How To Show 44ad Income In Itr 3

1In the general information tab an option to select section 115H who is a non-resident Indian in any previous year becomes assessable as a resident in India in respect of the total income of any subsequent year has been added. Presumptive taxation scheme of government which is covered under a series of sections of 44 ie.

How To File Income Tax Return Itr 4 U S 44ae Ay 2020 21 For Transport Business Itr 4 Youtube

How To File Income Tax Return Itr 4 U S 44ae Ay 2020 21 For Transport Business Itr 4 Youtube

An option of section 115H has been introduced where a person who was NRI in the previous year and becomes an assessable for income earned in India as a resident individual in the current year.

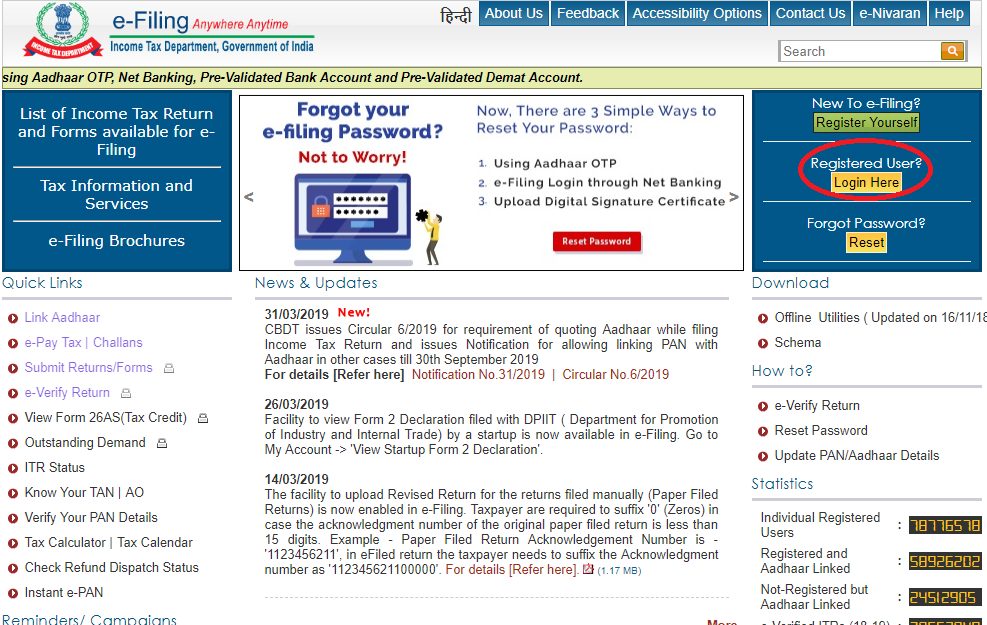

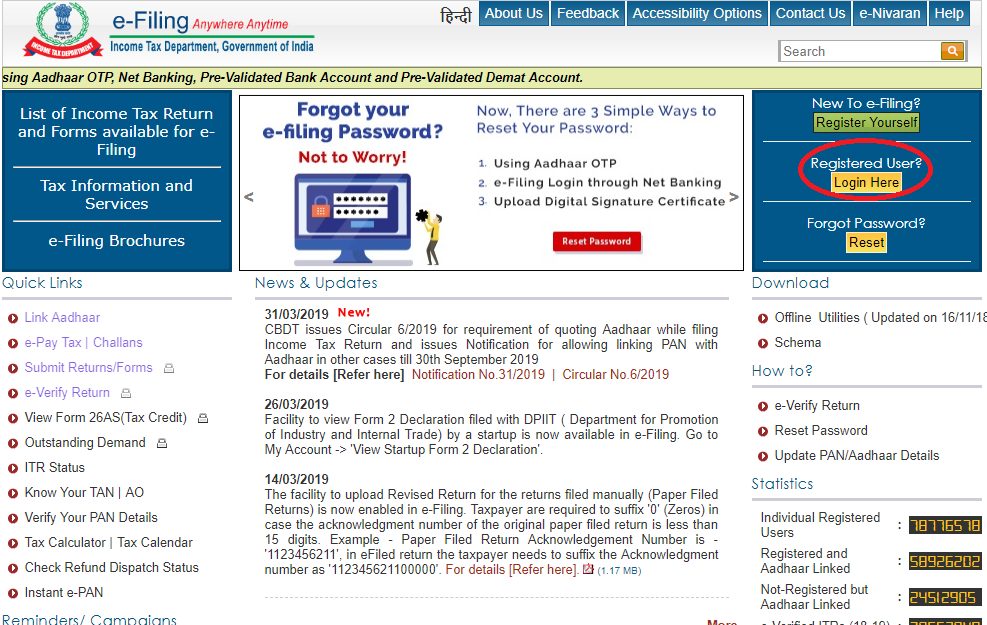

How to show 44ad income in itr 3. 70000 in cash to Mr. You are reading the Procedure of online fill up Income Tax Return. All assesses or taxpayer want to guide about Income Tax Return Form online filed by taxpayer.

If the taxpayer has a profit of more than or equal to 6 or 8 of Turnover Sales Audit is not applicable. Return Form ITR-V to Income tax office via mail. Link for ITR 1 and 2 video.

ITR -4 form is also applicable to individuals whose income from the profession is up to Rs50 lakh. You are reading Online efiling Income tax return forms in easy and simple step b self. They are supposed to file an ITR-4 form under the Presumptive scheme of taxation.

You are reading Income tax Act1961. You can file return under section 44AD using code 16019 - other professionals. Taxpayer filing ITR-3 form using this method must complete the acknowledgement in ITR-V.

2In the Profit and Loss schedule the GST related details have been added Limitation of maximum 40 depreciation in all depreciation related Schedules 4Partners of partnership firms as against ITR 2 will have to file their returns in ITR 3. Tax Audit and Books of Accounts for Presumptive Income under Section 44AD Books of Accounts under Sec 44AA If a taxpayer opts for a presumptive taxation scheme us 44AD and reports income at 68 or more of the gross receipts heshe is not required to maintain books. If your Turnover is more than 2 crore than you can not file return under section 44AD.

