Can My Employer Mail My W2

Your employer first submits Form W-2 to SSA. Review your paper Forms W-2 especially Copy A to ensure that they print accurately prior to mailing them to Social Securitys Wilkes-Barre Direct Operations Center.

Any Difference Between W2 By Mail And W2 By E Mail Personal Finance Money Stack Exchange

Any Difference Between W2 By Mail And W2 By E Mail Personal Finance Money Stack Exchange

If you cant get your Form W-2 from your employer and you previously attached it to your paper tax return you can order a copy of the entire return from the IRS for a fee.

Can my employer mail my w2. The W 2 form is usually mailed to you or made accessible online by the company you work for. If youre unable to get your Form W-2 from your employer contact the Internal Revenue Service at 800-TAX-1040. If you call the IRS after February 15 and after asking the employer for it then the IRS will send you a substitute form so that you can file without the W-2 and the IRS will tell your employer to.

The IRS will send you a letter with instructions and Form 4852 Substitute for Form W-2 Wage and Tax Statement or Form 1099-R Distributions from Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. Social Security accepts laser printed Forms W-2W-3 as well as the standard red drop-out ink forms. You must provide a copy of your Forms W-2 to the authorized IRS e-file provider before the provider sends the electronic return to the IRS.

You are supposed to be in. 6 2013 its entirely possible that the mailed W2s simply havent reached you yet. If your employer hasnt sent you the form yet contact them and ask for a copy.

Recently however some companies have delivered the. Contact your employer If you have not received your W-2 contact your employer to inquire if and when the W-2 was mailed. You can find this on a previous W-2 or ask your employer directly.

It now rests on you to act fast so that you can pay your taxes as per the law and also get your refunds on time. With respect to emailing you a copy of your W2 whether you have any ground to complain would depend in part on whether work duties of the person who. If the form is lost missing or you cant find it online contact your employer immediately.

Your name address Social Security number and phone number. The quickest way to obtain a copy of your current year Form W-2 is through your employer. You dont need to send your Forms W-2 to the IRS and should keep them in a safe place with a copy of your tax return.

Filing Without a W-2 If you dont get your duplicate W-2 in time to file youre still responsible for completing your taxes by the deadline. The W-2 form is a document issued from employers to employees that states how much money was earned in a certain year and how much tax was withheld from the employee. The IRS will contact the employer on your behalf and send you a Form 4852 a substitute W-2 to use to file your taxes.

The IRS will send your employer a letter requesting that they furnish you a corrected Form W-2 within ten days. Traditionally the W-2 is dispatched by regular mail. The deadline for employers to send out W2s to their employees is January 31st.

Once the correct details appear you will be given directions for importing your W2. All that you need is your employers name and their FEIN Federal Employer Identification Number. Its a good idea to call the IRS if you dont receive the W2 by mid-February.

If it was mailed it may have been returned to the employer because of an incorrect or incomplete address. Form W-2W-3 Instructions Form W-2cW-3c Instructions. Since today is Feb.

After SSA processes it they transmit the federal tax information to the IRS. The IRS will contact your employer or payer and request the missing form. Not only is it legal but many employers are now making the W2s available online so that their employees can print them.

Contact the IRS If you do not receive your W-2 by February 14th contact the IRS for assistance at 800-829-1040. So if your employer doesnt send your W2 in time then theres a problem brewing. Make sure they have your correct address.

Your employer is required to mail or otherwise deliver to you the required number of copies two three or four depending on where you live and work of Form W-2 not later than January 31 of each year in which you had wage income from that employer unless you have previously consented to receive such forms electronically and have not withdrawn that consent. The US post office is not always the most efficient of delivery services.

Wage Tax Statement Form W 2 What Is It Do You Need It

Wage Tax Statement Form W 2 What Is It Do You Need It

2013 W2 Form How To Determine Your Total In E Tax Withholding W2 Forms Power Of Attorney Form Resignation Letter Format

2013 W2 Form How To Determine Your Total In E Tax Withholding W2 Forms Power Of Attorney Form Resignation Letter Format

Any Difference Between W2 By Mail And W2 By E Mail Personal Finance Money Stack Exchange

Any Difference Between W2 By Mail And W2 By E Mail Personal Finance Money Stack Exchange

Understanding Your Tax Forms Form W 2 Wage And Tax Statement W2 Forms Tax Forms Irs Tax Forms

Understanding Your Tax Forms Form W 2 Wage And Tax Statement W2 Forms Tax Forms Irs Tax Forms

