How To Register A Sole Trader Business In Ireland

Only residents of the Republic of Ireland can register as Sole Traders or Partnerships in Ireland. Ensure that you have enough capital and pick a name for your business.

How To Register A Company In Ireland

How To Register A Company In Ireland

Value Added Tax VAT Relevant Contracts Tax RCT.

How to register a sole trader business in ireland. To set up as a sole trader you need to register for register for Self Assessment and file a tax return every year. For Irish Residents who are non-EU nationals please note you must have Stamp 4 and a letter of business permission from the Department of Justice to register a business name as a Sole Trader or Partnership. Youll need to file a tax return every year.

Non-resident sole traders must complete a. The Irish Trade Register will issue a Certificate Business Name which the sole trader must display at their place of business. If you are not eligible for eRegistration then you must complete a Form TR1 which can be used to register for.

Check to ensure that. Bank of Ireland allows sole traders to apply online for a sole trader business current account this link will take you to the Bank of Ireland business banking site. To register a business name the form required is a RBN1 form Registration of Business Name.

If so you must register this name with the CRO by completing and sending them a Form RBN1A. By taking on all the liabilities of your business you also reap the rewards but you can still employ people to help you grow your. To set up as a sole trader you must register for income tax with Revenue as a self-employed sole trader.

Funding Microfinance Ireland provides loans to small businesses with no more than 10 employees including sole traders and start-ups. By registering as self-employed you are ready to start earning promptly with minimal paperwork and little fuss. You can register on ROSie or you can for you can complete a form TR1.

You do this using Revenues online service. Therefore the first step towards becoming a sole trader is to register the business name with the Irish Companies Registration Office by filing the RNB1 Form. Registering as a company.

Once you have registered Revenue will. Ensure that the name you choose is memorable and that it represents the operations of your business. Open a bank account Then you need to open a bank account.

You can register your business name and file company returns online with the CRO using CORE Companies Online Registration Environment. To register as a sole trader you must be a resident within the State and have permission to work in Ireland if you are a non-EEA citizen. Using Revenue Online Service ROS.

To register as a sole trader you need a PPS number. If you want to stop being a sole trader you follow a similar process. It just takes a few minutes.

You can register a Company Business Name Trading Name Foreign Company External Company or Limited Partnership with the CRO. Employer Pay As You Earn PAYE Environmental Levy. You log into ROSie and click on Other Services.

To register online individuals would need to set up an account online through CORE on the Companies Registration office website and complete and submit the form online. All you need to do is identify the type of business you want to operate. Business name registration can also be done online in Ireland.

This business structure is an extension of the individual so a sole trader will pay personal income tax rates on. See registering for tax as a company for more information on registering your company with Revenue. Register for Self Assessment.

Perhaps the most popular way to start a business in Ireland quickly registering as a sole trader is the fastest and simplest approach to running your own business. You may wish to trade under a business name that is different from your name or the names of you partners. You can register different types of businesses with the CRO.

To set up as a sole trader you need to tell HMRC that you pay tax through Self Assessment. Please note that the CRO Public Office is based in Gloucester Place Lower Dublin 1 on the corner with Sean MacDermott Street. This form can be also be used to register for VAT.

Register for Income Tax by completing Form TR1 The first thing you need to do is complete a Form TR1 and submit it to your local tax office. Certain people can only register using the tax registration paper form TR1 pdf. To register as a sole trader in Ireland you will need to take the following steps.

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

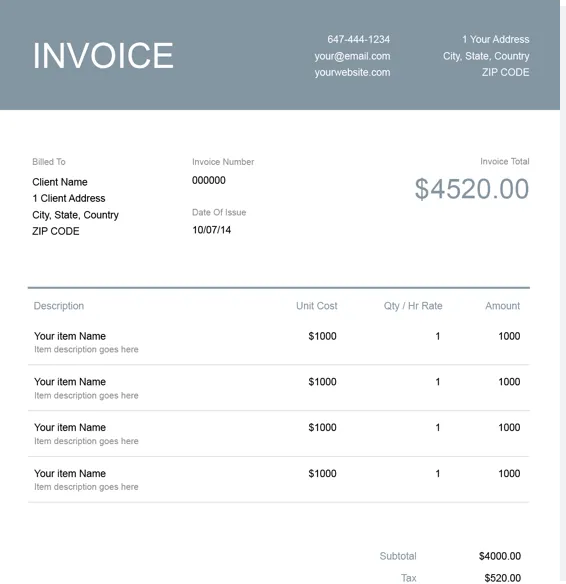

How To Invoice As A Sole Trader Invoicing Guide For Beginners

How To Invoice As A Sole Trader Invoicing Guide For Beginners

Step By Step To Starting Your Own Business

Step By Step To Starting Your Own Business

![]() Registering As A Sole Trader In Ireland A Step By Step Checklist

Registering As A Sole Trader In Ireland A Step By Step Checklist

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes

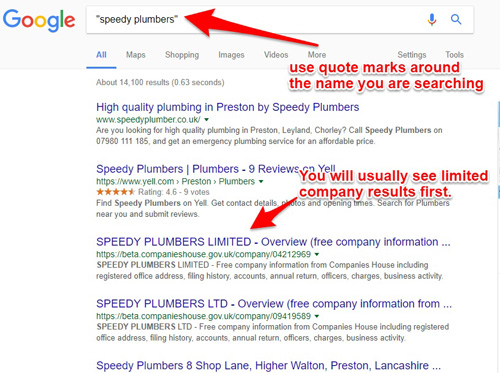

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

Types Of Companies In Ireland O Donnell Co Chartered Accountants

Types Of Companies In Ireland O Donnell Co Chartered Accountants

Irish Company Provides Company House Ireland Services To Individuals And Corporations Around The World You Start Up Business Business Format Company Secretary

Irish Company Provides Company House Ireland Services To Individuals And Corporations Around The World You Start Up Business Business Format Company Secretary

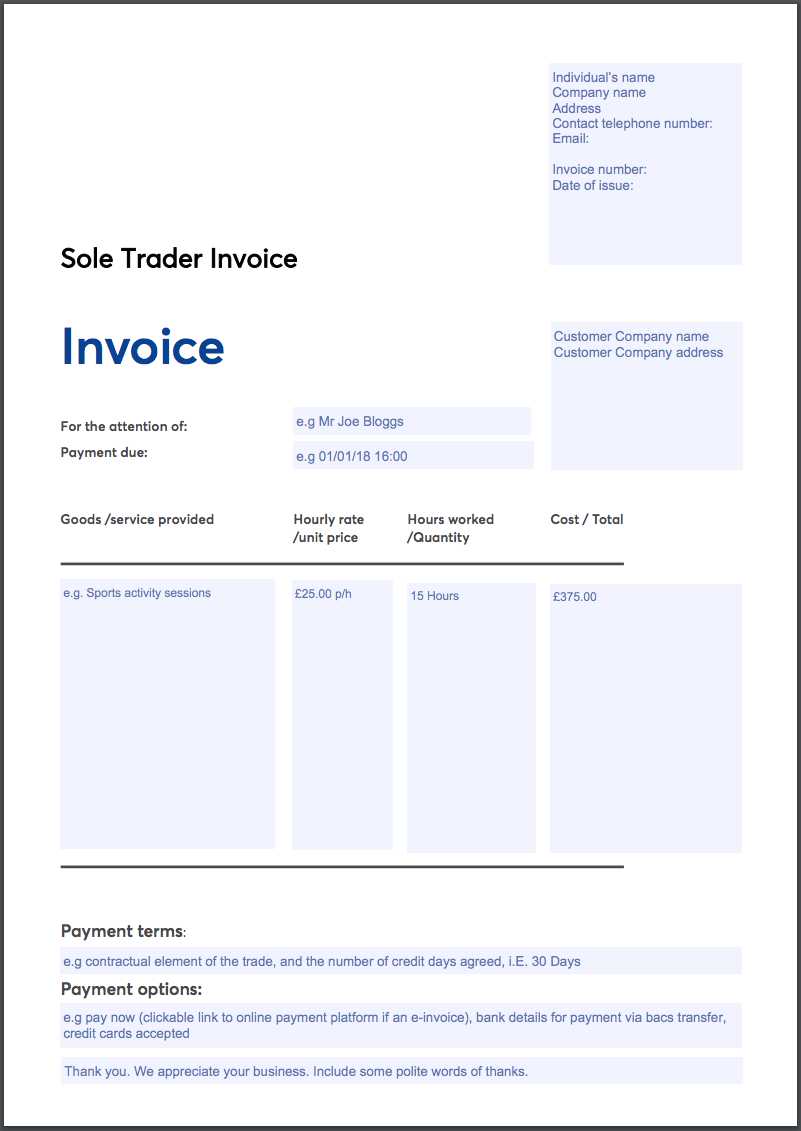

Free Invoice Template Sole Trader Ltd Company Vat Invoice Gocardless

Free Invoice Template Sole Trader Ltd Company Vat Invoice Gocardless

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Irish Sole Trader No Utr Number Account Suspended Sell On Amazon Amazon Seller Forums

Irish Sole Trader No Utr Number Account Suspended Sell On Amazon Amazon Seller Forums

A Sole Proprietorship Also Known As The Sole Trader Or Simply A Proprietorship Is A Type Of Business Entity That Is Sole Proprietorship Sole Trader Business

A Sole Proprietorship Also Known As The Sole Trader Or Simply A Proprietorship Is A Type Of Business Entity That Is Sole Proprietorship Sole Trader Business

Declaration Of Trust How To Register A Sole Proprietorship In Singapore

Sole Trader Invoice Template Free Download Send In Minutes

Sole Trader Invoice Template Free Download Send In Minutes

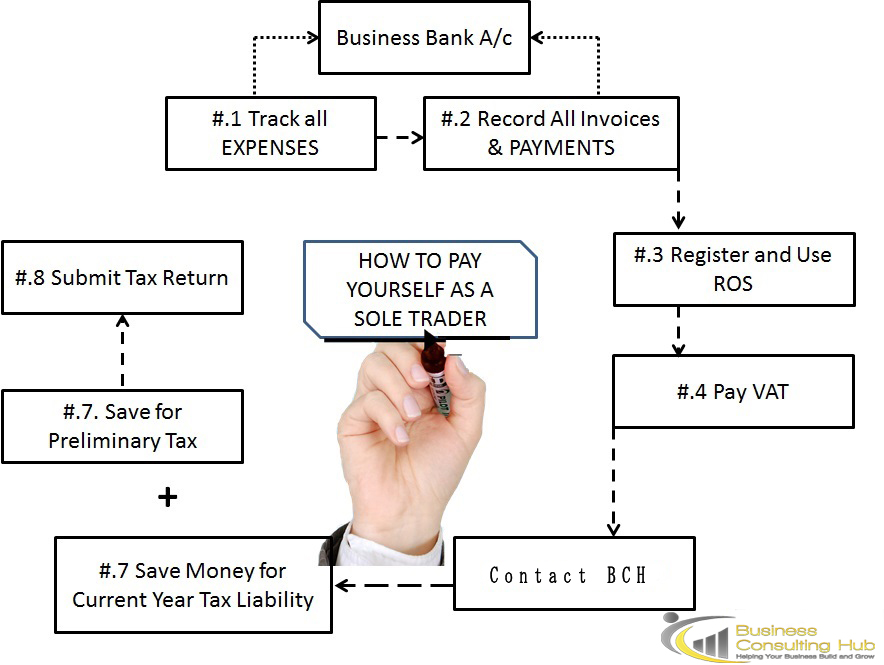

Becoming A Sole Trader In Ireland Business Consulting Ireland Company Formation Dublin

Becoming A Sole Trader In Ireland Business Consulting Ireland Company Formation Dublin

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Guide To Self Employment In Ireland 2021

Guide To Self Employment In Ireland 2021

Sole Trader Or A Limited Company Think Business

Sole Trader Or A Limited Company Think Business