How Much Does It Cost To Set Up An Installment Agreement With The Irs

The IRS does not charge a fee if you pay with a check or a direct debit from your bank account. Apply by phone in-person or mail and select Direct Pay.

Irs Letter 4458c Second Installment Agreement Skip H R Block

Irs Letter 4458c Second Installment Agreement Skip H R Block

If youre unable to pay your tax bills in full you may qualify for an installment payment agreement IPA.

How much does it cost to set up an installment agreement with the irs. How Much Does It Cost To Set Up An Installment Agreement With The Irs admin December 1 2020 Uncategorised 0 The maximum tax rate of 225 applies to tax payers who enter into a storm contract in person by telephone by mail or by filing Form 9465 with the IRS. Plus accrued penalties and interest until the balance is paid in full. Here are the setup fees when you apply for an IRS repayment plan.

However interest and any applicable penalties continue to accrue until your liability is paid in full. Setting up a Direct Debit Installment Agreement costs 31 if set up through the IRS Online Payment Agreement. Through your account you can request an IPA for a balance of 20000 or less and with 36 or fewer scheduled.

You can also mail a completed Form 9465 Installment Agreement Request or submit it at an IRS walk-in office. 31 to set up a long-term payment agreement online if. Direct debit helps you avoid late payments.

However starting January 1 2019 the user fee is 10 for installment agreements reinstated or restructured through an OPA. Apply online and agree to Direct Pay payments. 6 rows The top rate of 225 applies to taxpayers who enter into an installment agreement in person.

For a Direct Debit Installment Agreement in which the monthly payment is deducted from your checking account the fee is 31 if you apply online or 107 if you apply in person by phone or by mail. The IRS charges a setup fee of 120 52 if a client makes payments by direct debit and 43 for low-income taxpayers. As of 2017 the fees are the following amounts.

Free to set up a short-term 120 days or less payment agreement online. Theres no fee for this full payment. Individuals may be able to set up a short-term payment plan using the Online Payment Agreement OPA application or.

There are one-time fees for setting up installment agreements. Setting up a direct debit payment plan online would cost 31 or 107 if set up by phone mail or in-person if you can not pay off your balance within 120 days. If direct debit is not used then it will cost 149 to set up the plan online.

Typically you may have up to 3 to 5 years to pay off your balance. Taxpayers whose household income is at or below 250 of the federal poverty threshold can apply to have these fees reduced or waived. Pay amount owed through Direct Debit with automatic payments from your checking account also known as Direct Debit Installment Agreement DDIA.

Fees apply when paying by card. Under the agreement youll make monthly payments toward your unpaid tax balance. Itll cost you 34 to set up an agreement added to your balance.

If you apply for a payment plan installment agreement it may take up to 90 days to process your request. The fastest and easiest way to request an IPA is through your Online Services account. If you cannot pay off your balance within 120 days setting up a direct debit payment plan online will cost 31 or 107 if set up by phone mail or in-person.

If you can pay off your balance within 120 days it wont cost you anything to set up an installment plan. You are not required to mail a check or pay for postage each month. Interest and late-payment penalties continue to accrue during the installment period but the late-payment penalty is cut in half for any month an installment agreement is in effect.

If you choose to pay your installment agreement fees with a credit or debit card though the three payment processors approved by the IRS do charge a fee which is typically 187 to 199 to process these types of payments. Generally the fee is 89 to modify your installment agreement 43 if you are a low-income taxpayer. Fees to Set Up IRS Installment Agreements.

Apply by phone mail or in-person. Long-Term Payment Plan Installment Agreement pay monthly Pay monthly through automatic withdrawals. 43 setup fee which may be reimbursed if certain conditions are met.

Apply online by phone or in-person. Make monthly payment by check money order or debitcredit card. If not using direct debit then setting up.

Otherwise the setup fee is 149 dollars if not low income.

