Do I Need To Send A 1099 To Utility Companies

The same rule applies to farmers that make payments in connection with the trucking or. If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not.

1099 Payments How To Report Payments To 1099 Vendors

1099 Payments How To Report Payments To 1099 Vendors

Utilities eg telephone gas electric cable etc 3.

:max_bytes(150000):strip_icc()/1099c-5606545f559b4f28883a0de35905889b.jpg)

Do i need to send a 1099 to utility companies. Payment is considered taxable and reportable and it MAY need to be reported on Form 1099-MISC. You need to file Form 1099-MISC only if you pay an independent contractor 600 or more by cash check or direct deposit during the year. If you personally hire a vendor to do work unrelated to your company you dont have to send a 1099-MISC.

If you pay an independent contractor by an online payment service like PayPal credit card or any other type of electronic payment you dont need to file a Form 1099-MISC reporting the payment to the IRS. Thus trucking companies need not issue Form 1099s to owner-operators that are under lease for freight hauling services. Equipment instruments and disposable supplies.

Favorite Answer You do not have to send 1099s to corporations. If the following four conditions are met you must generally report a payment as nonemployee compensation. Vendors who operate as C- or S-Corporations do not require a 1099.

Payments made by PayPal or another third-party network gift card debit card or credit card also dont require a 1099. You do not need to send this form to vendors of storage freight merchandise or related items or when rent is paid to a real estate agent. Anyone who checks any box other than corporation needs to be sent a 1099-MISCform if.

Do not furnish a Form 1099-MISC to banks public utilities or tax exempt organizations. You are required to include the taxpayer identification number of the payee on your. However a few exceptions exist that require a.

Water waste disposal phone internet etc. Corporations with the exception of attorneys medical and healthcare services and CPA firms. FORM 1099-MISC REPORTING REQUIREMENTS.

