How To Calculate Investment Interest Expense Deduction

For those in the 25 bracket the resulting tax savings will be 625. Completing your tax return Claim on line 22100 the total interest expenses and carrying charges.

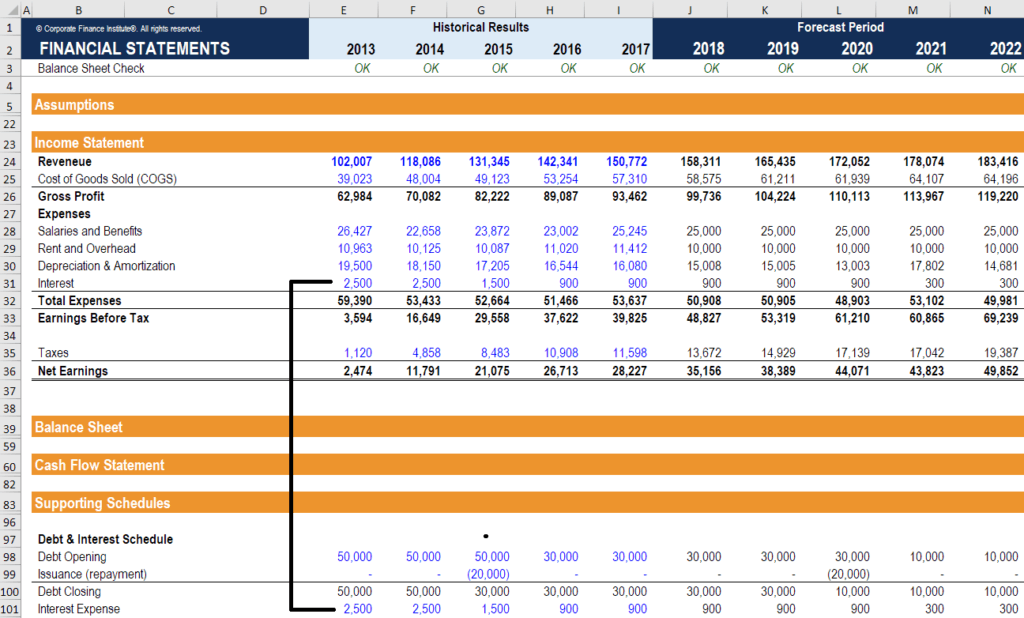

Interest Expense How To Calculate Interest With An Example

Interest Expense How To Calculate Interest With An Example

The annual investment interest deduction is limited to net investment income which is the total of taxable investment income reduced by investment expenses other than expenses related to investments that produce non-taxable income.

How to calculate investment interest expense deduction. Interest paid on debts incurred in order to invest such as margin accounts is generally deductible to the extent that it offsets investment income such as interest dividends and short term capital gains. If the investment interest expense is less than your investment income from interest and ordinary dividends minus any qualified dividends. Mortgage interest deductions.

Jan 12 2012 Investment interest expense is deductible to the extent of your investment income. But keep in mind that your deduction is capped at your net taxable investment income for the year. If you dont have any other deductible investment expense.

Line 4 from the list above less the sum of lines 7 and 8. Multiply the Schedule K. If you do enter your investment interest expenses on Line 9 of Schedule A.

This equals the Schedule K deferred obligation. To calculate your annual interest expense deduction limitation follow these five steps. Interest payments in excess of investment income can be carried forward in hopes of offsetting future investment income.

This calculator can help you better manage the. Dec 08 2016 For instance if you have 3000 in investment income and 2500 in investment interest paid then you can deduct all 2500. 3200 7000 gross investment income - 3800 deductible investment expenses is deductible in 2017The 3800 in deductible investment expenses is calculated by subtracting 1200 60000 AGI.

The investor would have an additional annual tax savings of more than 30k. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Feb 22 2021 For one you can only deduct investment interest expense up to the limit of your net investment interest This includes non-qualified dividends and capital gains.

To illustrate lets say that in 2020 you took out a 2000 personal loan with an interest rate of 4 to purchase an investment you expect to generate an 8 return. 2 from the 5000 in investment expenses other than interest. Investment income is current income from dividends interest and gains from properties that produce dividends and.

With regard to investment interest of 5000. Calculate your firms business interest income and business interest expense. Interest expense from her 25M mortgage is fully deductible.

You can include qualified dividends that pay only the lower dividend tax rates originally established during the Bush tax cuts but then youd give up their special qualified status. For each Form 6252 where line 5 is greater than 150000 figure the Schedule K-1 deferred obligation as follows. Identify the adjustments to taxable income to calculate ATI for.

