Business Loan Rates Navy Federal

Rates for refinance loans where the existing lender is not Navy Federal are subject to a 0750 higher rate. Navy Federal puts our members financial needs first with low fees great rates and discounts.

Go Rewards Credit Card Navy Federal Credit Union

Loans for a motorcycle loans start at 725 APR with terms up to 84 months.

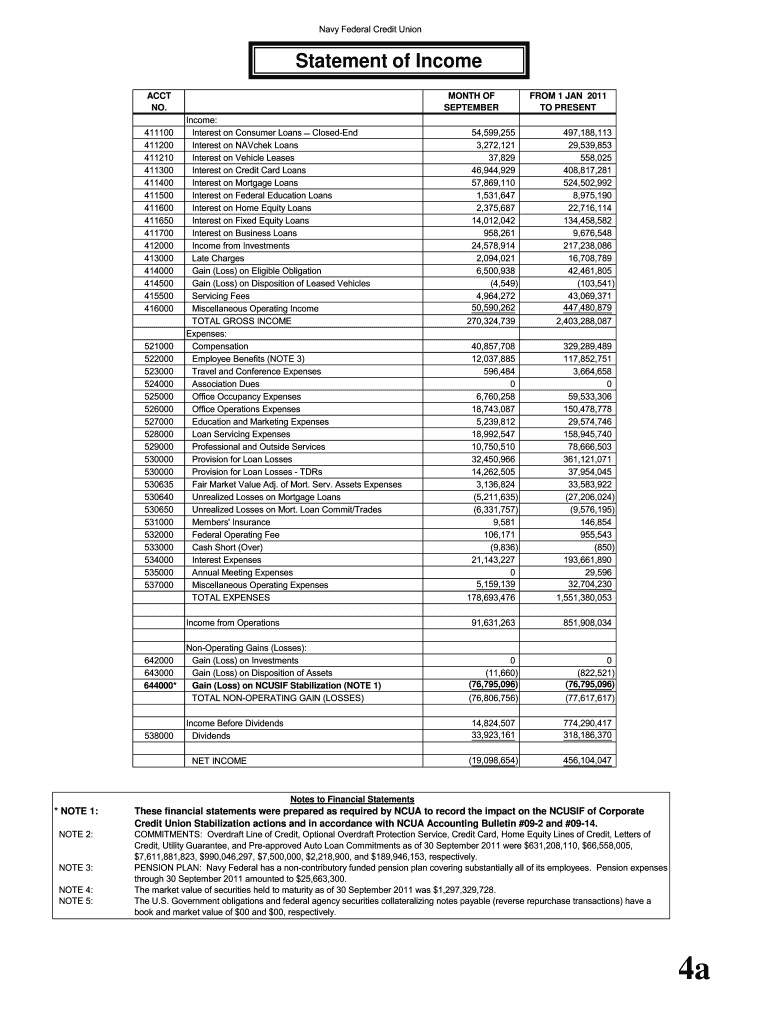

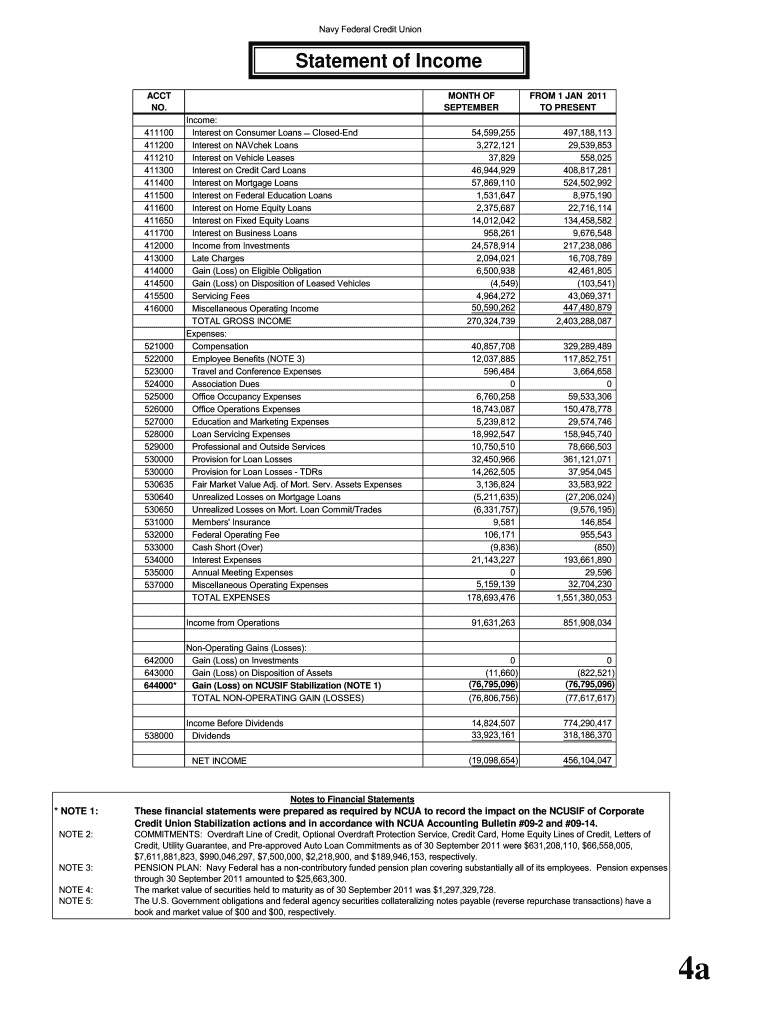

Business loan rates navy federal. A business checking line of credit CLOC is a credit product with a fixed rate of 179 APR. They envisioned a credit union that would offer loans with affordable rates and manageable terms. Rates start at 179 for boat loans with terms up to 180 months.

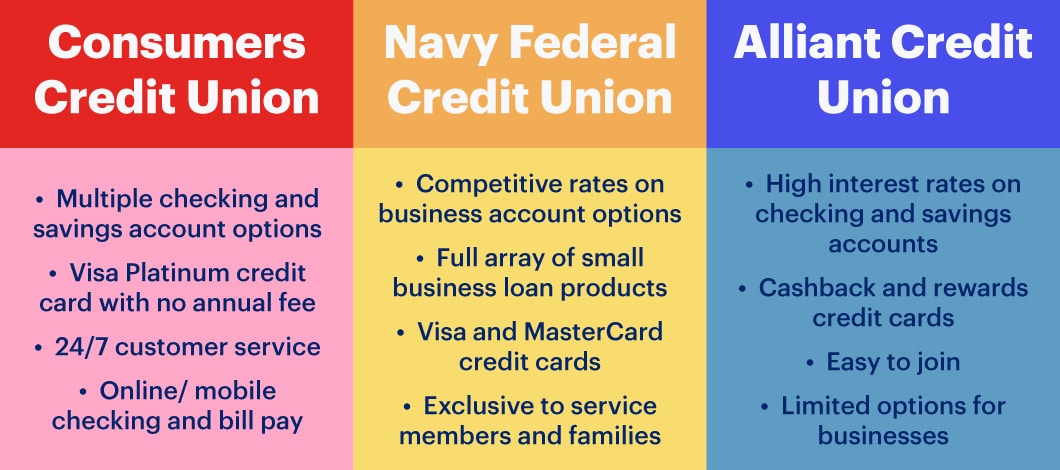

Up to 5 years. Navy Federal also has a selection of business convenience services including mobile deposits bill pay and payroll processing. Visit our site for more information about car loans and member benefits.

Credit unions often charge fewer origination. Rates displayed are the as low as rates for purchase loans and refinances of existing Navy Federal loans. Federal credit unions legally cant charge more than 18 interest on their loans and many others charge even less.

Must be a business member of Navy FCU. Navy Federal offers business loans and solutions dedicated to the commercial real estate industry. Rates for refinance loans where the existing lender is not Navy Federal are subject to a 0750 higher rate.

As of 5120 rates range from 915 APR to 18 APR are based on creditworthiness and will vary with the market based on The Wall Street Journal Prime Rate. Navy Federal considers cars with a certain number of miles and with a model year of 2019 to 2021 to be late-model vehicles. Other vehicle financing options.

If youre an active duty or retired member of the military you can can qualify for a 05 discount on your rate. None if performed at a Navy Federal branch or ATM. Rates are based on an evaluation of credit history so your rate may differ.

Collateral is required for everything except the unsecured business loans and general business assets vehicles real estate and CD accounts can be used to secure funding. Learn more about the benefits of a business membership. In addition to car loans Navy Federal Credit Union offers financing for a wide variety of other types of vehicles.

Wide range of loan amounts. This rate offer is effective 04152021 and subject to change. Otherwise 050 per domestic transaction or 100 per foreign transaction.

Rates are lowest for new-vehicle loans but Navy Federal also offers low rates on late-model used-car loans. Loans run from 250 to 50000 with terms up to 5 years. Navy Federals rates on older used vehicles or those with more than 30000 miles are similar to what some other.

CLOC repayment terms are 2 of the outstanding balance or 20 whichever is greater and the total outstanding balance will be due when it is less than 20. Navy Federal Credit Union offers competitive auto loan rates for military personnel veterans and their families. Navy Federal loans rates range from 749 to 1800 APR with no origination fees.

Navy Federal Credit Union unsecured business loans. Visit Business Solutions to learn more or call us at 1-877-418-1462. 3 rows Navy Federal Small Business Loans.

ATM cash advance fees. Navy Federal has the products and servicesincluding business loans and lines of creditthat our members need to pursue a successful business strategy. Rates for refinance loans where the existing lender is not Navy Federal are subject to a 0750 higher rate.

Message and data rates may apply. Also Navy Federals standard 1 loan origination fee can be rolled into the loan or waived in exchange for paying a higher mortgage rate further reducing the. Benefits of getting a business loan from a credit union.

Navy Federal Credit Union was founded at the end of the Great Depression by 7 Navy Department employees who wanted to help themselves and their co-workers reach their financial goals. Rates displayed are the as low as rates for purchase loans and refinances of existing Navy Federal loans. Borrowers can choose loan amounts from 250 to 50000 when applying for a personal loan at Navy Federal.

100 Financing Mortgages Navy Federal Credit Union

100 Financing Mortgages Navy Federal Credit Union

Should You Open A Navy Federal Credit Union Business Account

Should You Open A Navy Federal Credit Union Business Account

Navy Federal Credit Union Review Creditloan Com

Navy Federal Credit Union Review Creditloan Com

Navy Federal Business Loan Review 2021 Lendingtree

Navy Federal Business Loan Review 2021 Lendingtree

/navy-federal-inv-daccae32bfff43fdb1199a75c84e848d.png) Navy Federal Credit Union Personal Loans Review 2021

Navy Federal Credit Union Personal Loans Review 2021

Investment Property Financing Navy Federal Credit Union

Navy Federal Business Loans Our 2021 Review Finder Com

Navy Federal Business Loans Our 2021 Review Finder Com

Business Loans Business Solutions Navy Federal Credit Union

Business Loans Business Solutions Navy Federal Credit Union

Applying For An Auto Loan Navy Federal Credit Union

Should You Open A Navy Federal Credit Union Business Account

Navy Federal Credit Union Student Loan Refinancing Review 2021 Credible

Navy Federal Credit Union Student Loan Refinancing Review 2021 Credible

Navy Federal Credit Union Review Smartasset Com

Navy Federal Credit Union Review Smartasset Com

6 Best Credit Unions For Small Businesses Fast Capital 360

6 Best Credit Unions For Small Businesses Fast Capital 360

Best Auto Loan Rates For New Used Cars Magnifymoney

Best Auto Loan Rates For New Used Cars Magnifymoney

Navy Federal Personal Loan Review

Navy Federal Personal Loan Review

Navy Federal Business Loans Our 2021 Review Finder Com

Navy Federal Business Loans Our 2021 Review Finder Com

Navy Federal Bank Statement Pdf Fill Online Printable Fillable Blank Pdffiller

Navy Federal Bank Statement Pdf Fill Online Printable Fillable Blank Pdffiller

Mortgage Rates And Home Loan Options Navy Federal Credit Union