Section 44AD1 starts with the above wordings it means section 28 to section 43C is not applicable to assessee showing income under section 44AD. Assessment year This return form is applicable for AY. Cash Bank Bal.

Now the question is. I tried filling in ITR-3 under no account case as per 44AD but the utility asks for balance sheet and PL details. Even a freelancer with a notified profession is also supposed to file the ITR-4 form for the Income Tax Return.

Return under section 44ADA can be filed by an assessee who has income from profession as notified by CBDT. In this video I am going to talk about how to decide between ITR 3 and 4 and which details you need to show. 44AD 44ADA 44AE etc.

02 August 2017 Dear Expert I have income from two house properties and business turnover of 105 Lac with 9Lac profit. If youve e-filed a ITR-4S for FY 2015-16 then you must file an ITR4 now. Most of the people in India who do small business or profession shows their income under this section and using the presumptive taxation scheme wherein they are not required to maintain proper books of accounts.

In Income Tax News. Y for purchase of material on 15th March 2020. Debtors can be the amount receivable for the month of March.

Now a days very simple and easy step with instruction to prepared Online Income tax Return Form ITR-3 in. To adopt 44AD you are required to file form ITR 4 not ITR 3. X is a small business provider opting for section 44AD disallowance us 40A3 will not be.

Business income under section 44AD or 44AEb. All these taxpayers must be taxed under section 44AD. By transmitting the data in ITR-3 form electronically followed by the submission of return verification in.

Income earned in the FY. WRT to ITR-4 you can show creditors as 0. Turnover limit for 44AD is 2 crore.

If the taxpayer has income from capital gains along with presumptive income heshe should file Form ITR 3. ITR 4 is to be filed by the individualsHUF partnership firm whose total income of AY 2020-21 includes. The taxpayer should file ITR 3.