If you have carrying charges for Canadian and foreign investment income complete the chart for lines 12000 12100 12010 and 22100 on the Worksheet for the Return. Mortgage interest on 750k is deductible through the qualified residence interest rules and 175M is deductible through investment interest expense to the extent that she has investment income. Floor plan financing interest expense should be calculated.

The investment interest deduction is only allowed to taxpayers who itemize their deductions.

Haryana Employment Exchange Global Employment Usa Full Employment 5 Employment Law For Human Resource Pra Business Tax Business Marketing Business Tips

Haryana Employment Exchange Global Employment Usa Full Employment 5 Employment Law For Human Resource Pra Business Tax Business Marketing Business Tips

Common Questions For Form 4952 Investment Interes Intuit Accountants Community

How To Organize Your Taxes With A Printable Tax Planner All About Planners Expenses Printable Organization Planner Printables Tax

How To Organize Your Taxes With A Printable Tax Planner All About Planners Expenses Printable Organization Planner Printables Tax

Irs Topic 500 Itemized Deductions Http Www Irs Gov Taxtopics Tc500 Html Tax Itemize Financial Money I Irs Taxes Deduction Internal Revenue Service

Irs Topic 500 Itemized Deductions Http Www Irs Gov Taxtopics Tc500 Html Tax Itemize Financial Money I Irs Taxes Deduction Internal Revenue Service

How To Calculate The Interest Expense With Net Income And Ebit The Motley Fool

How To Calculate The Interest Expense With Net Income And Ebit The Motley Fool

List Of The Expenses You Can Claim As A Tax Deduction In Australia Is You Rent Out A Commercial Rental Property Investment Property Rental Property Investment

List Of The Expenses You Can Claim As A Tax Deduction In Australia Is You Rent Out A Commercial Rental Property Investment Property Rental Property Investment

All You Need To Know About Time Interest Earn Ratio The Time Interest Earned Ratio Is Measured By The Income Before Inve Earnings Investing Interesting Things

All You Need To Know About Time Interest Earn Ratio The Time Interest Earned Ratio Is Measured By The Income Before Inve Earnings Investing Interesting Things

All You Need To Know About Time Interest Earn Ratio The Time Interest Earned Ratio Is Measured By The Income Before Inv Interesting Things Earnings Income Tax

All You Need To Know About Time Interest Earn Ratio The Time Interest Earned Ratio Is Measured By The Income Before Inv Interesting Things Earnings Income Tax

Home Office Tax Deductions Calculator 2019 Microsoft Excel Spreadsheet Tax Deductions Home Based Business Deduction

Home Office Tax Deductions Calculator 2019 Microsoft Excel Spreadsheet Tax Deductions Home Based Business Deduction

How To Calculate The Interest Expense With Net Income And Ebit The Motley Fool

How To Calculate The Interest Expense With Net Income And Ebit The Motley Fool

Interest Expense Formula Top 2 Calculation Methods

Interest Expense Formula Top 2 Calculation Methods

10 Tax Deductions For Smart Investors Passive Real Estate Investing Real Estate Investing Flipping Real Estate Investor Real Estate Tips

10 Tax Deductions For Smart Investors Passive Real Estate Investing Real Estate Investing Flipping Real Estate Investor Real Estate Tips

What Is Form 4952 Investment Interest Expense Deduction Turbotax Tax Tips Videos

What Is Form 4952 Investment Interest Expense Deduction Turbotax Tax Tips Videos

How To Deduct Property Taxes On Irs Tax Forms Irs Tax Forms Mortgage Interest Irs Taxes

How To Deduct Property Taxes On Irs Tax Forms Irs Tax Forms Mortgage Interest Irs Taxes

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Expenses Fo Investment Property Being A Landlord Investing

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Expenses Fo Investment Property Being A Landlord Investing

How To Calculate The Interest Expense With Net Income And Ebit The Motley Fool

How To Calculate The Interest Expense With Net Income And Ebit The Motley Fool

Standard Deduction Vs Itemized Tax Deduction What S Better Standard Deduction Tax Deductions Deduction

Standard Deduction Vs Itemized Tax Deduction What S Better Standard Deduction Tax Deductions Deduction

What Are Deductible Investment Interest Expenses Turbotax Tax Tips Videos

What Are Deductible Investment Interest Expenses Turbotax Tax Tips Videos