Irs Installment Agreement Letter Page 1 Line 17qq Com

Irs Installment Agreement Letter Page 1 Line 17qq Com

Everything You Need To Know About An Irs Installment Agreement

Everything You Need To Know About An Irs Installment Agreement

New Jersey Irs Payment Plans Attorney Paladini Law Jersey City

New Jersey Irs Payment Plans Attorney Paladini Law Jersey City

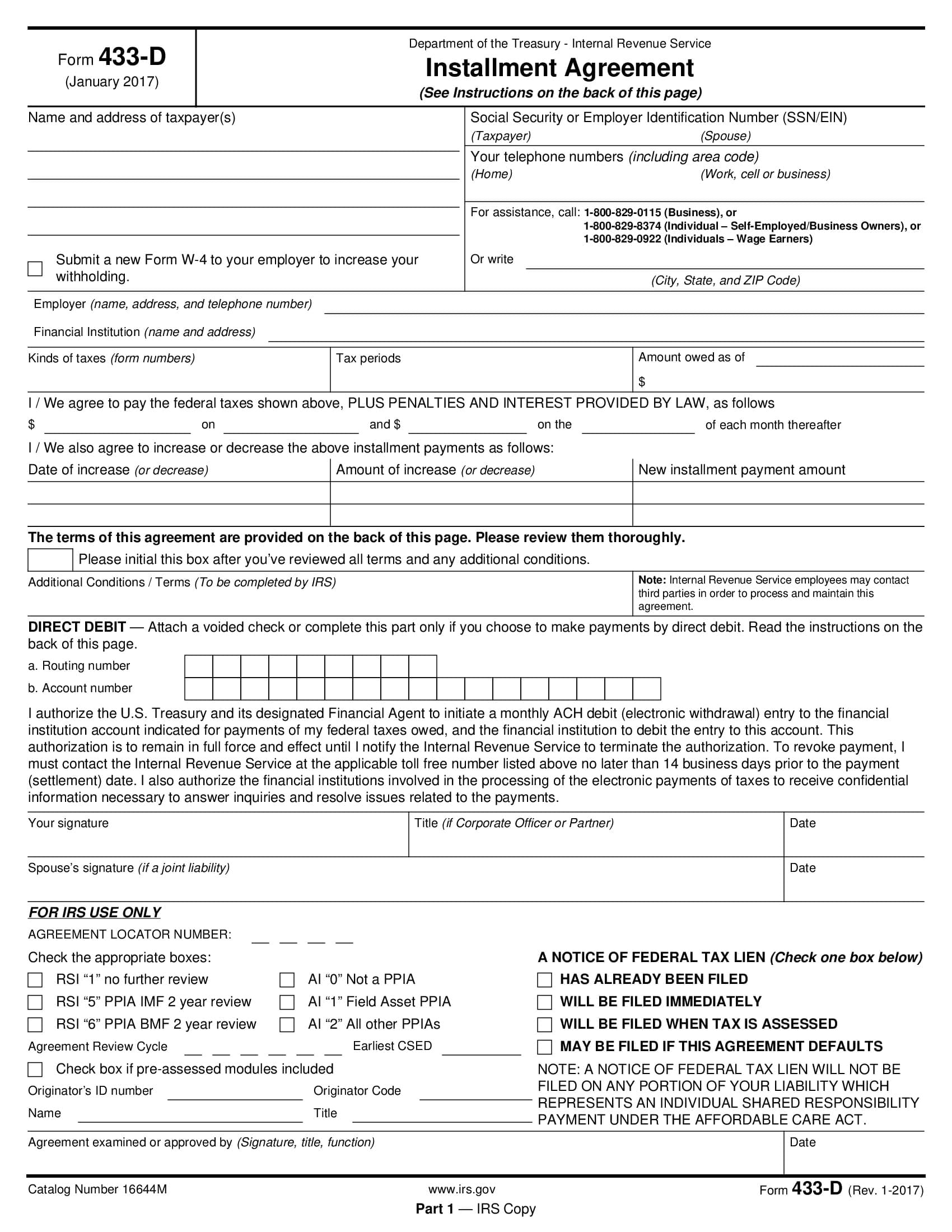

How To Complete An Irs Form 433 D Installment Agreement

How To Complete An Irs Form 433 D Installment Agreement

Irs Installment Agreement Interest Rate 2014 Rating Walls

Irs Audit Letter 2604c Sample 1

/9465-700bb91065234917b8d2866f2306afe9.jpg) Form 9465 Installment Agreement Request Definition

Form 9465 Installment Agreement Request Definition

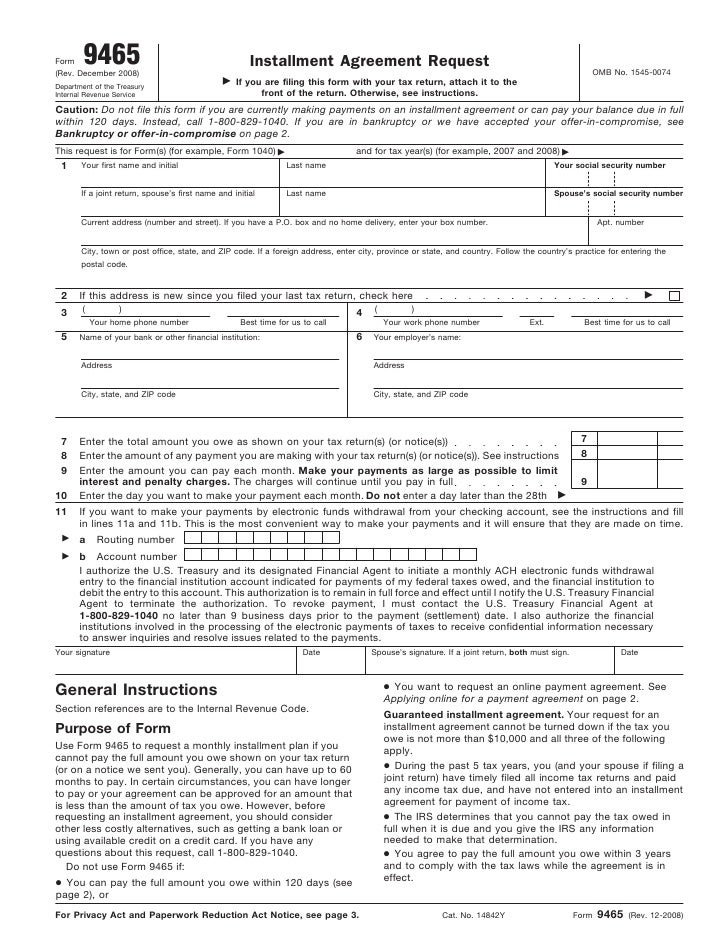

Form 9465 Installment Agreement Request

Form 9465 Installment Agreement Request

Irs Installment Agreement Interest Rate Beautiful Irs Payment Plan Form Installment Agreement Balance New Letter To Models Form Ideas

Irs Installment Agreement Interest Rate Beautiful Irs Payment Plan Form Installment Agreement Balance New Letter To Models Form Ideas

How Much Interest Does The Irs Charge On Installment Agreements Polston Tax

How Much Interest Does The Irs Charge On Installment Agreements Polston Tax

Irs Notice Cp523 Understanding Irs Notice Cp 523 Intent To Terminate Your Installment Agreement Seize Your Assets Pending

Irs Notice Cp523 Understanding Irs Notice Cp 523 Intent To Terminate Your Installment Agreement Seize Your Assets Pending

Everything You Need To Know About An Irs Installment Agreement

Everything You Need To Know About An Irs Installment Agreement

Everything You Need To Know About An Irs Installment Agreement

Everything You Need To Know About An Irs Installment Agreement

How Much Interest Does The Irs Charge On Installment Agreements Polston Tax

How Much Interest Does The Irs Charge On Installment Agreements Polston Tax

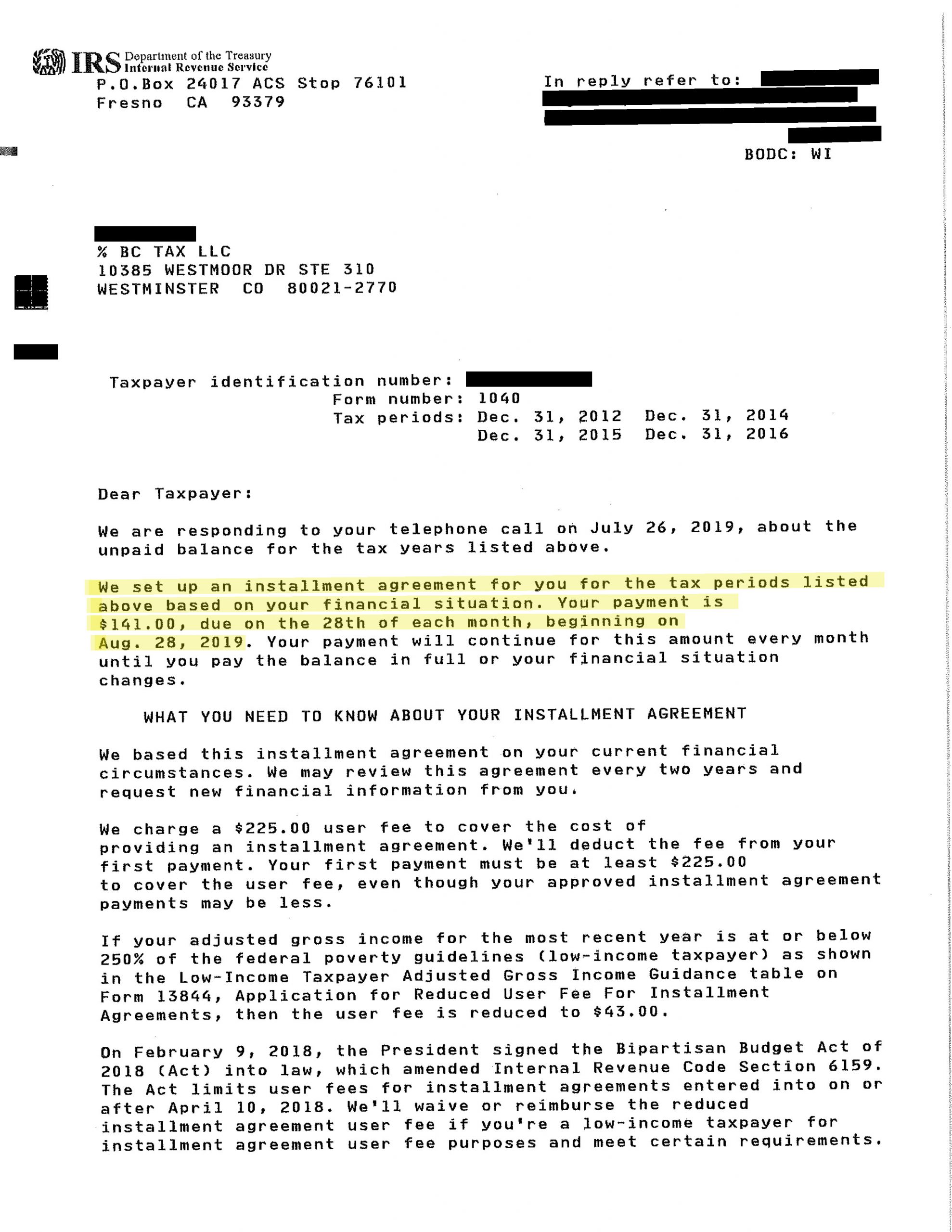

Taxpayer Owes The Irs Over 78 000 But Only Pays 141 A Month Bc Tax

Taxpayer Owes The Irs Over 78 000 But Only Pays 141 A Month Bc Tax

How To Set Up An Irs Payment Plan Mazuma Business Accounting

How To Set Up An Irs Payment Plan Mazuma Business Accounting

How To Request For Installment Agreement With Irs Form 9465

How To Request For Installment Agreement With Irs Form 9465

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

How Much Interest Does The Irs Charge On Installment Agreements Polston Tax

How Much Interest Does The Irs Charge On Installment Agreements Polston Tax