State Of New Mexico Business Tax Registration Form

Whether you are a small business owner a large multinational corporation a nonprofit organization or a sole proprietor these. The deadline for filing and paying 2020 New Mexico Personal Income Taxes has been extended until May 17 2021 in accordance with the extension granted by the IRS.

How To Get A Sales Tax Certificate Of Exemption In North Carolina

How To Get A Sales Tax Certificate Of Exemption In North Carolina

Obtain Business Licenses from the cities and counties in which you plan to do business 2.

State of new mexico business tax registration form. This Business Tax Registration Application Update Form is for the following tax programs. 505-827-3600 Option 2 Email. Others require a form to be downloaded completed and mailed or delivered to the relevant agency.

Known as a CRS Identification Number it is used to report and pay tax collected on gross receipts from business conducted in New Mexico. Hearing scheduled on new rules for New Mexico drivers licenses. 0 - - 00- Date Issued.

File the required reports for your New Mexico Foreign Corporation 3. You do not have to print a copy of an NTTC that you manage electronically because the electronic record of that execution is also our. Business Services Division Phone 505-827-3600 Option 1 Fax 505-827-4387 Email BusinessServicesstatenmus.

View documents in the folders below. New Registration Registration Update 3. To obtain your certificate complete and file Form ACD-31096 New Mexico Tax Clearance Request.

What does this letter mean. Registration is required by New Mexico Statute Section 7-1-12 NMSA 1978. You received this questionnaire because as an employer with th state of New Mexico you are required to fill this form out to register your business with the New Mexico Department of Workforce Solutions NMDWS.

Welcome to the Business Taxpayers pages of the New Mexico Taxation and Revenue Department. New Mexico Taxation and Revenue Department BUSINESS TAX REGISTRATION Application and Update Form Page 1 Section I. Gross Receipts Compensating Withholding Workers Compensation Fee Gasoline Special Fuels Cigarette Tobacco Products Severance Resource and Gaming Taxes.

Expand the folders below to find what you are looking for. July new business workshop to be presented online. First you need a Certificate of No Tax Due from the Taxation and Revenue Department Audit and Compliance.

This business tax registration application is for the following tax programs. On these pages you should be able to find information you need to take care of your business tax obligations to our state. The Tax Clearance Request form is available online.

For instructions on completing this form click here. Hours of Operation 800 AM - 500 PM Monday through Friday. And insures that every New Mexico citizen who needs a job will have one.

Some changes can be made online. 04232020 BUSINESS TAX REGISTRATION Application and Update Form Page 1 NM TRD ID. You can submit an ACD-31015 Application for Business Tax Identification Number to any local tax office.

If the vehicle is sold traded-in or given as a gift the vehicle owner is responsible for removing the license plate from the vehicle. Download or print the 2020 New Mexico Form ACD-31075 Business Tax Registration Update for FREE from the New Mexico Taxation and Revenue Department. In order to search for businesses you will be required to utilize the I am not a robot feature by clicking on the images as directed by our online portal.

You must update your business registration with the NEW MEXICO SECRETARY OF STATE select link your tax record with the NEW MEXICO TAXATION AND REVENUE select link and your unemployment insurance account with NEW MEXICO. Please visit the pages specific to the type of business you would like to register. More information is available here.

The New Mexico Department of Workforce Solutions is a World-Class market-driven workforce delivery system that prepares New Mexico job seekers to meet current and emerging needs of New Mexico businesses. If you are a buyer or lessee with a valid New Mexico CRS identification number you can obtain execute print and view New Mexico nontaxable transaction certificates NTTCs through Taxpayer Access Point. Complete all applicable fields see instructions on page 4 and 5 Please print legibly or type the information on this application.

All Corporations LLCs and Partnerships must first register with the Secretary of State. Gross Receipts Compensating Withholding Workers Com-pensation Fee Gasoline Special Fuels Cigarette Tobacco Products Severance Resource and Gaming Taxes. This letter means that you are an employer with the state of New Mexico and you are required to register your business.

You can register LLCs online but partnerships and corporations registration forms must be completed and submitted via mail or in person. Bureau of Elections Phone. Complete all applicable fields see instructions on page 4 and 5 Please print legibly or type the information on this application.

Why was this letter sent to me. We offer two ways to obtain a CRS identification number. Registration is required by New Mexico Statutes Section 7-1-12 NMSA 1978.

New Mexico is a Vehicle Plate to Owner state. Application for Business Tax ID Number Form ACD-31015 New Mexico Taxation and Revenue Department ACD-31015 Rev. Double-click a form to download it.

And every business who needs an employee will find one with the necessary skills and work readiness to allow New. New multi-year tax forms available. How to Apply for a CRS Identification Number.

Pay your taxes to the state of New Mexico more. When you change your businesss name address registered agent qualifying party licensee in charge or other legal representative. New Mexico Capitol Annex North 325 Don Gaspar Suite 300 Santa Fe NM 87501.

4 things you have to do in after you Form a New Mexico Foreign Corporation 1. Information about Online NTTCs. Keep proper records of your New Mexico Foreign Corporation on file 4.

Welcome to the Business Search screen where you may search for entities registered in New Mexico.

What Is A Multi Member Llc Advantages Disadvantages Explained Gusto

What Is A Multi Member Llc Advantages Disadvantages Explained Gusto

How To Get A Sales Tax Exemption Certificate In Iowa Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Iowa Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Colorado Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Colorado Startingyourbusiness Com

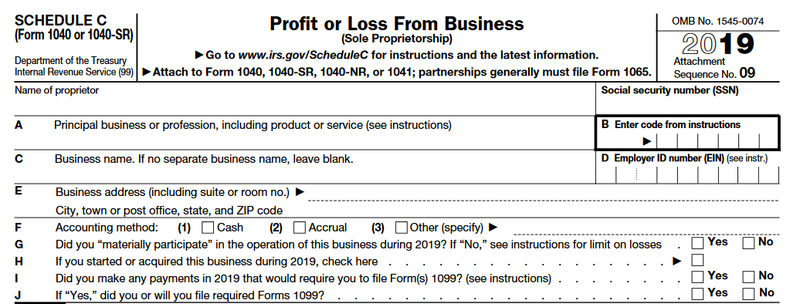

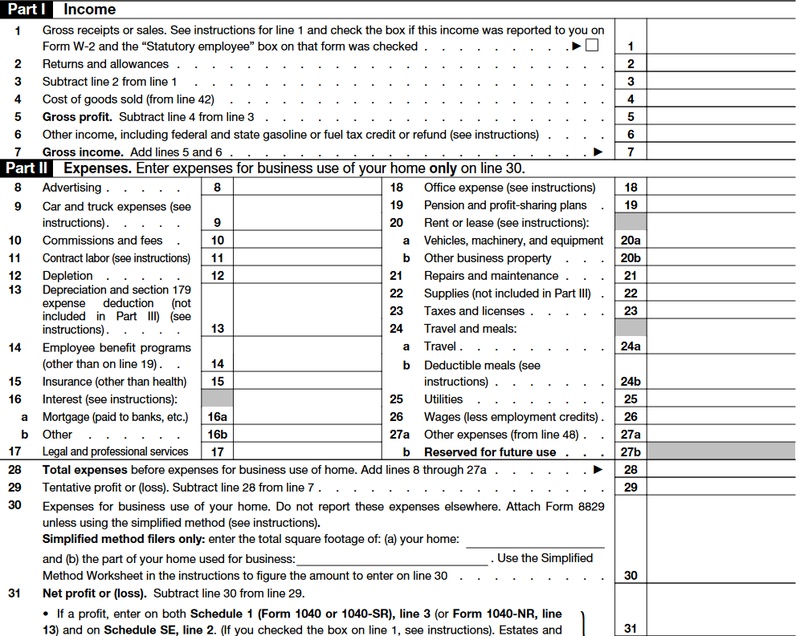

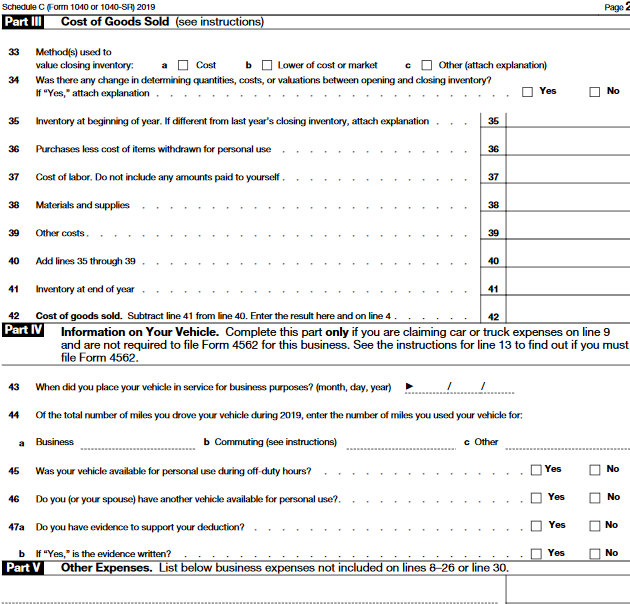

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Online Services Taxation And Revenue New Mexico

Online Services Taxation And Revenue New Mexico

How To Get A Sales Tax Exemption Certificate In Wisconsin Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Wisconsin Startingyourbusiness Com

How To Get A Resale Certificate In Massachusetts Startingyourbusiness Com

How To Get A Resale Certificate In Massachusetts Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

Stumped How To Form A Maryland Llc The Easy Way

How To Get A Resale Certificate In New Jersey Startingyourbusiness Com

How To Get A Resale Certificate In New Jersey Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Indiana Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Indiana Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Title Transfer Or Title Registration Global Multiservices Global Trucking Business Truck Stamps

Title Transfer Or Title Registration Global Multiservices Global Trucking Business Truck Stamps

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

How To Get An Exemption Certificate In Pennsylvania Startingyourbusiness Com

How To Get An Exemption Certificate In Pennsylvania Startingyourbusiness Com

10 Best States To Form An Llc Infographic Business Infographic States Infographic

10 Best States To Form An Llc Infographic Business Infographic States Infographic

Need A Deductions Working Sheet Paper Size A3 Here S A Free Template Create Ready To Use Forms At Formsbank Com Deduction Paper Size Sheet

Need A Deductions Working Sheet Paper Size A3 Here S A Free Template Create Ready To Use Forms At Formsbank Com Deduction Paper Size Sheet