Do You Have To Have A Business License To Receive A 1099

Get W-2 Forms and 1099. As a business owner you have many tax rules to follow to properly report your revenues and expenses.

If you need help with a 1099 contractor needing a business license you can post your job on UpCounsels marketplace.

Do you have to have a business license to receive a 1099. 1099 Forms Your Business Might Prepare or Receive. If you are self-employed you can start with Form 1040-ES Estimated Tax for Individuals and then file the other necessary forms with your 1040 Form during the tax season. Form 1099-MISC is paperwork that works like a W-2 reporting income for independent.

1099 Requirements Generally any time you pay someone 600 or more in a year for services in the course of your trade or business you must. I am paid on a 1099 basis not as a W2 employee. Here are the instructions.

You can use your personal name and social security number for the business. Again paying others with a 1099. You are otherwise in business for yourself including a part-time business Since you received a 1099-k the IRS has also received a copy and they will expect it to be reported on your tax return.

No you do not have to have a business license to claim an expense against your 1099 income. Youll need to choose a business name for which you might also have to register a Doing Business As DBA unless youre working under your own name or it is part of the name of your business. You can use your business entity to purchase insurance and take the deductions for this expense again minimizing your tax bill.

The general rule is that business owners must issue a Form 1099-NEC to each person to whom they have paid at least 600 in rents services including parts and materials prizes and awards or other income payments. A business jointly owned and operated by a married couple is a partnership and should file Form 1065 US. The short answer is.

For example if you earned less than 600 from a side gig in 2020 the payer doesnt have to send you a 1099 form but you still have to report the earnings. Tell your employer to send you a w2 or your calling. Do I need a business license.

No calculation on the PPP application will involve payroll because you dont have employees and thus no payroll numbers for you or others will exist. IF you are not a registered business with the state and dont have a sales tax permit. If you file it.

If you are in a trade or business you must prepare 1099-MISC forms to show the amounts you have paid to others during the year. If you are an online retailer and accept credit card payments over the Internet you may also have to deal with reporting any 1099-K forms that you receive from credit card or third party processors. Your basically committing fraud with a signature.

Yes if you are not paid as an employee you are considered an independent contractor and are. You dont have to do anything to register your business just start using a Schedule C to report your business income with your personal tax return. A business license is a permit from your local government authorizing you to operate in its jurisdiction.

Youll also need to get a tax registration certificate as well as pay self-employment and estimated income taxes. 1099s are from one business to another. Weve put together some of the most common questions weve received surrounding PPP and 1099 workers to give you.

How do you claim business deductions. The IRS considers trade or business to include. Youre now technically self-employed and have to file Schedule C to report that 1099-MISC income.

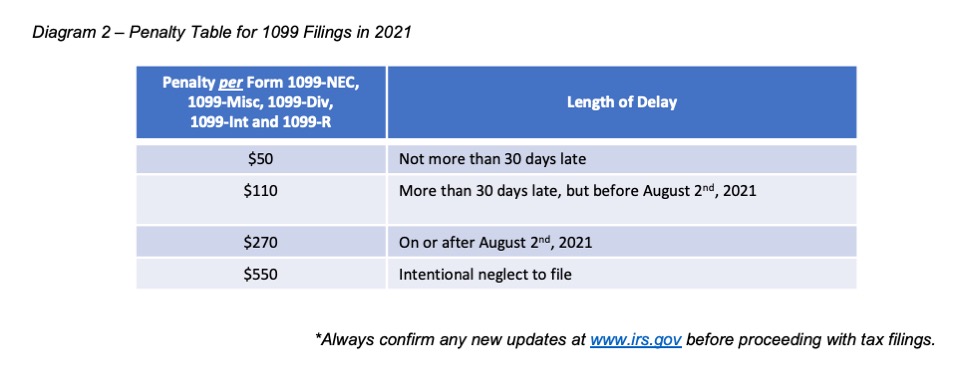

You enter the income and expense as self employment income on Schedule C even if you have no license for a business. Failing to do so can result in penalties and fines. If youre a 1099 worker or a small business that employs 1099 workers seeking a Paycheck Protection Program PPP loan you likely have questions about whether or not you qualify for a PPP loan what you need to apply and how potential loan forgiveness will work.

If your Form 1099-MISC shows an amount in Box 7 for non-employee compensation and its because you did consulting work or other services for someone and you received compensation you DO now have a business. Therefore if you earned money at a side job during the tax year you should report your earnings to the IRS. You are a member of a partnership that carries on a trade or business.

How are you running a legal business. Earnings of more than 400 annually must be reported to the IRS. Return of Partnership Income unless the spouses qualify and elect to have the business be treated as a qualified joint venture or they operate their business in one of the nine community property states.

You dont need to issue 1099s for payment made for personal purposes.

1099 Employees Need A Business License Quickbooks First Class Flights Enterprise

1099 Employees Need A Business License Quickbooks First Class Flights Enterprise

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Do You Have To Carry Workman S Comp Insurance On 1099 Contractors Workers Compensation Insurance Contractors General Contractor Business

Do You Have To Carry Workman S Comp Insurance On 1099 Contractors Workers Compensation Insurance Contractors General Contractor Business

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Filing Form 1099 Misc For Your Independent Contractors Small Business Tax Tax Write Offs Business Tax

Filing Form 1099 Misc For Your Independent Contractors Small Business Tax Tax Write Offs Business Tax

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Irs Approved 1099 K Tax Forms File Form 1099 K When Working With Payment Card And Third Party Network Transactions A Payment Settleme Tax Forms W2 Forms Form

Irs Approved 1099 K Tax Forms File Form 1099 K When Working With Payment Card And Third Party Network Transactions A Payment Settleme Tax Forms W2 Forms Form

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Filing A 1099 Misc Form The Right Way Before January 31 2019 Small Business Ideas Startups Business Basics Successful Business Owner

Filing A 1099 Misc Form The Right Way Before January 31 2019 Small Business Ideas Startups Business Basics Successful Business Owner

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Irs Approved 1099 R Tax Forms You File This Form For Each Person To Whom You Have Made A Designated Distribution Or Are Disability Payments Tax Forms Annuity

Irs Approved 1099 R Tax Forms You File This Form For Each Person To Whom You Have Made A Designated Distribution Or Are Disability Payments Tax Forms Annuity