Do You Give A 1099 For Rent

The 1099-MISC form will now be used for two reasons a property management company will now use the 1099 MISC form is to report payments of over 600 in a calendar year for. That person must declare the rent received from you as income provided it is 600 or more.

State And Federal Deadlines And Important Reminders For Filing 1099 Forms

State And Federal Deadlines And Important Reminders For Filing 1099 Forms

The recipient of the of the rent must declare it on Schedule E of the federal return.

Do you give a 1099 for rent. List rent paid to your landlord in Box 1 of the 1099-MISC. If a commercial tenant pays you over 600 of rent annually you must supply your tenant with your Form W-9. Landlords must provide a Form W-9 to their property managers so they can receive a Form 1099 to report rent paid in excess of 600 during the year.

Rental residence tenants paying rent to real estate agents acting as property. Only rent for office space is reported on a 1099 not utilities freight or storage costs. It makes no difference whether the sum was one payment for a single job or the total of many small payments for multiple jobs.

Use IRS Form W-9 to obtain your landlords address Social Security number or tax identification number and enter it all into your landlords 1099 as well. The IRS does require real estate agents collecting rents for property owners to give those owners 1099-MISC forms. However you do not have to report these payments on Form 1099-MISC if you paid them to a real estate agent or property manager.

Real estate rentals paid for office space. The rules you refer to were not to be implemented until 2012 for payments made during 2012. A clause in the 2009 Affordable Care Act said that when you own a rental you send a 1099-MISC to anyone who billed you more than 600 for work on the property.

Moreover a 1099-MISC isnt necessary unless you pay 600 or more in. If you use a property manager you will need to file a Form 1099 for their service fees not including reimbursed expenses. You do not.

But the real estate agent or property manager must use Form 1099-MISC to report the rent paid over to the property owner. Rent sent to owners owner disbursements also called owner distributions and. As mentioned above property managers must do the same for the following contractors not taxed as corporations that were hired and paid over 600 a year.

If you merely rent out your land to farmers and do not materially participate in the labor or management of the farming process yourself you are considered a landowner not a farmer according to the IRSForm 4835 is the way for non-participating farmland. Form 1099-MISC in particular represents an attempt on behalf of the IRS to keep track of miscellaneous incomes that otherwise wouldnt appear on a traditional W-2. The President signed the repeal bill on April 14 2011.

You will then receive a Form 1099 form reporting the rental income you received. 1099-MISC Rent Reporting Filing a 1099-MISC applies only to the rent you pay for business property not your personal property. This helps the IRS to compare payments made with income reported.

That rule was repealed but the old. Tenants paying 600 or more to landlords must provide 1099s except when rent payments are made to real estate agents. You will need to file a 1099-MISC form to declare the amount of rent you paid.

The basic rule is that you must file a 1099-MISC form with the IRS if you pay an unincorporated independent contractor 600 or more during a year for rental-related services. You must issue Form 1099-MISC to each individual and business that your company paid rental income in excess of 600 during a calendar year for property. You do not have to file a 1099 if you pay the rent to a corporation or a real estate agent.

If youve paid 600 or more in rent to someone in 2020 it will need to go on your 1099-MISC. However if you pay your office rent to a real estate agent you dont have to provide a 1099 to the agent. In doing so the requirement for rental property owners to issue Form 1099-MISC no.

A landlord who rents out the property that you use for your business should also be represented on your 1099-MISC. The sole purpose of filing a 1099 for rental property investors is to help the Internal Revenue Service IRS keep track of income generated from non-employment-related activities. You must give landlords a 1099 if you pay rent directly to the building owner.

They were repealed by HR 4.

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Will I Receive A Form 1099 For Rent

Will I Receive A Form 1099 For Rent

1099 Misc Forms The What When How Buildium Irs Forms 1099 Tax Form Fillable Forms

1099 Misc Forms The What When How Buildium Irs Forms 1099 Tax Form Fillable Forms

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Do I Need To File A 1099 For My Rental Property

Do I Need To File A 1099 For My Rental Property

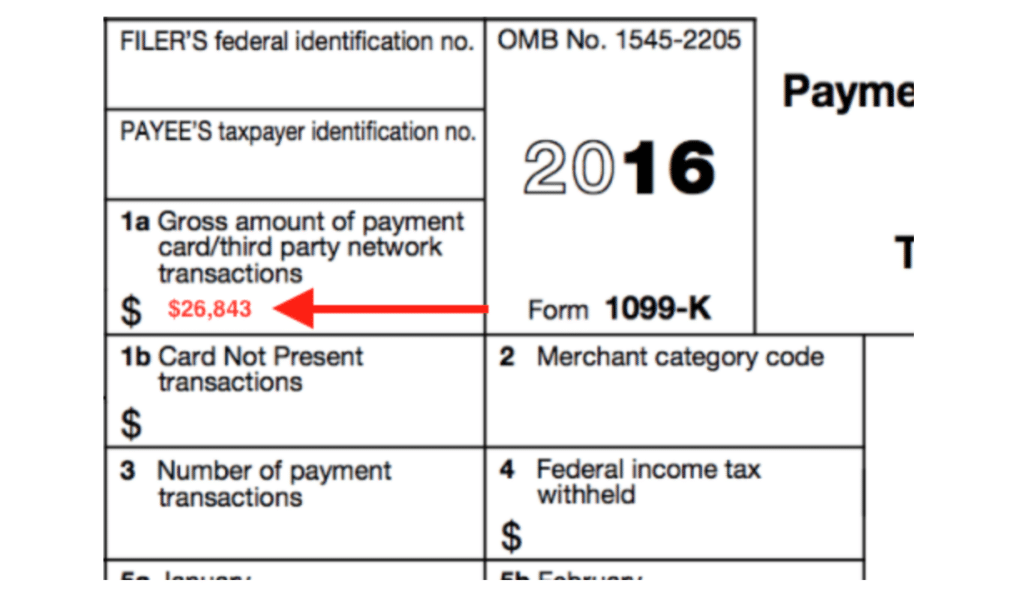

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

A Guide To Form 1099 Misc For Rental Property Owners Real Estate Investment Companies Real Estate Investing Real Estate Classes

A Guide To Form 1099 Misc For Rental Property Owners Real Estate Investment Companies Real Estate Investing Real Estate Classes

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

1099 Requirements And How To Fill Out Form 1099 Misc For Property Management Rentables

1099 Requirements And How To Fill Out Form 1099 Misc For Property Management Rentables

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Importance For Recipients Tax Return In 2020 Tax Return Irs Forms 1099 Tax Form

Importance For Recipients Tax Return In 2020 Tax Return Irs Forms 1099 Tax Form

Downloadable Form W 9 Irs W 9 Form Free Download Create Edit Fill And Print Irs Forms Rental Agreement Templates Fillable Forms

Downloadable Form W 9 Irs W 9 Form Free Download Create Edit Fill And Print Irs Forms Rental Agreement Templates Fillable Forms

1099 Form Fillable 1099 Misc Tax Form Diy Guide Rental Agreement Templates Letter Example Tax Forms

1099 Form Fillable 1099 Misc Tax Form Diy Guide Rental Agreement Templates Letter Example Tax Forms

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Small Business Tax Business Tax

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Small Business Tax Business Tax

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Will I Receive A Form 1099 For Rent

Will I Receive A Form 1099 For Rent

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster