How To Fill Out A W9 For My Business

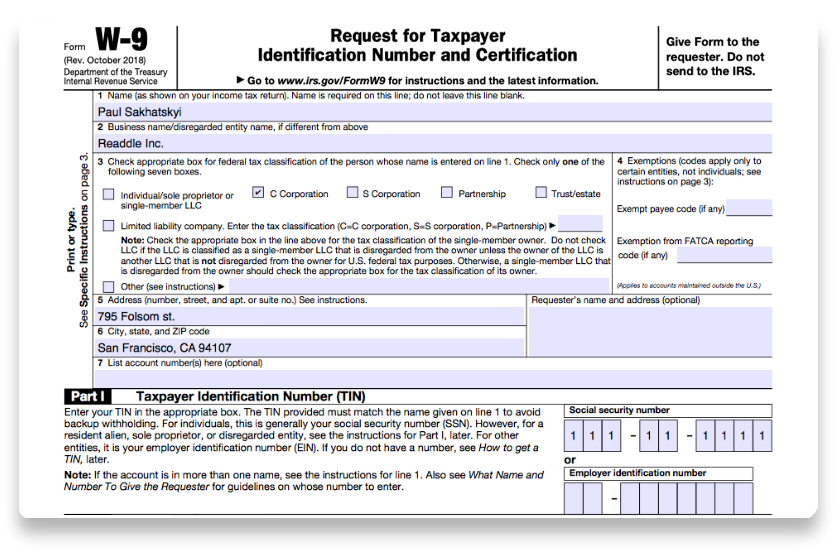

This the legal name of your as an individual or as a company. Name as shown on your income tax return.

How To Fill Out A W9 As A Single Member Llc Should You Use Ein Or Ssn Your Freelancer Friend

How To Fill Out A W9 As A Single Member Llc Should You Use Ein Or Ssn Your Freelancer Friend

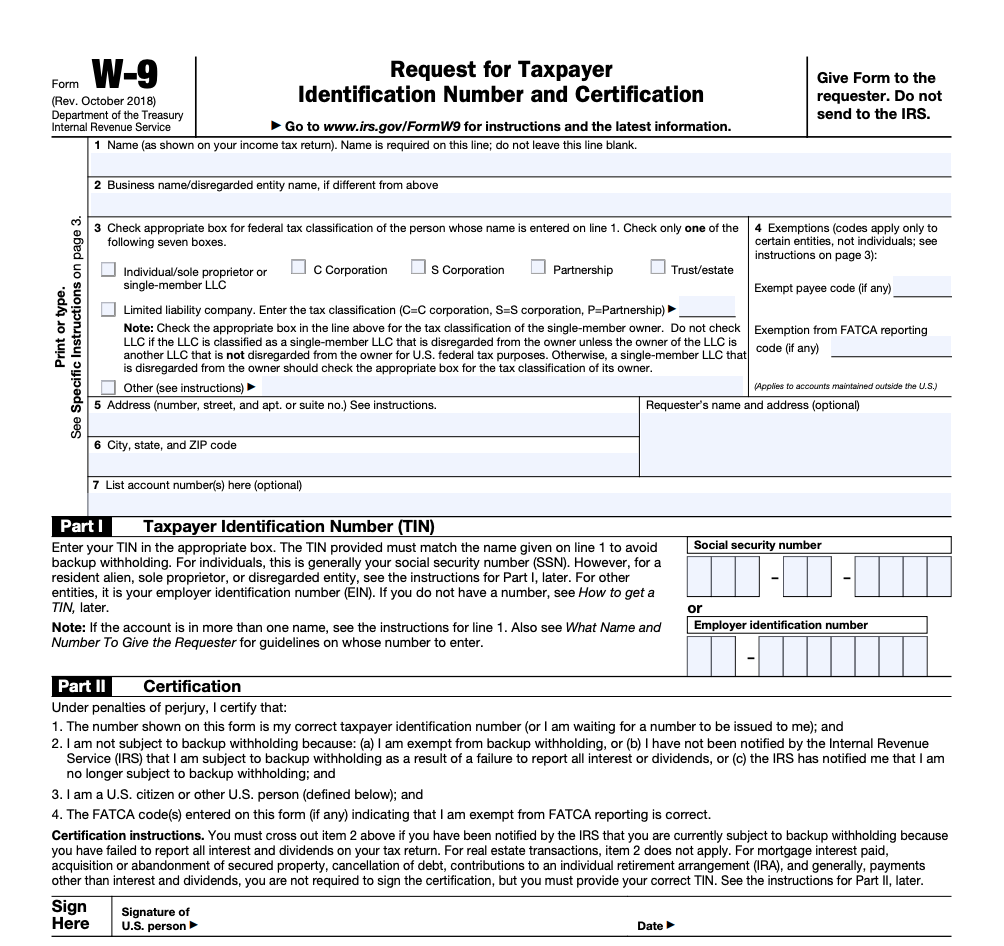

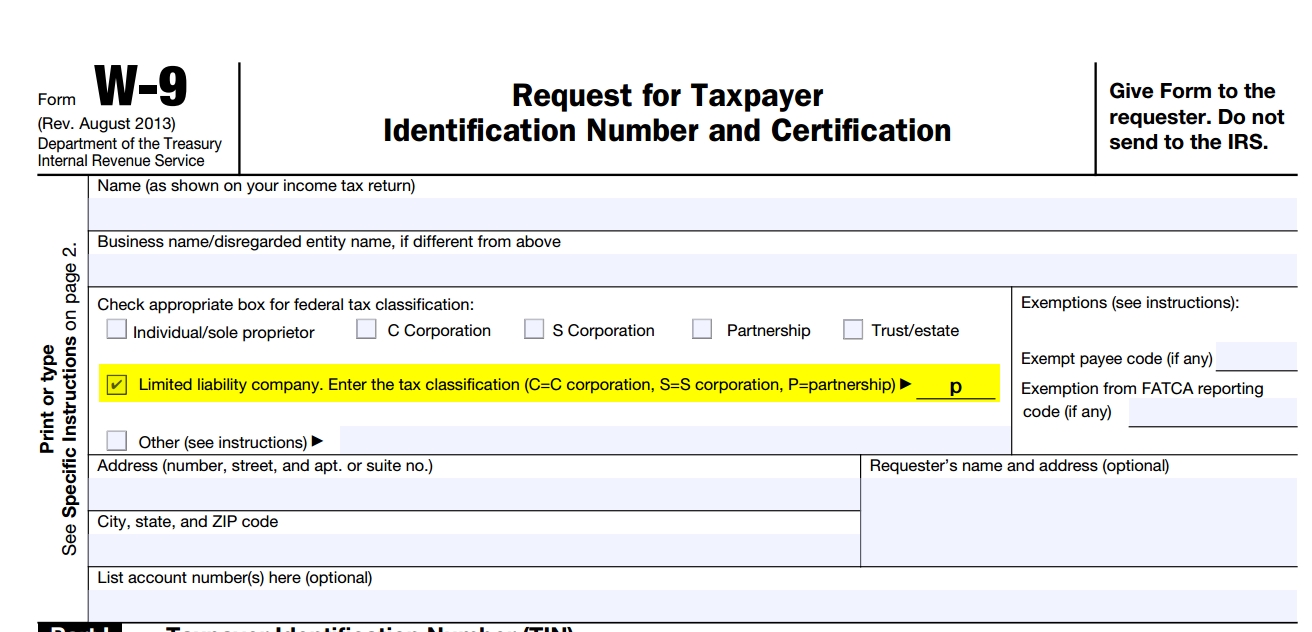

Make sure youve got the right form.

How to fill out a w9 for my business. Why did my landlord gave me a W-9. Yes you are the owner of your own self employment business. At the top of the form provide your name and the name of your business if its different from your own name.

Do not leave this line blank. The business that hires you should fill in its name and employer identification number EIN. Yes the business name is you and you use your ssn.

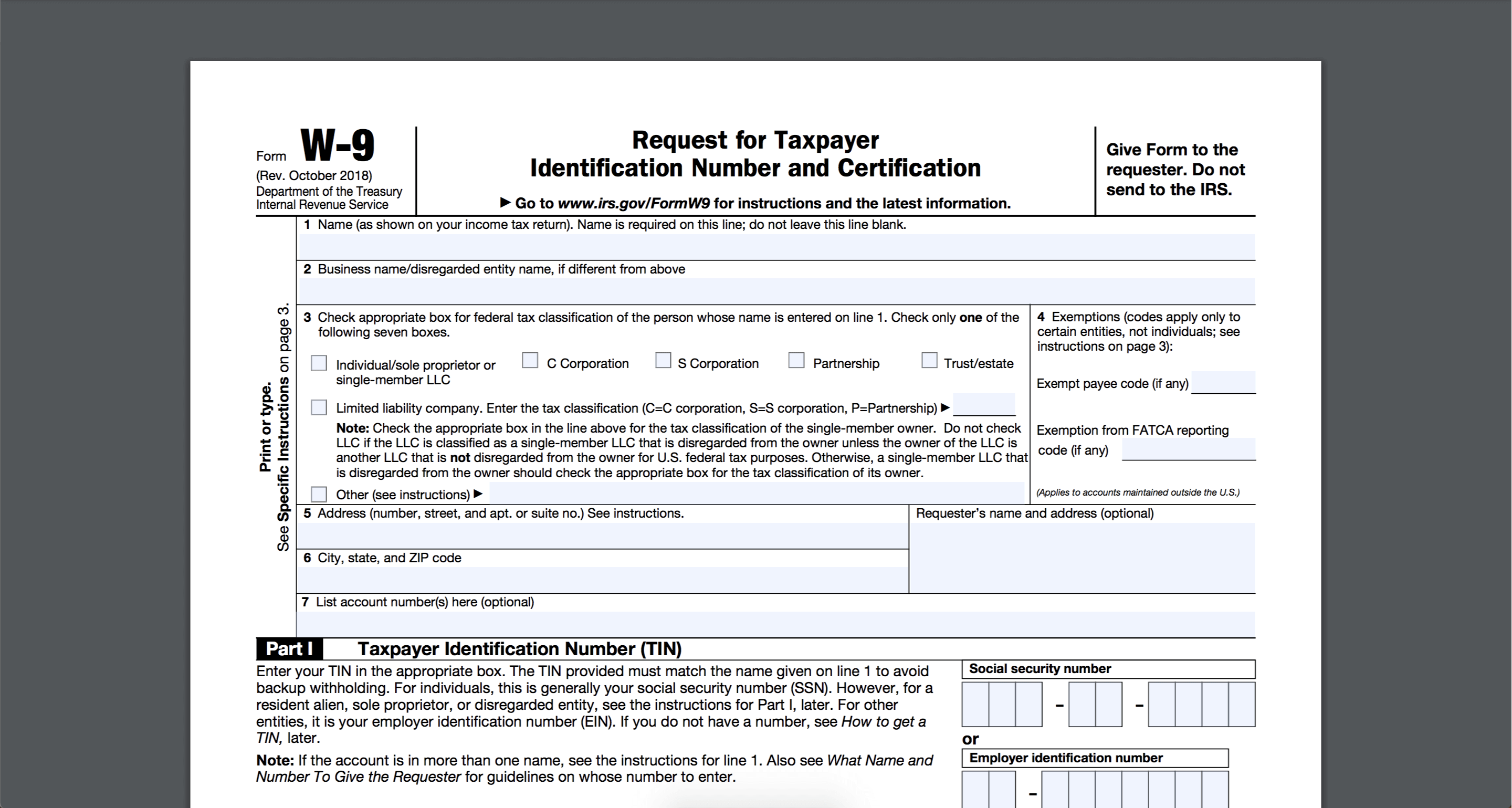

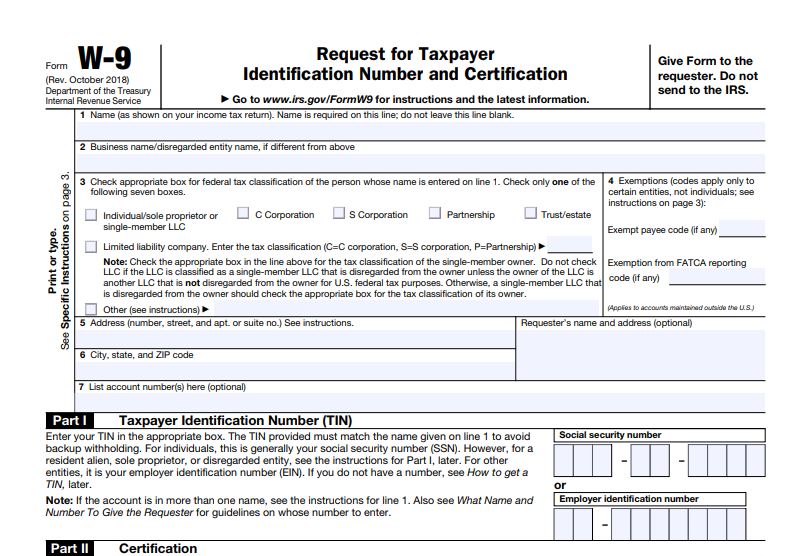

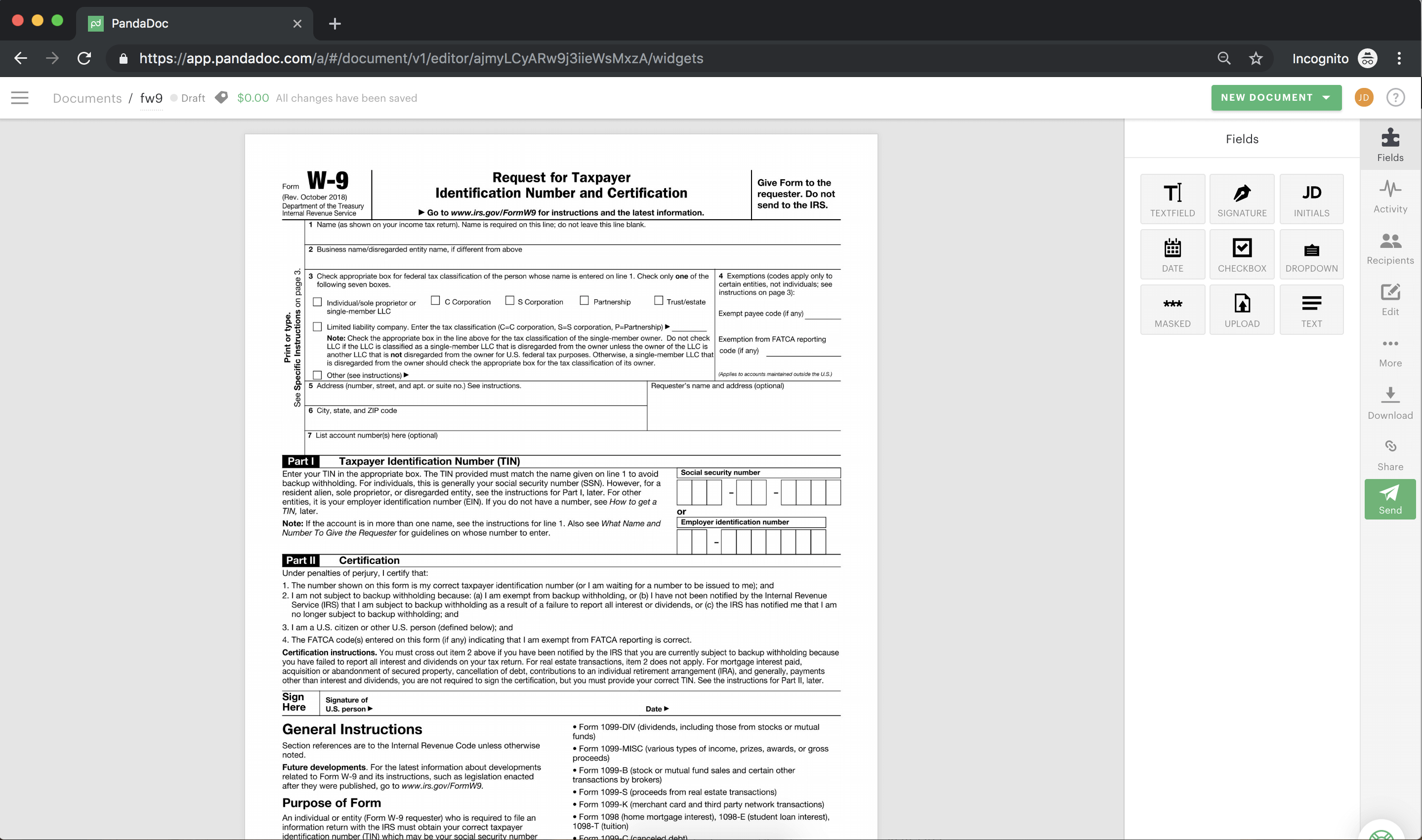

How to fill out your W-9 form Line 1 Name. The W9 form is a one-page tax document issued by the IRS to regulate the relationship between employees and their employers. Section one of the W-9 is where you will need to fill in your name.

You may receive the form from the client or company that hired you. You can still fill out form W-9. Business namedisregarded entity name if different from above.

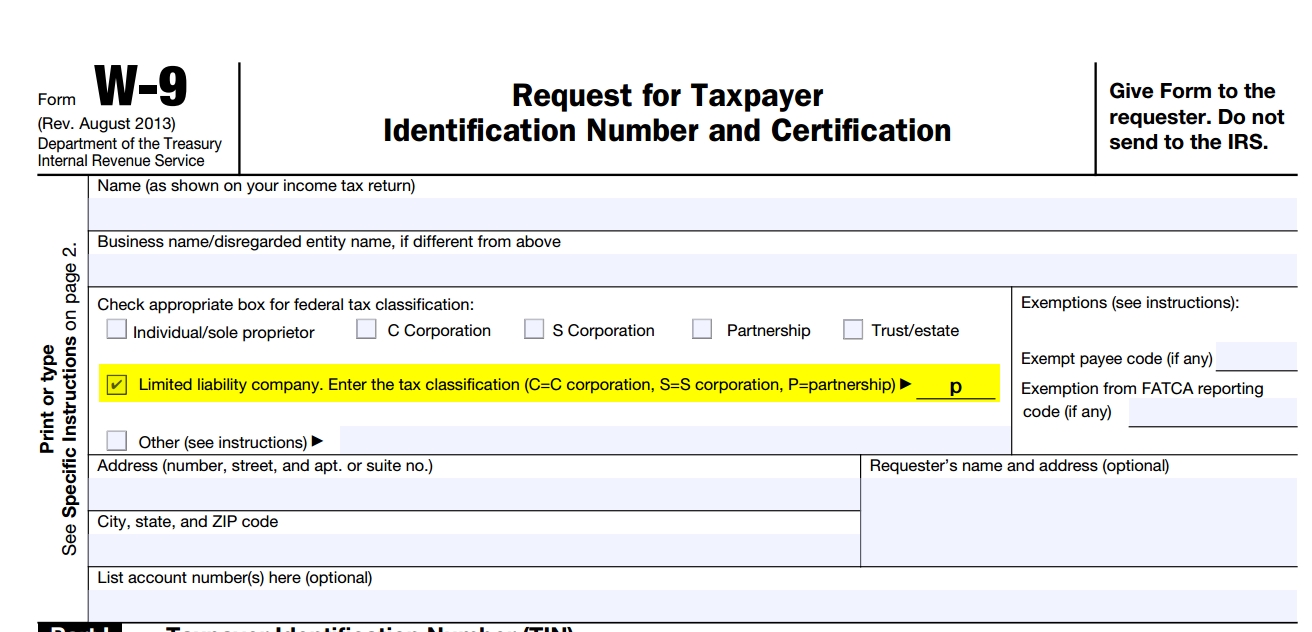

If you receive a 1099 for LLC income you will probably need to fill out a W-9 form for the payer. Obtain a W-9 form from the IRSgov website. How to Fill out a W-9 for a Nonprofit Corporation.

It is your responsibility as an employee to fill in this form and to submit it back to the IRS together with other documents. Use your own info. You will then fill out the form line by line.

Youll then fill out the form line by line. Can I refuse to fill out a W9. Provide the nonprofit corporations name as it is shown on its nonprofit tax forms and articles of incorporation.

You may develop and use your own Form W-9 a substitute Form W-9 if its content is substantially similar to the official IRS Form W-9 and it satisfies certain certification requirements. The following are instructions for filling out the specific parts on the W-9 form. You only need to complete this line if your name here is different from the.

This line is optional and would include your business name trade name DBA name or disregarded entity name if you have any of these. Of the following seven boxes. The people or company that pays you is your customer or client.

Move on to Part I. Line 1 Name. Type your information directly into the form and save a copy of it to your hard drive or download and print out the form and then complete it by hand.

Check the first box. This line should match the name on your income tax return. The official name of this form is Request for Taxpayer Identification Number TIN and Certification.

You need to fill out schedule C for self employment. You are an individual sole proprietor. Line one of Form W-9 asks for your name.

Enter your business name if different on the second line. The IRS says you should apply for your number and write applied for in the space for the TIN. Yes you can refuse a request to fill out the W-9 but only if you are suspicious as to why a business has made the request.

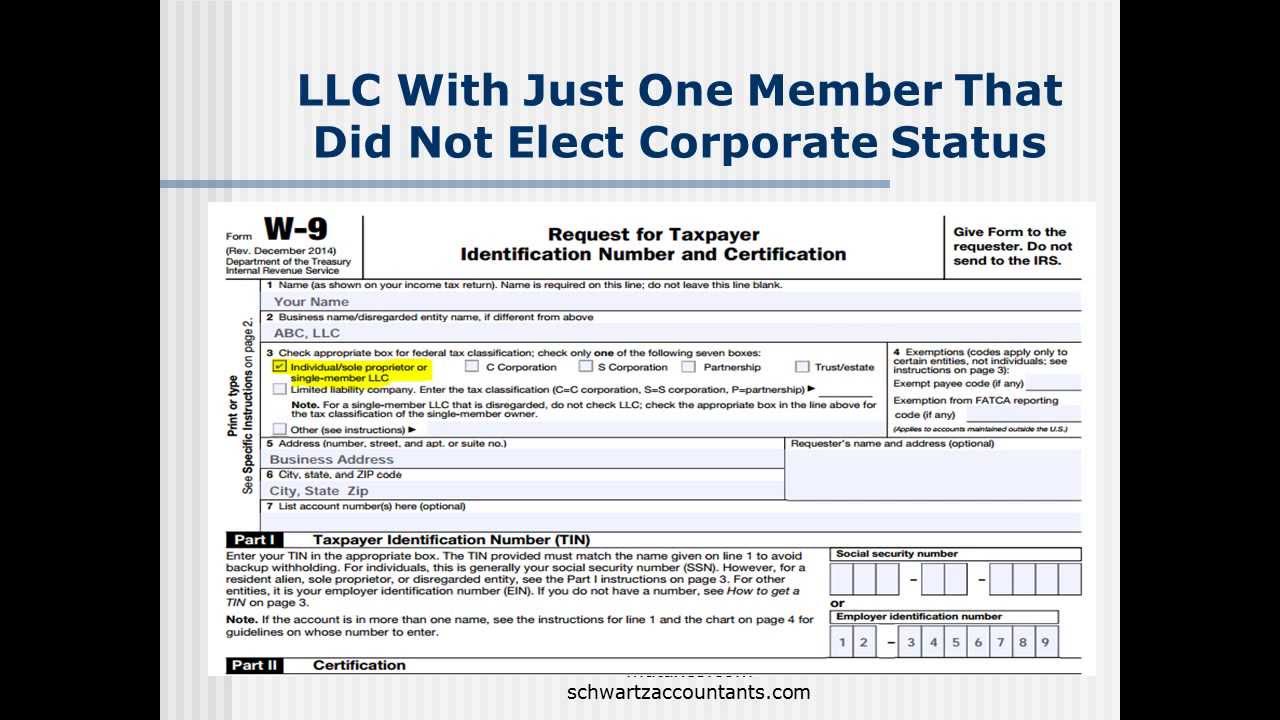

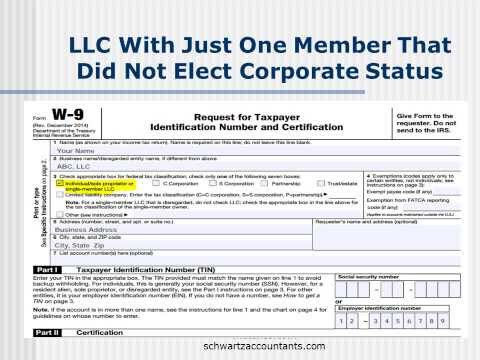

Be wary of filling out the W-9 if the business does not have a legitimate reason to ask you to fill it out. When filling out the W-9 check the box under the business name line if you have filed paperwork to be taxed as a C or S corporation. Name is required on this line.

Filling Out the W-9 1. If you are running a sole proprietorship you would enter YOUR name. This should be your full name.

The business that hires you should fill in its name and employer identification number. You may incorporate a substitute Form W-9 into other business forms you customarily use such as. Youll want to get this number as quickly as possible because until.

The form itself isnt even an entire page long excluding the instructions. The name on line 1 should never be a disregarded entity a single owner LLC. Complete the basic information in section one.

Line 2 Business name. To clarify this point the name on line 1 must match with the name the IRS associates with your TIN. Line 1 Name.

Next to this box denote either a C or an S depending on which type of corporation you have elected. Enter your name as shown on your income tax return on the first line. Businesses in the United States are instructed by the IRS to request the W-9 be completed by any service provider theyre paying US 600 or more to during the tax year.

Filling out a W-9 is pretty straightforward. Form W-9 is one of the easiest IRS forms to complete but if tax forms seem daunting to you follow the guide below. Check appropriate box for federal tax classification of the person whose name is entered on line 1.

How to Fill Out and Read Form W-9 Completing Form W-9 is pretty straightforward. You are in business for yourself. If you are a full-time employee its not necessary to fill out a W-9.

8 Detailed Guide on How to Fill Out a W9 Form for a Business or LLC.

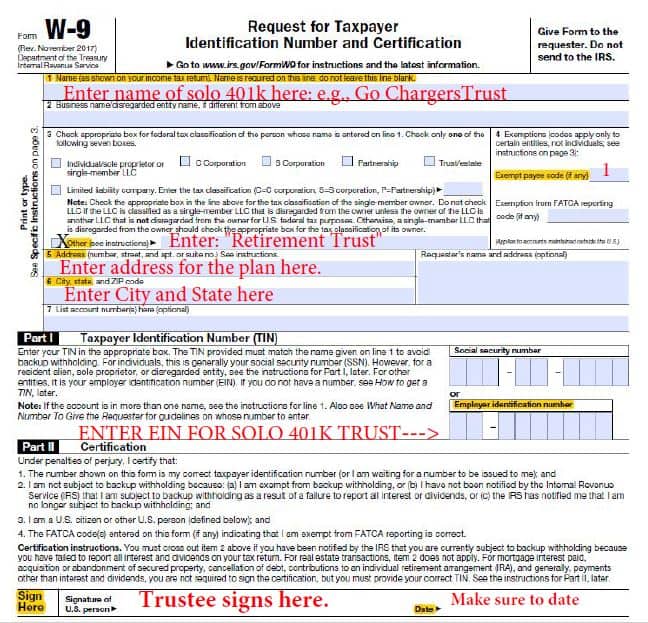

W 9 For Solo 401k Plan How To Complete W 9 For Solo 401k Plan My Solo 401k Financial

W 9 For Solo 401k Plan How To Complete W 9 For Solo 401k Plan My Solo 401k Financial

What Is A W 9 Form How Do I Fill Out A W 9 Gusto

What Is A W 9 Form How Do I Fill Out A W 9 Gusto

How To Fill Out Irs Form W 9 2020 2021 Pdf Expert

How To Fill Out Irs Form W 9 2020 2021 Pdf Expert

What Is A Form W9 And How Do I Fill One Out Countless

What Is A Form W9 And How Do I Fill One Out Countless

Properly Completing Irs Form W 9 For Your Ira Llc Or Checkbook Control Ira Self Directed Ira Handbook

Properly Completing Irs Form W 9 For Your Ira Llc Or Checkbook Control Ira Self Directed Ira Handbook

Let S Do W 9s And 1099 S Better In 2019 Berkshirerealtors

Let S Do W 9s And 1099 S Better In 2019 Berkshirerealtors

What Is A Form W9 And How Do I Fill One Out Countless

What Is A Form W9 And How Do I Fill One Out Countless

How To Fill Out And Sign Your W 9 Form Online

How To Fill Out And Sign Your W 9 Form Online

What Is A W 9 Business Attorney Nonprofit Attorney

What Is A W 9 Business Attorney Nonprofit Attorney

W 9 Form Fill Out The Irs W 9 Form Online For 2019 Smallpdf

W 9 Form Fill Out The Irs W 9 Form Online For 2019 Smallpdf

W 9 Basics How To Complete A W 9 Form For An Llc Youtube

W 9 Basics How To Complete A W 9 Form For An Llc Youtube

W 9 Form For Non Profits How To Fill It And Purpose Of The W 9 Form Form Applications In United States Application Gov

W 9 Form For Non Profits How To Fill It And Purpose Of The W 9 Form Form Applications In United States Application Gov

How To Fill Out And Sign Your W 9 Form Online

How To Fill Out And Sign Your W 9 Form Online

How To Complete An Irs W 9 Form Youtube

How To Complete An Irs W 9 Form Youtube

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

W 9 Basics How To Complete A W 9 Form For An Llc Youtube

W 9 Basics How To Complete A W 9 Form For An Llc Youtube

Learn How To Fill Out A W 9 Form Correctly And Completely

Learn How To Fill Out A W 9 Form Correctly And Completely

:max_bytes(150000):strip_icc()/FormW-94-d634d707ffee44839b5a46c998bd71aa.png)