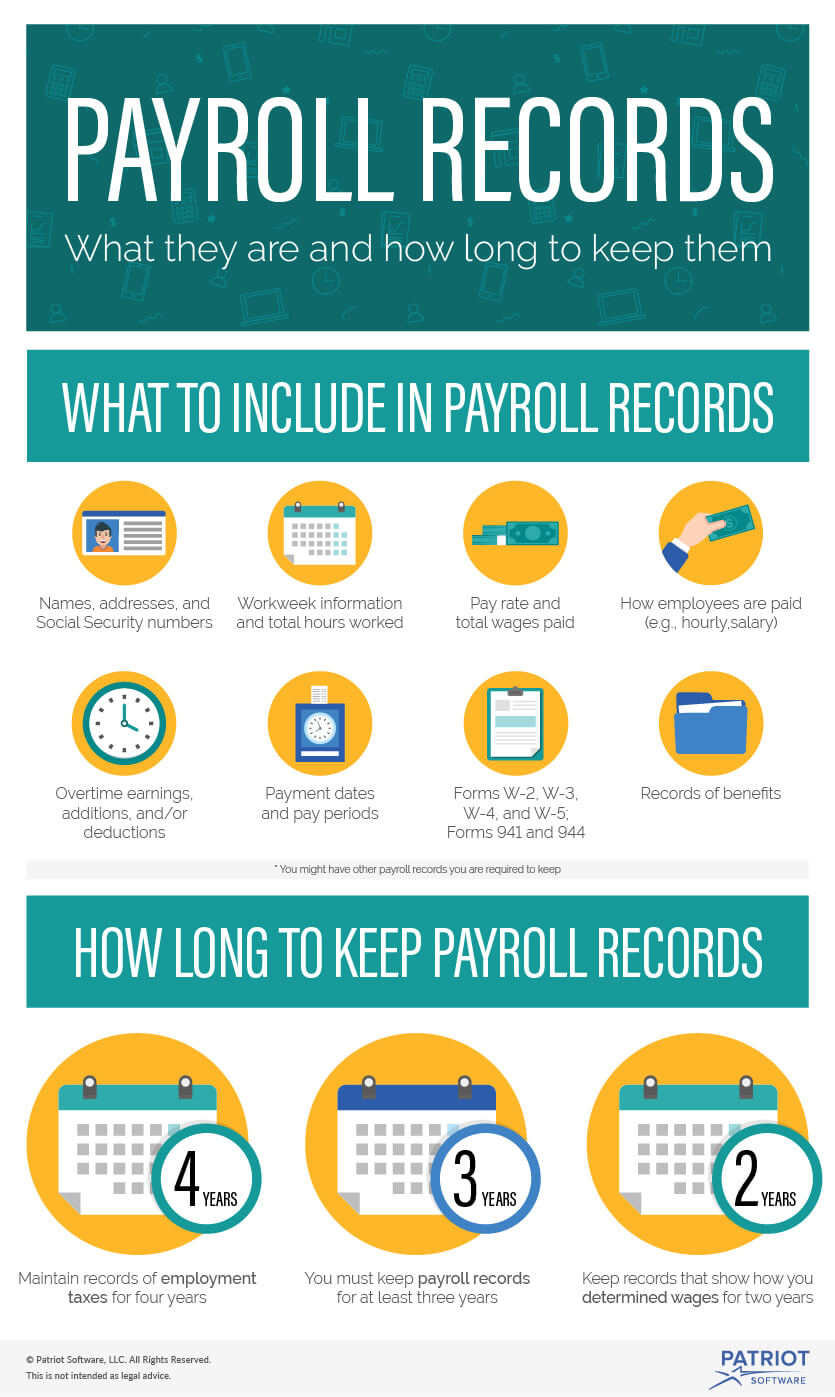

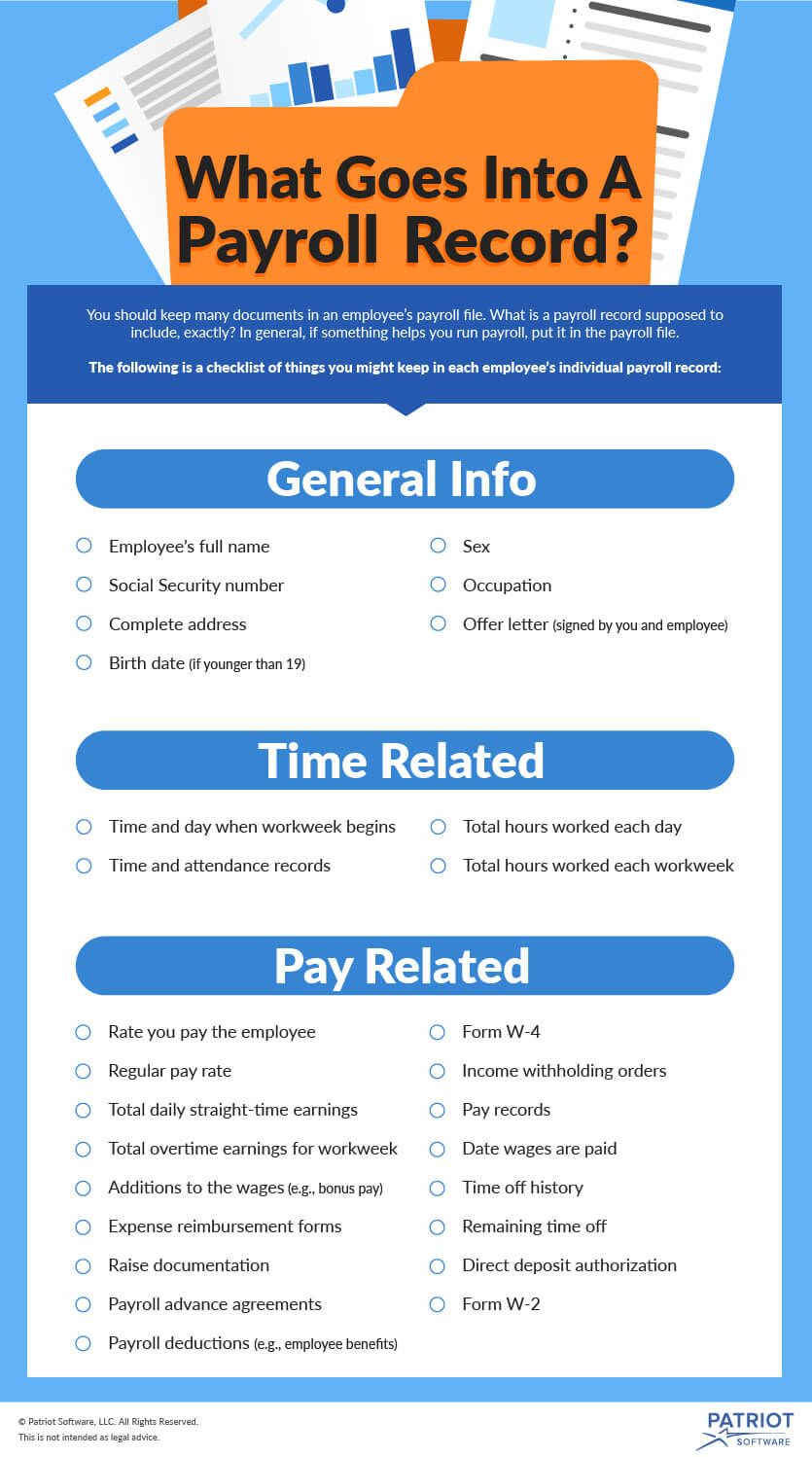

Per federal law you should retain payroll records for three years and payroll tax records such as unemployment taxes need to be kept for four years. The information must be dated and kept on file for. Names addresses and Social Security numbers of all employees Workweek information eg start and end dates.

States such as New York and agencies such as ERISA governing private retirement and. What is a payroll register. Prepared payroll register sheet 2.

Absent Parent The parent who does not live with or have custody of a child but does have responsibility for financial support. ABATrans Code A nine-digit numeric code created by the American Bankers Association that identifies an employers bank and routing for electronic transactions. Every time payday comes this is the document you will refer to so you know how much salary you owe to your employee.

The totals on this register can be used as the basis for a payroll journal entry. Form 940 reports your total unemployment tax liability and payments throughout the year and must be filed with the IRS annually. The difference between payroll register and paycheck history reports.

