Business Purchase Price Formula

Oct 14 2019 Finally Company A must record goodwill since the actual price paid for the acquisition 10 billion exceeds the sum of the net identifiable assets and write-up 3 billion 5 billion 8 billion. At 100 shares each the dollar amounts of Ford stock purchases are 4000 6000 and 8000 or a total of 18000 and the purchase total is divided by 300 shares to equal 60 per share.

Good Matrix For Crafters Considering Selling Their Wares Handmade Business Craft Pricing Pricing Formula

Good Matrix For Crafters Considering Selling Their Wares Handmade Business Craft Pricing Pricing Formula

Mar 05 2019 Another way to value a business is to multiply the annual earnings based on how long you think the company will operate.

Business purchase price formula. By Richard Parker President of The Business For Sale Buyer Resource Center and author of How To Buy A Good Business At A Great Price. This will give you another financially-based estimate of how much money a business is making. Tally the value of assets.

When valuing a business you can use this equation. For example a company with a share price of 40 per share and earnings per share after tax of 8 would have a PE ratio of five 408 5. Paid to owners level of risk and possible adjustments for.

Accurately valuing a small business is often the most challenging part of the process for prospective business buyers. Actual price - Standard price x Actual quantity Purchase price variance. Dec 20 2020 The formula is.

Sep 26 2017 To arrive at a valuation price multiply the the normalized income by a discount rate that reflects any risk or uncertainty in business income. The price earnings ratio PE ratio is the value of a business divided by its profits after tax. Similar to bond or real estate valuations the value of a business can be expressed as the present value of expected future earnings.

Multiply your SDCF figure by a market multiple usually between 1 and 3 for small businesses to arrive at a market price. If the investment is considered as safe as an investment in an excellent corporate stock that earns 10 percent in dividends and price increases the buyer should be willing to pay 200 000 20000 010. Asset Approach If your business owns real estate or significant assets you should incorporate the.

The deposit you will pay to the vendor will depend on the amount that has been agreed to in the sale of business agreement. However a deposit larger than 10 may be unreasonable to ask for. Use this calculator to determine the value of your business today based on discounted future cash flows with consideration to excess compensation.

Learn How to Sell your Business How to Buy a Business How to Value a Business How to Choose a Business Broker Exit Strategy The Business Sellers Guide. If a buysell agreement between related parties sets a formula purchase price for a deceased members interest resulting in a value less than that ultimately allowed for estate tax purposes because the Sec. Subtract any debts or liabilities.

Getting a Professional Appraisal. Determine the Cash Flow of the business. A positive variance means that actual costs have increased and a negative variance means that actual costs have declined.

Value Earnings after tax. See business valuation tool instructions for an explanation of the factors involved in the calculation. The standard price is the price that engineers believe the company should pay for an item given a certain quality level purchasing quantity.

This number is known as a multiplier of earnings. How To Value A Business. Therefore Company A must recognize 2 billion 10 billion.

Nov 25 2019 In general the average companys asking price can be expressed as 06 multiplied by annual revenue. There are a number of ways to determine the market value of your business. Add up the value of everything the business owns including all equipment and inventory.

Typically this will be 10 of the total purchase price but you can negotiate a different deposit price with the vendor before you exchange contracts. Nov 21 2009 Adjust the compensation of any other owners down to the standard for the market. If this investment were as safe as Government bonds that yields 6 percent the buyer should be willing to pay 333000 20000 006.

2703 requirements were not met the heirs will receive the lesser amount for their interest while the estate tax value will be.

How To Price Your Creative Work Creative Biz School Things To Sell Craft Business Business Tips

How To Price Your Creative Work Creative Biz School Things To Sell Craft Business Business Tips

How To Calculate Wholesale Price Wholesale Price Calculator

How To Calculate Wholesale Price Wholesale Price Calculator

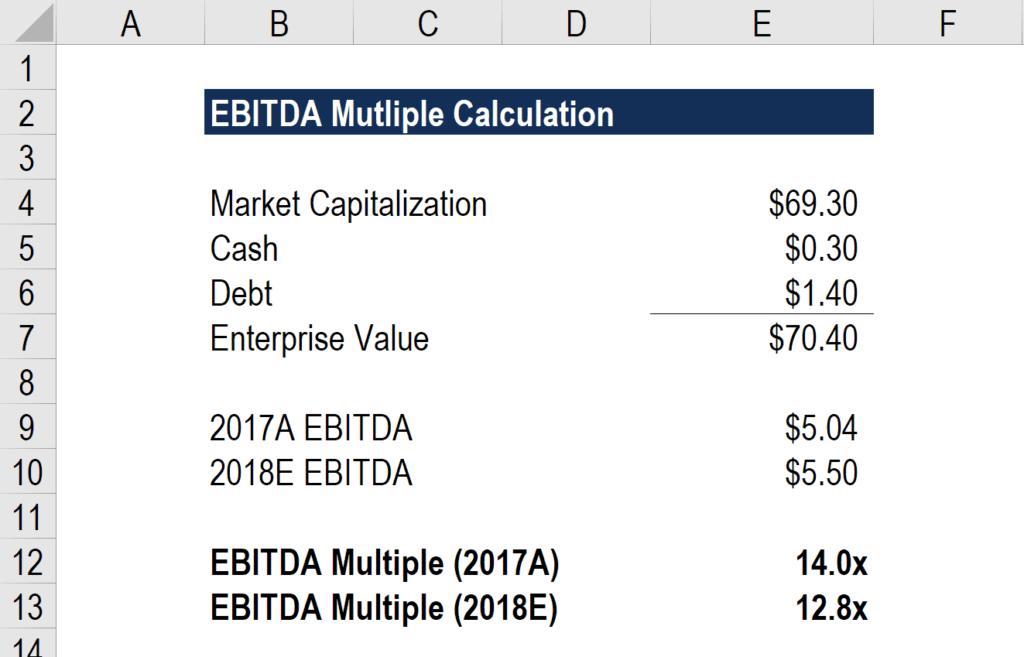

Ebitda Multiple Formula Calculator And Use In Valuation

Ebitda Multiple Formula Calculator And Use In Valuation

Fcf Formula Formula For Free Cash Flow Examples And Guide

Fcf Formula Formula For Free Cash Flow Examples And Guide

Structuring Business Assets Purchases With Taxes In Mind

Structuring Business Assets Purchases With Taxes In Mind

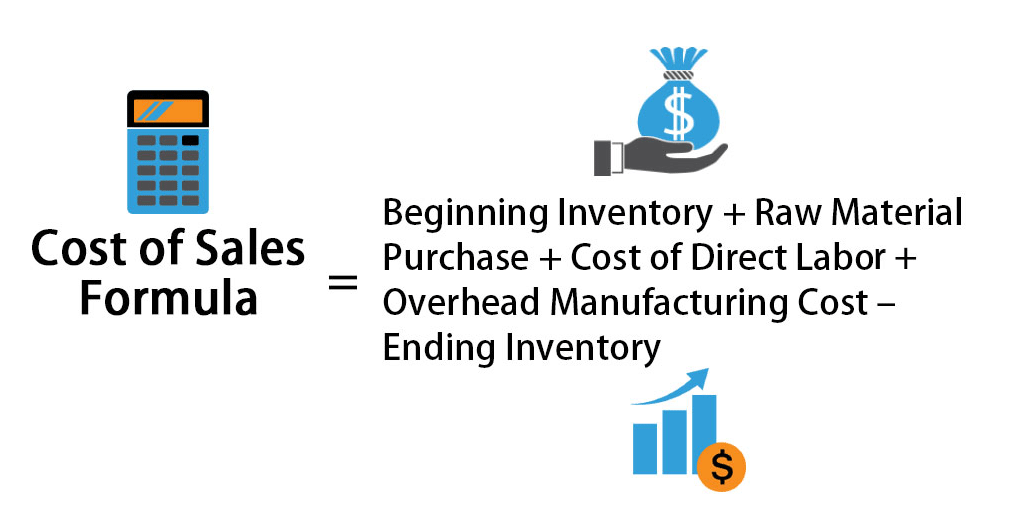

Cost Of Sales Formula Calculator Examples With Excel Template

Cost Of Sales Formula Calculator Examples With Excel Template

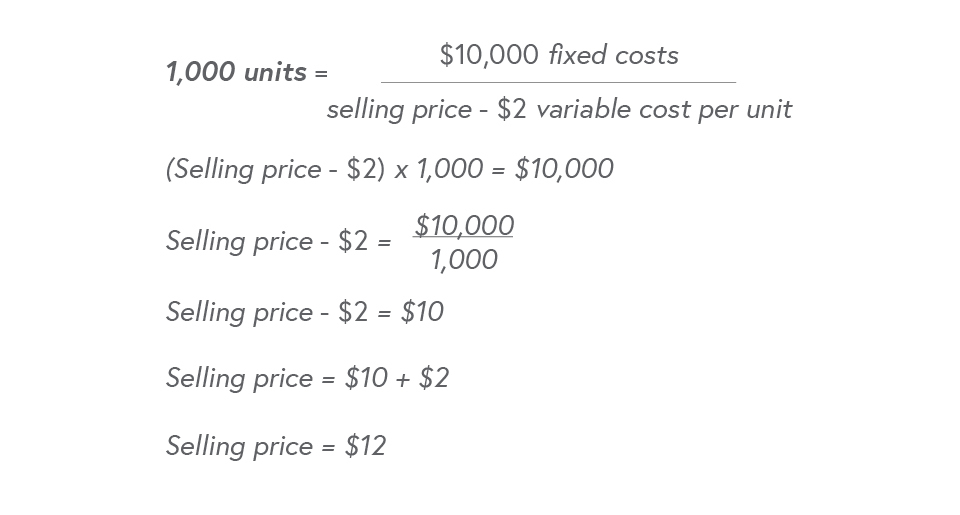

Impact Of Selling Price And Profit In Breakeven

Impact Of Selling Price And Profit In Breakeven

Ending Inventory Formula Step By Step Calculation Examples

Ending Inventory Formula Step By Step Calculation Examples

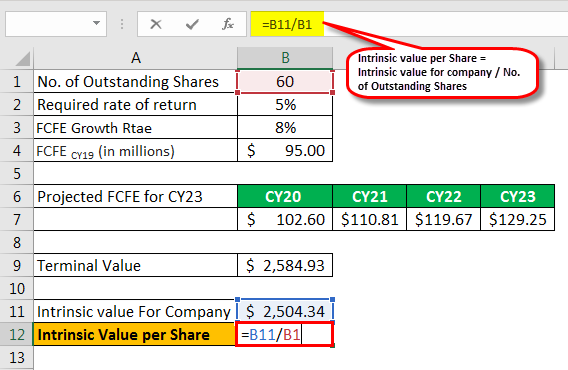

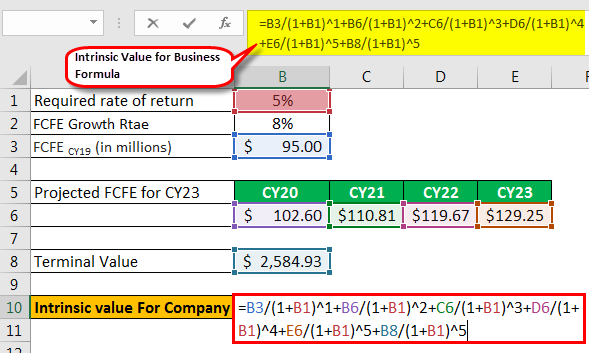

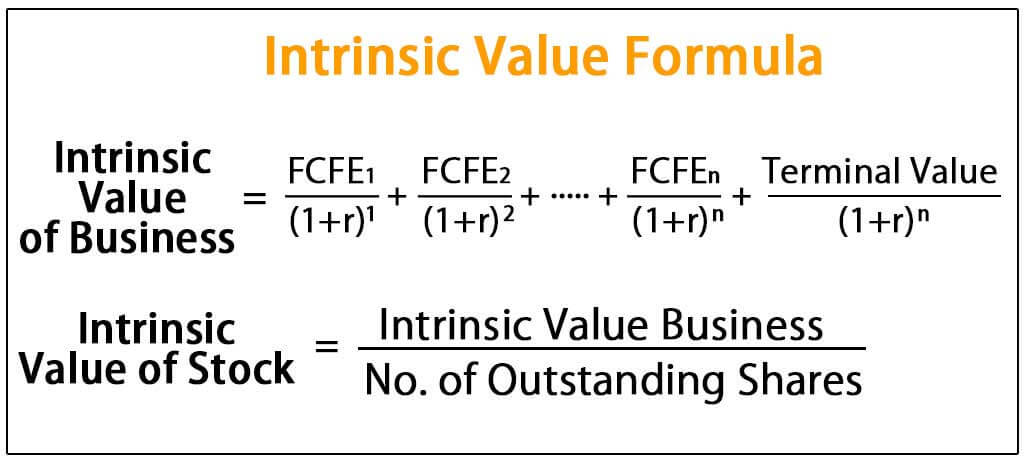

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Intrinsic Value Formula Example How To Calculate Intrinsic Value

/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg) Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