If the taxpayer has incurred loss or the profit is less than 6 or 8 of Turnover Sales and the Total Income is more than Basic Exemption Limit Audit as per Sec 44AB e is applicable. Form ITR 4 is selected by the taxpayers for presumptive income scheme us 44AD 44ADA 44AE. The ITR-4S return form has been discontinued from FY 2016-17 AY 2017-18.

44AD is applicable to Individuals HUF and Partnerships firm only. Without which it shows the return to be defective under section 139. Some common instructions to fill up all the ITR forms ITR 2 3 5 and 7 are as follows.

Changes in ITR-3. Who can file ITR 4s. Can be shown as actual.

If Tax audit is applicable to you than you can not show income under section. This form is for individuals HUFs and Firms other than LLP being a resident having total income upto Rs50 lakhs and having income from business and profession which is computed under Section 44AD 44ADA or 44AE of the Income Tax Act 1961. ITR 4 can be used by an IndividualHUF to report income on presumptive basis as provided under specified sections for example Section 44AD44AE and 44ADA of the Income Tax Act 1961.

Introduction of Section 115 H Option. By conveying the data in ITR-3 form electronically under electronic verification code.

How To File Income Tax Return Itr 4 Ay 2020 21businessman Itr 4 Fy 2019 20 Ay 2020 21 Live Filing Youtube

How To File Income Tax Return Itr 4 Ay 2020 21businessman Itr 4 Fy 2019 20 Ay 2020 21 Live Filing Youtube

Itr 3 For A Y 2019 20 How To File Itr 3 2019 Business Income Tax Return Finance Gyan Youtube

Itr 3 For A Y 2019 20 How To File Itr 3 2019 Business Income Tax Return Finance Gyan Youtube

What Itr Should I File If There Is A Brokerage Income Under The Section 194h And Other Retail Businesses For The Ay 18 19 Quora

Itr Filing Fy2020 21 How To File Itr Online India Paisabazaar Com

Itr Filing Fy2020 21 How To File Itr Online India Paisabazaar Com

Itr For Fy 2018 19 Or Ay 2019 20 Changes How To File

Itr For Fy 2018 19 Or Ay 2019 20 Changes How To File

Itr 4 For A Y 20 21 F Y 19 20 Live Filing Online Finance Gyan How To File Itr 4 Youtube

Itr 4 For A Y 20 21 F Y 19 20 Live Filing Online Finance Gyan How To File Itr 4 Youtube

How To File Income Tax Return India If I Left My Job Mid Year To Do Freelancing Consultant Contractor Do I File Multiple Returns Itr 1 And Itr 4 How Can I Get Benefits From

How To File Business Itr Income Tax Return Itr 4 U S 44ad For Ay 2020 21 Youtube

How To File Business Itr Income Tax Return Itr 4 U S 44ad For Ay 2020 21 Youtube

Balance Sheet For Itr 4 Ay 2018 19 How To Prepare Balance Sheet Youtube

Balance Sheet For Itr 4 Ay 2018 19 How To Prepare Balance Sheet Youtube

Itr Filing Penalty For Late Filing Of Income Tax Return Tax Return Income Tax Return Income

Itr Filing Penalty For Late Filing Of Income Tax Return Tax Return Income Tax Return Income