A payroll register is the record for a pay period that lists employee hours worked gross pay net pay deductions and payroll date. Making payroll tax deposits Submitting quarterly payroll tax reports to. A payroll register is a record of all pay details for employees during a specific pay period.

Form 941 reports your total payroll tax liability and payments from the previous quarter and must be filed with the IRS quarterly. A payroll is a document where you can find a list of the names of your employees with their corresponding total amount of wages. In other words a payroll register is the document that records all of the details about employees payroll during a period.

You can e-file any of the following employment tax forms. The following are payroll records that you must maintain in your files. The payroll register is a spreadsheet that lists all of this payroll information for each employee across a given time period.

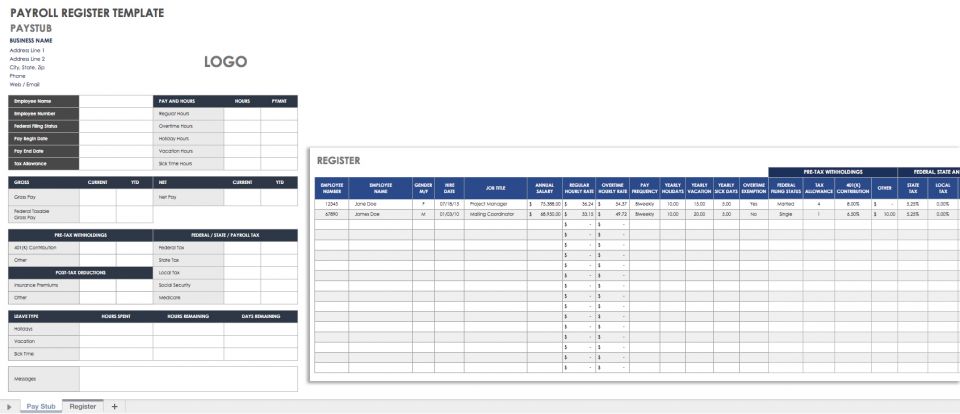

Payroll records are documents related to paying your employees. Review options from small businesses to e-file Forms 940 941 944 and 945. The Payroll Register worksheet is where you can keep track of the summary of hours worked payment dates federal and state tax withholdings FICA taxes and other deductions.