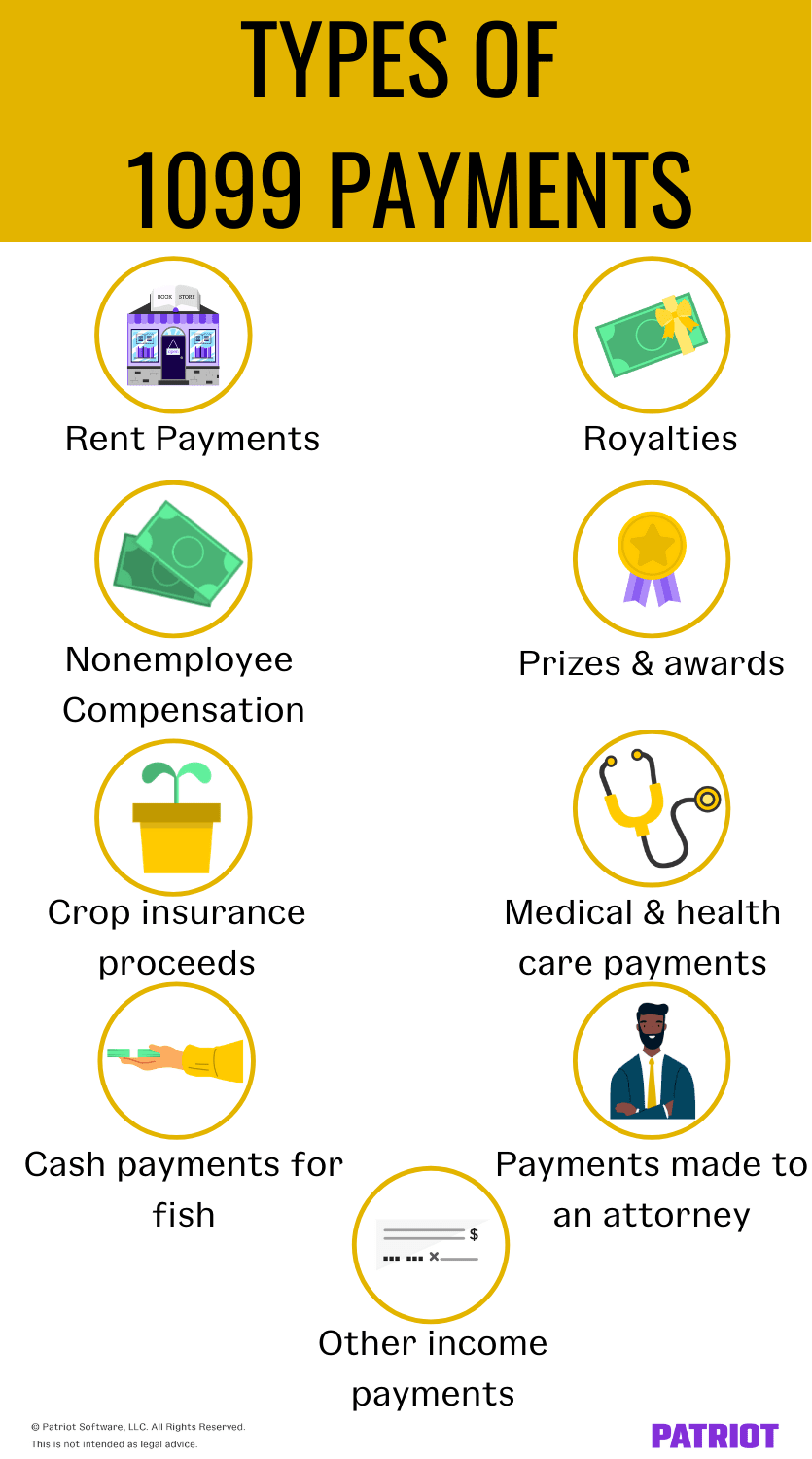

The primary purpose of the 1099-MISC is to report income individuals independent contractors etc receive to. Below that threshold you do not need to report the payment. Items that do NOT need to be reported on Form 1099-MISC.

See the instructions for more details. You must send and file a 1099-MISC for certain types of payments if you paid 600 or more during the year. If youve paid 600 or more in rent to someone in 2020 it will need to go on your 1099-MISC.

The exception to this rule is with paying attorneys. On that form they are required to check whether they are taxed as a sole proprietor partnershipor corporation. IRS Regulations require businesses and payers to file information returns for certain types of payments for rents services prizes and awards made in the course of your trade or business.

If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business. Hello again Jan Anytime that you pay someone more than 600 during the year for services which they have performed you should have that person or company fill out a W-9 form for you. Storage unit records storage etc.

Nonprofits are considered a business. In that statement alone there are some keys to what needs to be reported including. This brings us to the question of whether or not you need to report utilities paid with rent on your 1099-MISC.

16041-3 c exempts payments for freight services from the general requirement for payors to issue Form 1099 to independent contractors and others with which they do business. Expense Reimbursements to non-employeesstudents substantiated by original receipts where required 2. Also most corporations will not be issued a Form 1099-MISC unless they have been paid 600 or more in a calendar year for certain services including medical or legal services and including gross proceeds paid to attorneys.

1 To a Business First the payments need to be made in a business so you dont have to prepare a 1099-MISC for the guy who cuts your home lawn. Reporting Payments to Independent Contractors. Form 1099-MISC is used to report payments made to vendors that provide services to a business.

Due to the high level of administrative reporting for corporations the IRS exempts corporations from needing to receive a Form 1099-MISC. This helps the IRS to compare payments made with income reported. If your vendor is a corporation a C Corp or an S Corp you do not need to issue them a 1099.

You are not required to issue 1099s for payments made for personal use.

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Overview And Faq Buildium Help Center

Form 1099 Overview And Faq Buildium Help Center

State And Federal Deadlines And Important Reminders For Filing 1099 Forms

State And Federal Deadlines And Important Reminders For Filing 1099 Forms

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

How To Fill Out And Print 1099 Nec Forms

How To Fill Out And Print 1099 Nec Forms

1099 Misc Form 2018 Credit Card Services Electronic Forms Tax Forms

1099 Misc Form 2018 Credit Card Services Electronic Forms Tax Forms

26 Best Form 1099 A Photo Best Form Template Example Within 1099 Template 2016 Free

26 Best Form 1099 A Photo Best Form Template Example Within 1099 Template 2016 Free

Form 1099 Overview And Faq Buildium Help Center

Form 1099 Overview And Faq Buildium Help Center

Bank Money Deposit Form 2 Advantages Of Bank Money Deposit Form And How You Can Make Full Us Bank Of America Banking App Power Of Attorney Form

Bank Money Deposit Form 2 Advantages Of Bank Money Deposit Form And How You Can Make Full Us Bank Of America Banking App Power Of Attorney Form

Taxes Checklist Tax Prep Checklist Tax Checklist Tax Preparation

Taxes Checklist Tax Prep Checklist Tax Checklist Tax Preparation

Ambit Energy Statement Ambit Energy Energy Bill Template

Ambit Energy Statement Ambit Energy Energy Bill Template

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Training Dynamo S Survival Guide For Microsoft Dynamics Gp And The New 1099 Nec Form The Official Blog For Training Dynamo Llc

Training Dynamo S Survival Guide For Microsoft Dynamics Gp And The New 1099 Nec Form The Official Blog For Training Dynamo Llc

:max_bytes(150000):strip_icc()/1099c-5606545f559b4f28883a0de35905889b.jpg) Form 1099 C Cancellation Of Debt Definition

Form 1099 C Cancellation Of Debt Definition

Download A 1099 Form Irs Employee 1099 Form Free Download Irs Email Signature Templates Free Email Signature Templates

Download A 1099 Form Irs Employee 1099 Form Free Download Irs Email Signature Templates Free Email Signature Templates