Sba Loan Approval Odds

Approval decision and disbursement of loan funds is dependent on receipt of your documentation. The SBA offers disaster assistance in the form of low interest loans to businesses nonprofit organizations homeowners and renters located in regions affected by declared disasters.

The Sba Loan Approval Formula Youtube

The Sba Loan Approval Formula Youtube

IRS Form 4506-T completed and signed by Applicant business each.

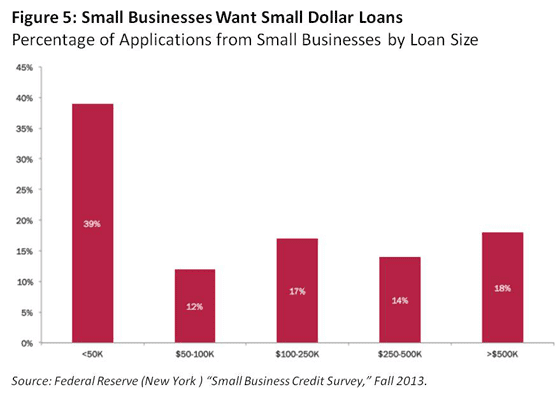

Sba loan approval odds. SBA also provides eligible small businesses and nonprofit organizations with working capital to help overcome the economic injury of a declared disaster. The main denials I have seen have been. Start or expand your business with loans guaranteed by the Small Business Administration.

No tax transcript record 2019 blank transcript record 2019 discrepancy in numbers between these 3 things. But due to lower odds of approval it may not be worth your time to apply for an SBA Express loan unless your business has strong financials and a long track record of success. Though SBA disaster loans have been available for years the EIDL was signed into law in March of 2020 as part of the CARES Act which was.

The SBA allows lenders to pass along certain fees to borrowers. The guaranty fee is 2 percent of the 127500 guaranteed or. If all goes well you may be able to secure fast financing with an SBA Express loan.

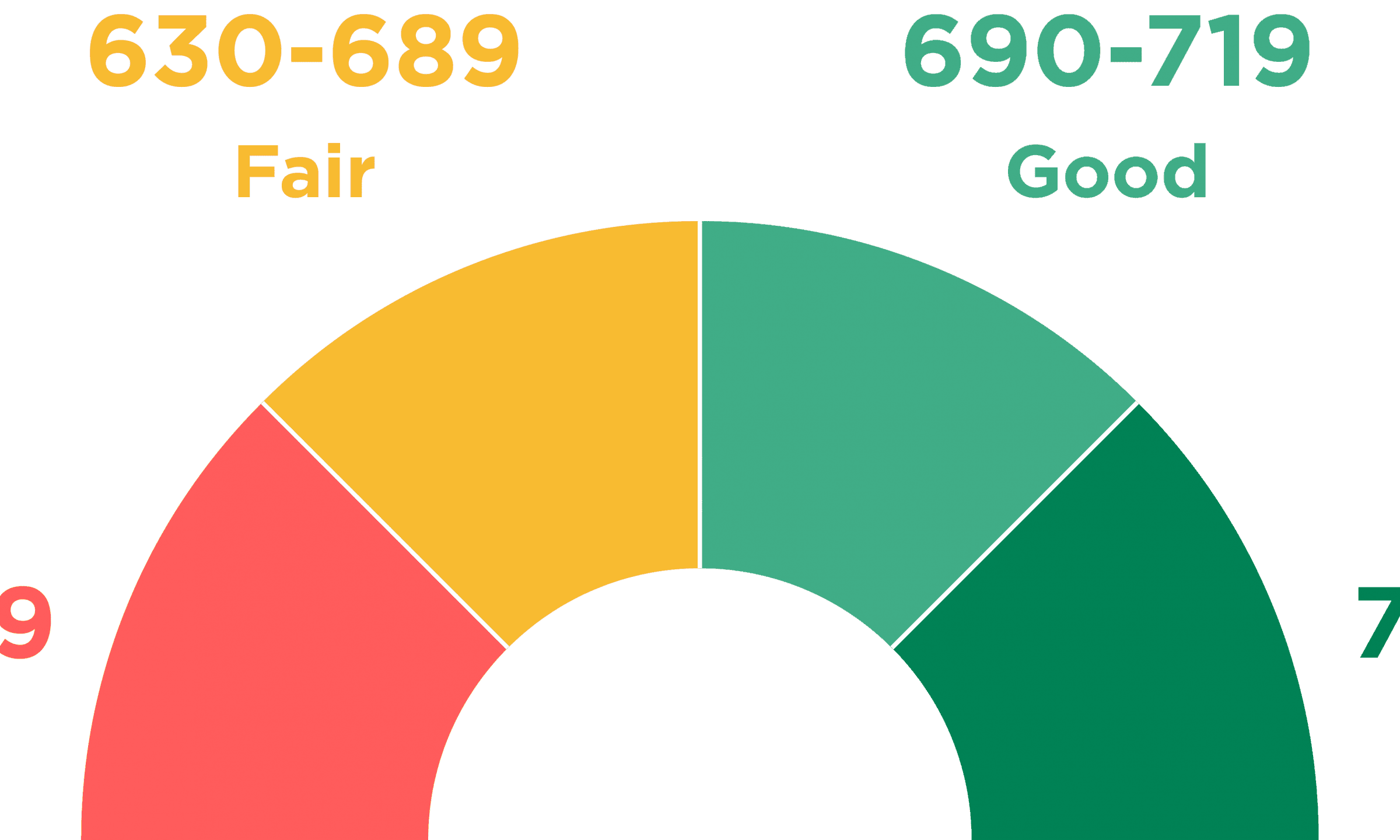

When you apply for an SBA loan or any loan your odds of approval depend on a lot of factors. EIDL targeted application 2019 numbers EIDL loan application 2019. To improve their odds of SBA loan approval business owners can improve credit score by using credit cards.

Heres everything you need to know about the Small Business Administration-guaranteed loans. Use Lender Match to find lenders that offer loans for your business. 101 How to boost your approval odds Credit card data.

BUSINESSES HOMEOWNERS AND RENTERS Business Loan Application SBA Form 5 completed and signed by business applicant. DAvolio says increasing your odds of being approved for an SBA loan often hinges on how well you manage your credit score the strength of. According to monthly reports released by Biz2Credit small business loan approval rates at small banks stood at 185 in September 2020 a slight increase from the low point in April 2020 when small business approval rates at small banks stood at 118 but still far.

If youre aiming to get approved for another SBA loan after obtaining your first one theres a good chance that the lender may require a credit score higher than 650. Large banks are choosier only approving approximately 25 of SBA loans. Well it seems to depend on the type of bank you apply at.

For example if you took out a 150000 loan the SBA would typically guarantee 85 percent. Do you have valuable assets to secure another SBA loan. Small community banks and credit unions are what SCORE recommends that small businesses use.

So what are the chances of getting approved for an SBA loan. As of April 13 SBA has reported of all completed applications Submitted. The Economic Injury Disaster Loan program through the SBA is a long-standing program intended to help businesses hurt by tornados or wildfires.

Instead the SBA approves lenders to provide loans to small businesses under their loan programs. If you apply for an SBA loan your loan wont be from the SBA and you wont make your payments to the agency. After the national disaster was declared in March 2020 funds became available to help small businesses impacted by the pandemic.

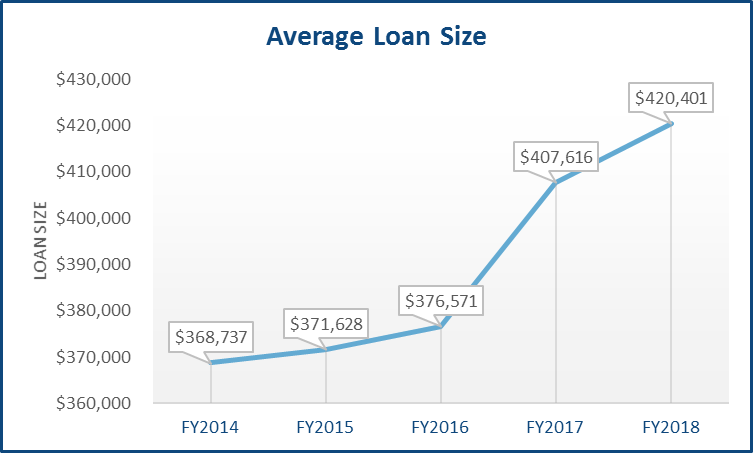

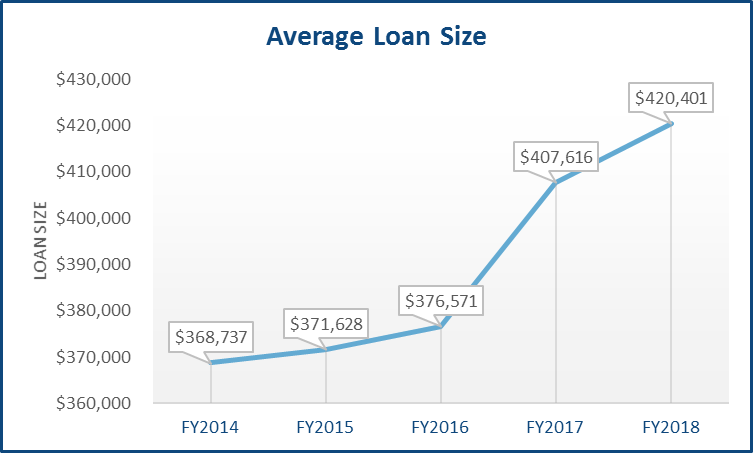

This eguide is designed to give you an overview of the SBA loan programs to help you decide if an SBA loan may be right for your. The average loan amount in. To get approved for an SBA loan.

20 approved 12 denied 68 still in processing. Small Business Administration guarantees loans up to 5 million in the 7a program which can be used for working capital. You may for instance be charged an SBA guaranty fee based on the size of the SBA guarantee and the amount you have borrowed.

Specifically what is their situation and how likely are they to approve your loan. Currently the US. Assuming you have most of the right qualifications the 5 Cs of credit etc a lot of it depends on the lender you are seeking financing from.

Eidl Loan Approval Processing Time What To Expect

Eidl Loan Approval Processing Time What To Expect

Sba Loans Minimum Credit Score Requirements By Loan Type

Sba Loans Minimum Credit Score Requirements By Loan Type

10 Reasons You Don T Qualify For An Sba Disaster Loan

10 Reasons You Don T Qualify For An Sba Disaster Loan

What Is A Good Credit Score For A Business Loan Priceithere Com

What Is A Good Credit Score For A Business Loan Priceithere Com

Eidl Loan Approval Processing Time What To Expect

Eidl Loan Approval Processing Time What To Expect

5 Steps To An Easy Sba Loan Advance Point Capital

5 Steps To An Easy Sba Loan Advance Point Capital

Benefits Of Small Business Loans In Minnesota Business Loans Small Business Loans Types Of Small Business

Benefits Of Small Business Loans In Minnesota Business Loans Small Business Loans Types Of Small Business

Sba Ppp Loan Approval Statistics Bryan Cave Leighton Paisner Jdsupra

Sba Ppp Loan Approval Statistics Bryan Cave Leighton Paisner Jdsupra

Fico Sbss The Sba Loan Credit Score Nav

Fico Sbss The Sba Loan Credit Score Nav

Social Security Disability Game Plan To Get Benefits Business Loans Small Business Loans Social Security Disability

Social Security Disability Game Plan To Get Benefits Business Loans Small Business Loans Social Security Disability

What You Need To Know About Credit Scores Eidls And Ppp Loans Workest

What You Need To Know About Credit Scores Eidls And Ppp Loans Workest

6 Tips To Improve Your Chances Of Getting A Small Business Loan Small Business Loans Business Read Small Business

6 Tips To Improve Your Chances Of Getting A Small Business Loan Small Business Loans Business Read Small Business

Bridge Payday Pay Loans Online Instant Cash Advances Now By Bridgepayday Pay Loans Payday Loans Online Payday

Bridge Payday Pay Loans Online Instant Cash Advances Now By Bridgepayday Pay Loans Payday Loans Online Payday

Best Personal Loans For Fair Credit Credit Score 600 669

Best Personal Loans For Fair Credit Credit Score 600 669

Guaranteed Approval Small Business Loans Even For Bad Credit

Guaranteed Approval Small Business Loans Even For Bad Credit

Get Unsecured Business Loans Today Business Loans Business Cash Advance Small Business Loans

Get Unsecured Business Loans Today Business Loans Business Cash Advance Small Business Loans

Which Is Better Private Lenders Or Traditional Lenders Small Business Loans Small Business Resources Business Loans

Which Is Better Private Lenders Or Traditional Lenders Small Business Loans Small Business Resources Business Loans

5 Steps To An Easy Sba Loan Advance Point Capital

5 Steps To An Easy Sba Loan Advance Point Capital