The register also lists the totals for all employees combined during the period. Accounting staff can keep payroll records where it makes sense for paying the employee. A payroll register is usually part of an online accounting software package or online payroll applicationThe information in the payroll register is used to help you with several important payroll tax tasks.

The payroll file enables accounting staff to pay the employee without accessing employee confidential information. Its secure and accurate. Below were going to lay out the exact information contained in a payroll register.

You receive acknowledgement within 24 hours.

15 Free Payroll Templates Smartsheet

15 Free Payroll Templates Smartsheet

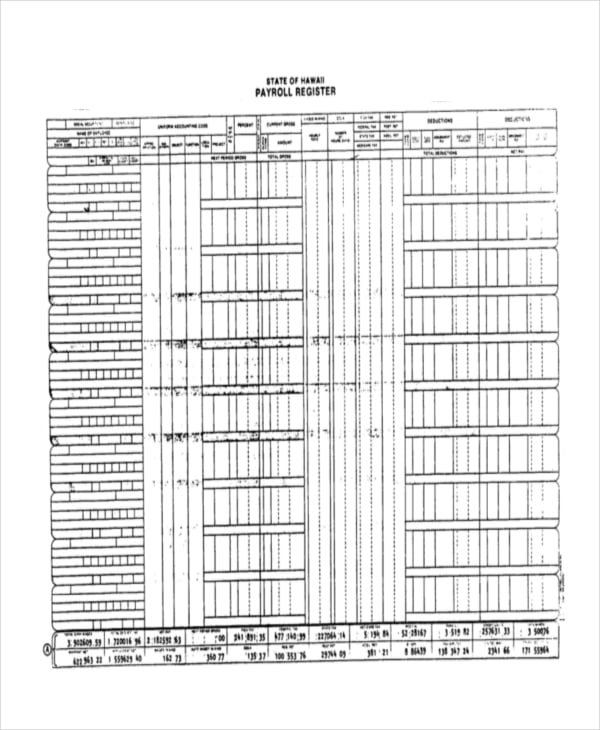

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template Cnbam

Payroll Register Template Cnbam

How Long To Keep Payroll Records Retention Requirements

How Long To Keep Payroll Records Retention Requirements

Free Payroll Template For Excel Payroll Template Payroll Bookkeeping Templates

Free Payroll Template For Excel Payroll Template Payroll Bookkeeping Templates

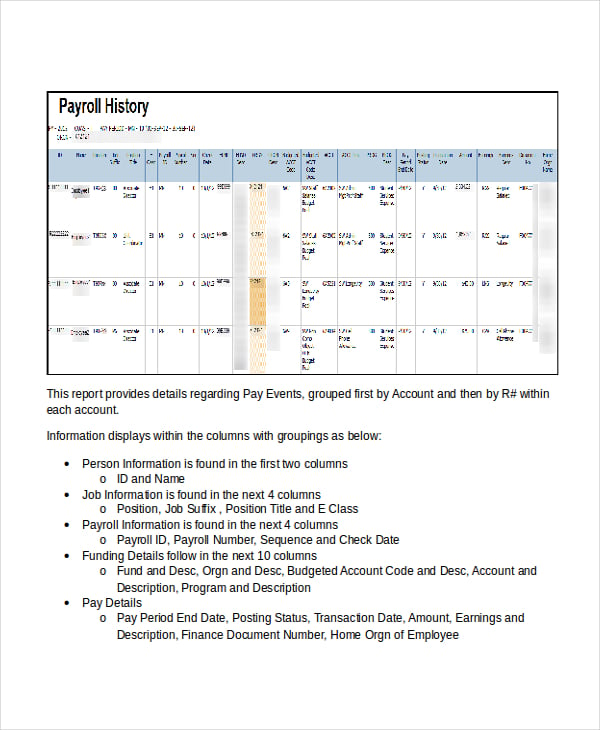

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Employee Payroll Register Template Pdf Format E Database Org

Employee Payroll Register Template Pdf Format E Database Org

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Free 7 Sample Payroll Register Templates In Ms Word Pdf

What Should I Include In My Employee Payroll Records

What Should I Include In My Employee Payroll Records

Self Employment Ledger Forms Inspirational Self Employment Ledger Template 13 Trust Account Ledger Bookkeeping Templates Small Business Bookkeeping Payroll

Self Employment Ledger Forms Inspirational Self Employment Ledger Template 13 Trust Account Ledger Bookkeeping Templates Small Business Bookkeeping Payroll

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates