How To Request 1099 From Edd

Visit Ask EDD and select the Form 1099G category or call 1-866-401-2849 during regular business hours. Or you can fill out an online form here.

To 5 pm except on state holidays.

How to request 1099 from edd. If we find you were a victim of fraud we will remove the claim from your Social Security number and send you an updated 1099G. For more information see IRS Publication 525 Taxable and Nontaxable Income. Visit Ask EDD to request to backdate your claim if you think it has the wrong start date.

Send any fraudulent documents or mail to EDD PO Box 826880 MIC 43 Sacramento CA 94280-0225. A copy of your Form 1099G will be mailed to you. Be sure to include your Social Security number and explain why you believe the Form 1099G1099INT is incorrect.

Check the applicable boxes that describes your need for an extension. UI Benefits- Monetary Unit. Be sure to correct your address before you request the duplicate form.

You can also write Return to Sender on the envelope and provide it to your mail carrier. Taxpayers will have to. If you have a Paid Family Leave claim or you are unable to access your information online you can request a copy of your Form 1099G by calling the EDDs Interactive Voice Response IVR system at 1-866-333-4606.

Please provide your Claimant ID number or Social Security Number current mailing address and the tax year that is being requested. If you are requesting an extension for Forms W-2 or 1099-NEC or if you checked the box on line 5 you must meet one of the following criteria. Businesses that transmit electronically must submit 2 monthly reports that are not less than 12 days and not more than 16 days apart.

Contact a Customer Service representative at 8043678031 or write to us at PO Box 1115 Richmond Virginia 23218-1115 to request a letter of correction. This option is available 24 hours a day 7 days a week. The EDD has one designated phone line you can use to request a corrected 1099.

Tax preparation software with a 1099-G. You will only get a Form 1099-G if all or part of your SDI benefits are taxable. During 2013 I did some consulting and earned 6610 paid in increments of mostly 400 or 75 in various dates through out the year.

Call the EDD Interactive Voice Response IVR System at 1-866-333-4606 and follow the instructions to get your Form 1099G information or to request that your 1099G be mailed to you. I was getting around 450week from EDD. If required the taxpayer reports the refund in year it was received 2020.

Enter your Social Security number and follow the prompts. Report Payroll Tax Fraud. The IVR system is available 24 hours a day 7 days a week.

I am getting UI EDD benefits for 2013. Visit Ask EDD and select the Form 1099G category or call 1-866-401-2849 Monday through Friday from 8 am. Write what needs to be corrected on your Notice of Award and mail it to the EDD address on the notice.

If we find you were a victim of fraud we will remove the claim from your Social Security number and send you an updated. If you received only regular state unemployment benefits Pandemic Emergency Unemployment Compensation PEUC or State Extended Benefits SEB during 2020 you should complete the Request Replacement 1099-G Form to request a copy of your 1099-G form by mail. The 1099-G may automatically populate.

To request a duplicate 1099-G for any tax year prior to 2013 you must mail or fax a request to the location below. Logon to Unemployment Benefits Services select My Contact Information from the Change My Profile menu and update your address. I was under the impression only W2 salary is considered by EDD and not 1099 income.

The filer suffered a catastrophic event in a federally declared disaster area that made the filer unable to resume operations or. If you received PUA benefits as well as regular state unemployment benefits PEUC or SEB the 1099-G form in your MyUI. What is an EDD Customer Account Number and why cant I access my UI Online portal without one.

Review IRS tax guidance on benefit identity theft. A 1099-G will be issued for the year the taxpayer receives the refund in this case 2020. Select Unemployment Insurance Benefits then Claim Questions then Backdate the Effective Date of my UI Claim Due to COVID-19.

Call Tele-Serv at 800-558-8321 and select option 2 to request a duplicate 1099-G. You must report independent contractor information to the EDD within 20 days of either making payments totaling 600 or more or entering into a contract for 600 or more or entering with an independent contractor in any calendar year whichever is earlier. If your SDI benefits are taxable and you dont receive your Form 1099-G by mid-February you may call EDD at 800 795-0193 to get another copy.

How can I get one and how can I certify without a customer acc. When tax preparation software is used. Submit a Fraud Reporting Form online.

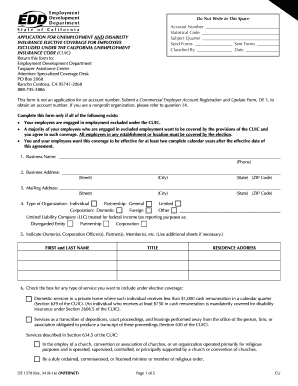

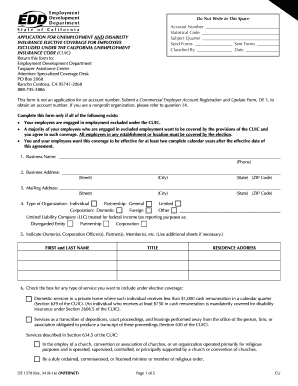

2019 2021 Form Ca De 927b Fill Online Printable Fillable Blank Pdffiller

2019 2021 Form Ca De 927b Fill Online Printable Fillable Blank Pdffiller

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

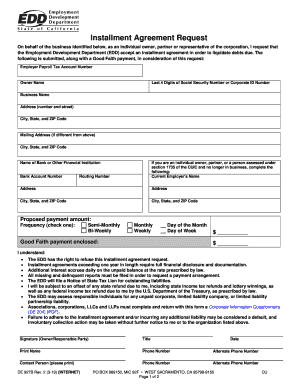

Unemployment Application Form Pdf Fill Out And Sign Printable Pdf Template Signnow

Unemployment Application Form Pdf Fill Out And Sign Printable Pdf Template Signnow

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

1099 G Fill Online Printable Fillable Blank Pdffiller

1099 G Fill Online Printable Fillable Blank Pdffiller

Https Www Edd Ca Gov Unemployment Pdf Unemployment 1099g Info Sheet Pdf

Https Www Edd Ca Gov Pdf Pub Ctr De1326e Pdf

Https Forms In Gov Download Aspx Id 14557

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Employment Ka Matlab Kya Hota Hai Employment 08865 Employment 89131 Employment Agencies Near Employment Agency Employment Application Working For Amazon

Employment Ka Matlab Kya Hota Hai Employment 08865 Employment 89131 Employment Agencies Near Employment Agency Employment Application Working For Amazon

Edb General Info Section B11 Required Forms For New Hires Tax Forms Employee Tax Forms Business Letter Template

Edb General Info Section B11 Required Forms For New Hires Tax Forms Employee Tax Forms Business Letter Template

Https Www Labor Idaho Gov Dnn Portals 0 Publications Ui Benefits And 1099g Form Pdf V 011321

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

Https Www Edd Ca Gov Pdf Pub Ctr De1326er Pdf

Https Www Edd Ca Gov Pdf Pub Ctr De230 Pdf

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor