Which Of The Following Is Not A Disadvantage Of The Partnership Form Of Business Organization

An unincorporated business owned by two or more persons voluntarily acting as partners co-owners is call a partnership. Access to more capital.

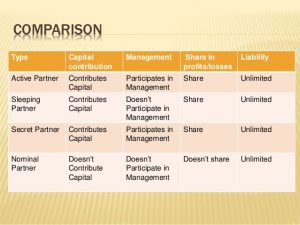

4 Types Of Partnership In Business Limited General More

4 Types Of Partnership In Business Limited General More

It is difficult to raise capital.

Which of the following is not a disadvantage of the partnership form of business organization. Even if the fum is to be registered the expenses are not much compared to company form of organization. 1 The disadvantage of the partnership form of business organization compared to corporations include. Businesses as partnerships do not have to pay income tax.

The partnership has several advantages over the sole proprietorship. 1 Less formal with fewer legal obligations. Partners are taxed on their share of the profit or loss at their individual tax rates.

1The correct answer is option d Explanation. Some advantages of an LLC include. An agreement is necessary and the procedure for registration is very simple.

The most significant advantage of partnerships is the exemption from tax at the business level. A firm consists of more than one person. The following are the advantages of partnership business.

The partnership form of business ownership enjoys the following advantages. Advantages and Disadvantages of Partnerships. Each partner files the profits or losses of the business on his or her own personal income tax return.

In a sole proprietorship liability is shared with many partners. Therefore it can secure more capital from. Limited resources Since there is a limit of maximum partners 20 in case of non-banking firms and 10 in banking firms the capital raising capacity of a partnership firm is limited compared to a Joint Stock Company.

C The requirement for the partnership to pay income taxes. Partnership is one of the most common types of business entities practiced today. First it brings together a diverse group of talented individuals who share responsibility for running the business.

There are many advantages and disadvantages of partnership as a form of business entity and they should be carefully considered. Similarly a partnership can be dissolved easily at any time without undergoing legal formalities. Second it makes financing easier.

More partners can be taken into partnership if capital needs are large. The accounting process is generally simpler for partnerships than for limited companies. The owner is responsible for all the obligations of the business.

A Partnership is a business with two or more individuals owns and manages the business. That is each partner is liable for their share of the partnership debts as well as being liable for all the debts. Disadvantages of a partnership include that.

As the name states owners and managers have limited personal liability for business debts whereas individuals assume full. The partnership form of business organisation suffers from the following disadvantages. A sole proprietorships business activity may be more stable than the proprietors willingness to remain actively involved in the business.

A partnership business can be defined as the coming together of two or more people to form a business with the aim of making profit. Partners share the unlimited liabilities of the business and operate the business together. Option d holds not a disadvantage as partnership form of business is easy to form anddoes not involve registration with lengthy legal procedur view the full answer Previous question Next question.

A The legal requirements for formation. This way the business does not get taxed separately. A partnership firm can be formed without any legal formalities and expenses.

The liability of the partners for the debts of the business is unlimited each partner is jointly and severally liable for the partnerships debts. Advantages of a General Partnership. There is an increased ability to raise funds when there is more than one owner.

While an advantage of the sole proprietorship form of organizations is its simplicity this unlimited liability feature is a disadvantage to the owner. Just like other types of business partnership business has so many advantages and disadvantages. A sole proprietorship is the least expensive business organization to create.

What form of business organization is a voluntary association between two or more persons who co-own a business for profit. This form of business is a hybrid of other forms because it has some characteristics of a corporation as well as a partnership so its structure is more flexible. One of the main advantages of a partnership business is the lack of formality compared with managing a limited company.

General unlimited personal In an ______ partnership the partners divide the profits and the management responsibilities and share _______ liability for the firms debts. The business can draw on the financial resources of a number of individuals. A partnership is easy to form as no cumbersome legal formalities are involved.

The partnership form of organisation enjoys large resources than a sole proprietorship so that the scale of operation can be enlarged to get the benefit of large-scale economies. A sole proprietorship is not taxed as an organization. It can only use the owners personal saving and consumer loans.

B Unlimited liability for the partners.

Business Ownership Structure Types Business Structure Business Basics Business Ownership

Business Ownership Structure Types Business Structure Business Basics Business Ownership

Partnership Vs Corporation Vs Sole Proprietorship Pesquisa Google Sole Proprietorship Starting A Business Corporate

Partnership Vs Corporation Vs Sole Proprietorship Pesquisa Google Sole Proprietorship Starting A Business Corporate

Comparison Chart Of Business Entities Startingyourbusiness Com Sole Proprietorship Business Comparison

Comparison Chart Of Business Entities Startingyourbusiness Com Sole Proprietorship Business Comparison

Advantages And Disadvantages Of Partnership Merits And Demerits Of Partnership Forms Of Business Organis Business Studies Business Organization Partnership

Advantages And Disadvantages Of Partnership Merits And Demerits Of Partnership Forms Of Business Organis Business Studies Business Organization Partnership

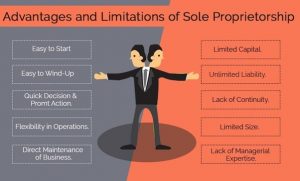

Sole Proprietorships Advantages Disadvantages Piktochart Infographic Teaching Business Business Basics Sole Proprietorship

Sole Proprietorships Advantages Disadvantages Piktochart Infographic Teaching Business Business Basics Sole Proprietorship

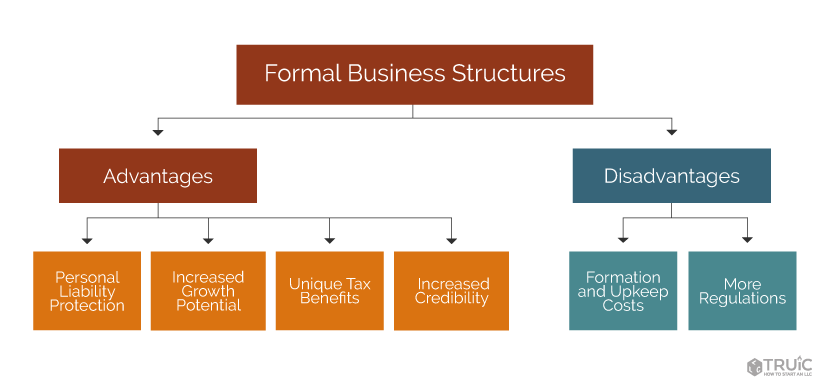

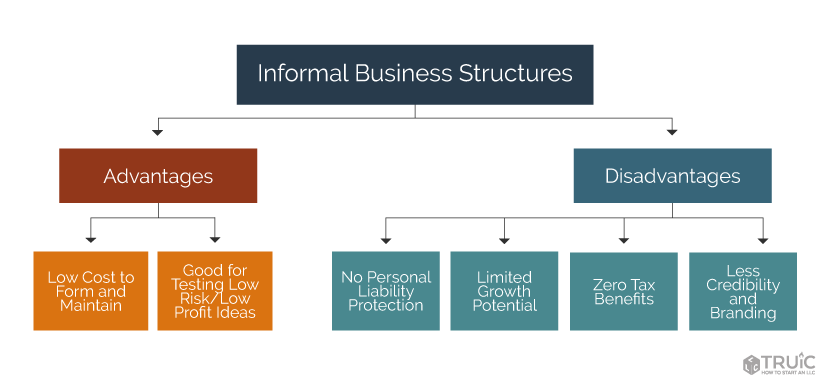

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic

Economics Business Organizations Simulation Activities Distance Learning Student Activities Student Organization Activities

Economics Business Organizations Simulation Activities Distance Learning Student Activities Student Organization Activities

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

Great Activity For Introduction To Business And Marketing Course Through This Activity Stude Business Ownership Importance Of Time Management Online Education

Great Activity For Introduction To Business And Marketing Course Through This Activity Stude Business Ownership Importance Of Time Management Online Education

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic

Advantages And Disadvantages Of Partnership Efinancemanagement

Advantages And Disadvantages Of Partnership Efinancemanagement

Cs Foundation Detailed Explanation Of Forms Of Business Organization Business Organization Business Sole Proprietorship

Cs Foundation Detailed Explanation Of Forms Of Business Organization Business Organization Business Sole Proprietorship

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

Gross Vs Net Revenue Difference Importance And More Money Management Bookkeeping Business Accounting And Finance

Gross Vs Net Revenue Difference Importance And More Money Management Bookkeeping Business Accounting And Finance

Business Ownership And It S Different Types

Business Ownership And It S Different Types

Types Of Business Organizations What Business Organization Should You Establish Your Business Under Business Organization Business Infographic Infographic

Types Of Business Organizations What Business Organization Should You Establish Your Business Under Business Organization Business Infographic Infographic

Browse Our Sample Of It Partnership Agreement Template For Free Contract Template Business Template Professional Templates

Browse Our Sample Of It Partnership Agreement Template For Free Contract Template Business Template Professional Templates