Structuring Business Assets Purchases With Taxes In Mind

Structuring Business Assets Purchases With Taxes In Mind

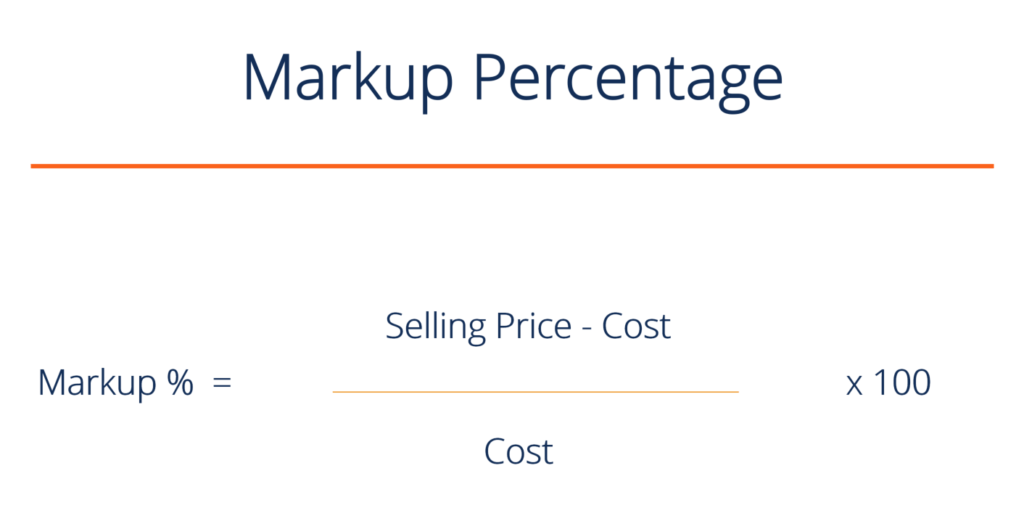

Markup Calculator Calculate The Markup Formula Examples

Markup Calculator Calculate The Markup Formula Examples

Cost Based Pricing Definition Formula Top Examples

Cost Based Pricing Definition Formula Top Examples

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Bond Pricing Formula How To Calculate Bond Price

Bond Pricing Formula How To Calculate Bond Price

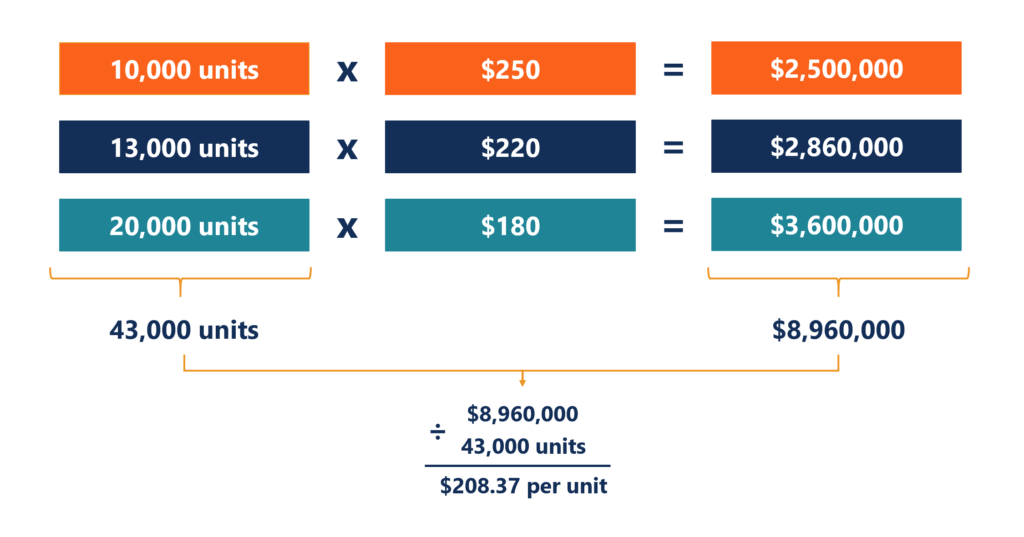

Average Selling Price Asp Overview How To Calculate Uses

Average Selling Price Asp Overview How To Calculate Uses

Calculate Retail Markdown For Products

Calculate Retail Markdown For Products

Cost Of Sales Formula Calculator Examples With Excel Template

Cost Of Sales Formula Calculator Examples With Excel Template

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Intrinsic Value Formula Example How To Calculate Intrinsic Value