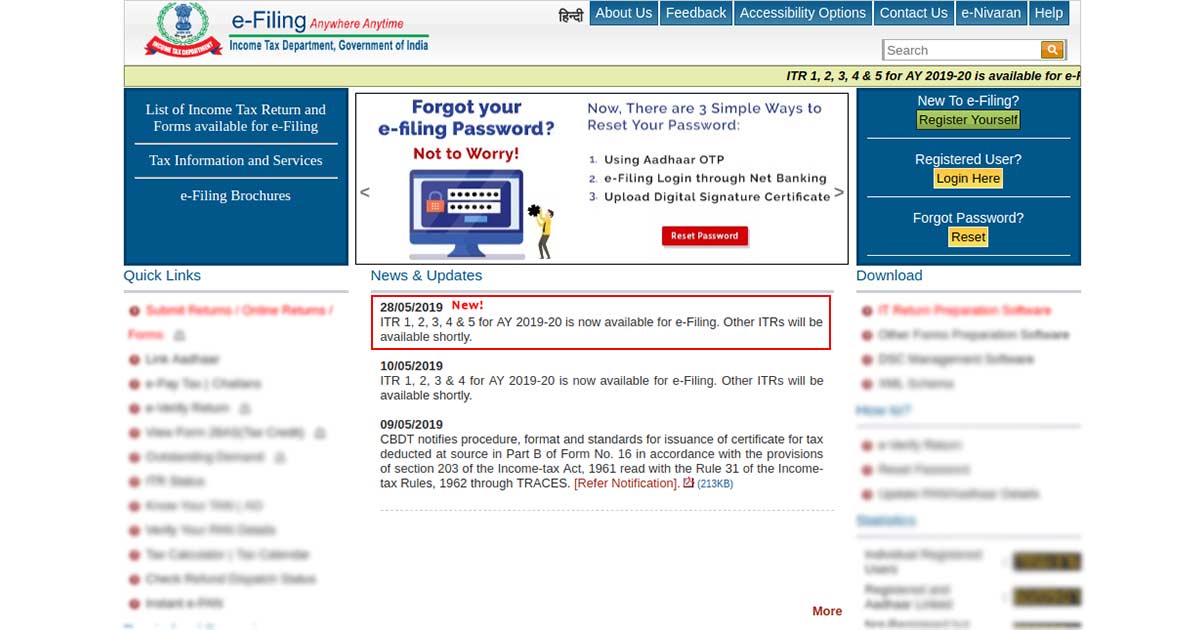

Income Tax Department Available Itr 1 2 3 4 5 6 7 For E Filing

Income Tax Department Available Itr 1 2 3 4 5 6 7 For E Filing

Cash Transaction Limit As Per Income Tax Act In India Cashtransaction Incometaxact Incometax Taxplanning Incometaxservice Casht Income Tax Taxact Income

Cash Transaction Limit As Per Income Tax Act In India Cashtransaction Incometaxact Incometax Taxplanning Incometaxservice Casht Income Tax Taxact Income

Itr3 How To File Itr 3 For Income From Business And Profession 2017 18 Hindi Itr 4 Is Now Itr 3 Youtube

Itr3 How To File Itr 3 For Income From Business And Profession 2017 18 Hindi Itr 4 Is Now Itr 3 Youtube

7 Golden Rule Before Filing Income Tax 1 Give Right Information As A Responsible Taxpayer You Should Take Ca Income Tax Income Tax Return File Income Tax

7 Golden Rule Before Filing Income Tax 1 Give Right Information As A Responsible Taxpayer You Should Take Ca Income Tax Income Tax Return File Income Tax

How To File Income Tax Return Itr 4 Ay 2019 20 For Small Businessman In Hindi Youtube

How To File Income Tax Return Itr 4 Ay 2019 20 For Small Businessman In Hindi Youtube

Section 44ad No Tax Upto 1cr Income Under Presumptive Taxation Want To Know How Tax4wealth Chan Taxact Limited Liability Partnership Income Tax

Section 44ad No Tax Upto 1cr Income Under Presumptive Taxation Want To Know How Tax4wealth Chan Taxact Limited Liability Partnership Income Tax

Pin By Tax4 Wealth On Income Tax Saving How To Plan What Is Family Tax

Pin By Tax4 Wealth On Income Tax Saving How To Plan What Is Family Tax

How To File Income Tax Return Itr 4 Ay 2020 21 For Business Professional Online Itr 4 Filing Youtube

How To File Income Tax Return Itr 4 Ay 2020 21 For Business Professional Online Itr 4 Filing Youtube

How To E File Itr 4 Sugam For Ay 2020 21 Youtube

How To E File Itr 4 Sugam For Ay 2020 21 Youtube