Didn T Get Your W2 Here S What To Do Now The Motley Fool

Didn T Get Your W2 Here S What To Do Now The Motley Fool

Is Your Employer Legally Obligated To Give You Your W2 Form Quora

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa Irs Forms W2 Forms Irs

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa Irs Forms W2 Forms Irs

Any Difference Between W2 By Mail And W2 By E Mail Personal Finance Money Stack Exchange

Any Difference Between W2 By Mail And W2 By E Mail Personal Finance Money Stack Exchange

How To Find Your W2 Form Online Finding Yourself W2 Forms Online

How To Find Your W2 Form Online Finding Yourself W2 Forms Online

Form W2 Everything You Ever Wanted To Know

Form W2 Everything You Ever Wanted To Know

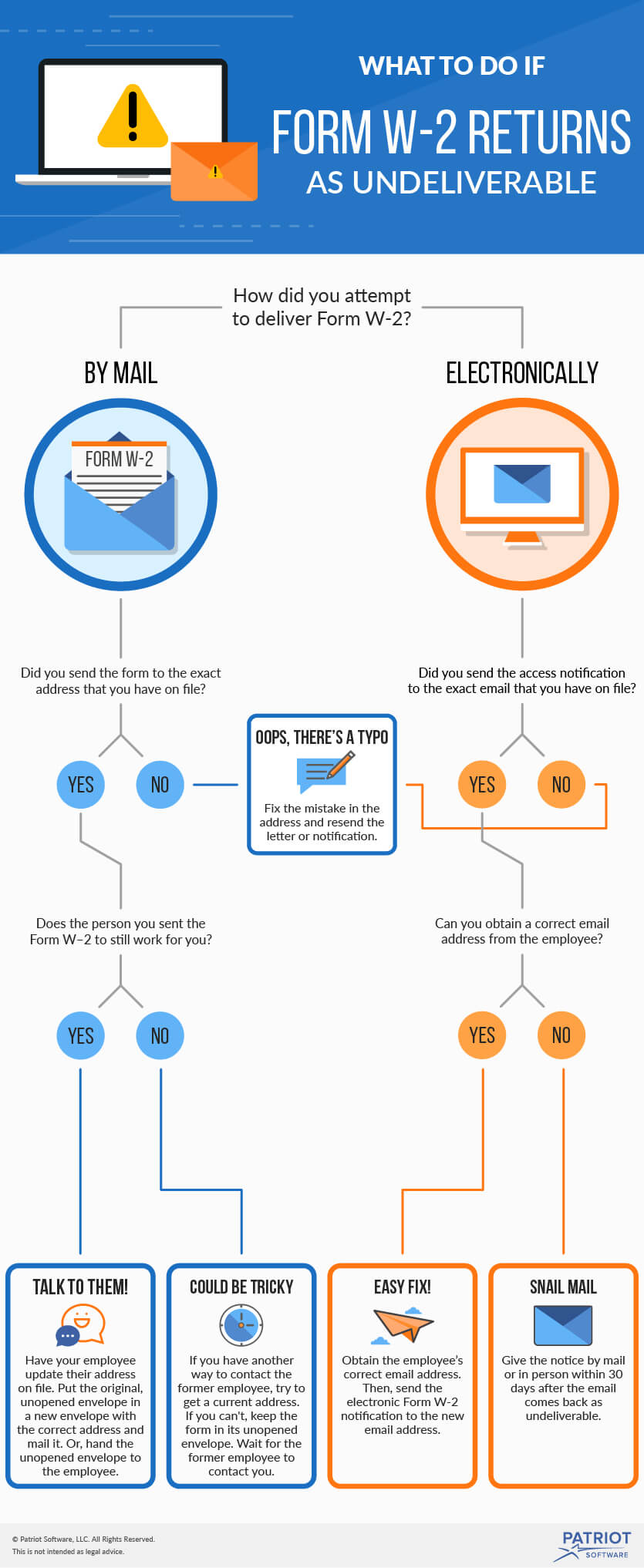

Form W 2 Returned To Employer Follow These Steps

Form W 2 Returned To Employer Follow These Steps

How To Get Your W2 Form Online For Free 2020 2021

How To Get Your W2 Form Online For Free 2020 2021

Fillabletaxforms Create A Free W2 Form W2 Forms Tax Forms Credit Card Services

Fillabletaxforms Create A Free W2 Form W2 Forms Tax Forms Credit Card Services

How To Find My W2 Form Online With H R Block Hr Block Employer Identification Number Tax Forms

How To Find My W2 Form Online With H R Block Hr Block Employer Identification Number Tax Forms

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time