As A Form Of Business A Partnership Cannot Issue Stock

Unlimited liability for the owner complete responsibility for talent and financing and business dissolves if the owner dies. For example the December 2017 issue of Kiplingers Personal Finance has an article.

:max_bytes(150000):strip_icc()/handshake-5bfc2eedc9e77c0051448938.jpg) Silent Partner Vs General Partner What S The Difference

Silent Partner Vs General Partner What S The Difference

The exclusion is limited to the partners percentage interest in the partnership at the time the stock was acquired.

As a form of business a partnership cannot issue stock. B has only one owner. A soleproprietorship a business owned by only one person accounts for 72 of all US. Only businesses structured as a C-or S-corporation are allowed to issue stock.

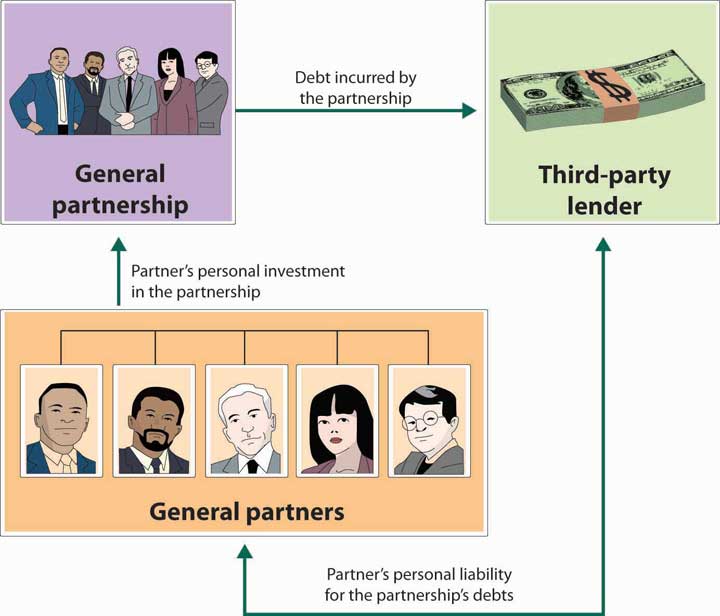

A partnership is a business form created automatically when two or more persons engage in a business enterprise for profit. The partnership return must show the names and addresses of each partner and each partners distributive share of taxable income. Stock owned by or for a partner wouldnt be thought of by the partnership as owned under Section 318a 3A unless at least 5 percent of the value of the interests in this partnership are owned by and for this partner direct or indirect ownership.

As a form of business a partnership. Limited Partnership LP FAQs What Is a Limited Partnership LP in Business. Only firms organized as sole proprietorships have limited lives.

What are the benefits of qualified small business stock If you acquired the stock after September 27 2010 and you hold it for 5 years you can exclude up to 10 million entirely from federal. A limited liability company LLC cannot issue shares of stock. Form 965-A Individual Report of Net 965 Tax Liability.

Form 965-A Individual Report of Net 965 Tax Liability. Partnerships are the most complicated type of business to form. Consider the following language from the Uniform Partnership.

A limited liability company which is treated as a partnership cannot take advantage of incentive stock options engage in tax-free reorganizations or issue Section 1244 stock. Unlike a corporation an LLC does not issue shares of stock. C cannot issue stock.

Complete control for the owner easy and inexpensive to form and owner gets to keep all of the profits. Businesses that operate in more than one state may not receive consistent treatment. Form 8990 Limitation on Business Interest Expense Under Section 163j Forms for Individuals in Partnerships.

Although LLCs cannot issue stock there are no LLC statues prohibiting a business from issuing bonds. The process to issue bonds is much more complex than issuing stock. This is a common format for private stock offerings undertaken by real estate developers seeking to raise money for construction.

The stock can be acquired by a partnership so that a partner who is an individual and not a corporation can use the exclusion as long as he or she was a partner when the stock was purchased and at all times thereafter. A has limited liability. Instead an LLC issues membership interests that represent ownership rights in.

C and S chapter companies cannot use this method. If you are an individual in a partnership you may need to file the forms below. C corporations can issue qualified small business stock LLCs cannot issue qualified small business stock.

All business organizations have bylaws. Both sole proprietorship and partnership income is taxed as individual income. Publicly traded partnerships PTPs have become popular investment vehicles as investors look for higher distribution yields than stocks are paying.

D has the most government rules and regulations affecting it. Businesses that form a limited partnership generally do so to own or operate a set of specific assets such as a real. 1 Unfortunately what is often touted as dividend income are really partnership distributions that cannot be directly compared to dividends paid by corporations.

By Tom Speranza JD. Using the expertise of a firm knowledgeable in issuing bonds is recommended. Neither can S corporations.

There is a lack of uniformity among limited liability company statutes. Partnership Return Form 1065 Every partnership that engages in a trade or business or has gross income must file an information return on Form 1065 showing its income deductions and other required information. This form of private stock offering is designed for companies that are organized as limited partnerships.

A general partnership is legally the same as a corporation. An LLC is a business entity structured to have either a single or multiple owners who. A form of business organization with the liability-shield advantages of a corporation and the flexibility and tax pass-through advantages of a partnership.

A limited liability company LLC is a business entity that combines the liability protections of a corporation with the flexible structure of a partnership.

4 Types Of Partnership In Business Limited General More

4 Types Of Partnership In Business Limited General More

Business Partnership Agreement Template Inspirational 10 Marketing Partnership Agreement Template Memo Template Statement Template Templates

Business Partnership Agreement Template Inspirational 10 Marketing Partnership Agreement Template Memo Template Statement Template Templates

4 Types Of Business Partnerships Which Is Best For You Score

4 Types Of Business Partnerships Which Is Best For You Score

Advantage Taxation Limited Liability Partnerships Or Private Limited Company Limited Liability Partnership Private Limited Company Limited Liability Company

Advantage Taxation Limited Liability Partnerships Or Private Limited Company Limited Liability Partnership Private Limited Company Limited Liability Company

Free Partnership Agreement Template Create A Partnership Agreement

Free Partnership Agreement Template Create A Partnership Agreement

C Corp Vs S Corp Head To Head Difference S Corporation C Corporation Business Tips

C Corp Vs S Corp Head To Head Difference S Corporation C Corporation Business Tips

Partnership Agreement Template Real Estate Forms Contract Template Business Plan Template Investment Club

Partnership Agreement Template Real Estate Forms Contract Template Business Plan Template Investment Club

Hr Business Partnership Model Http Itz My Com Human Resources Business Partner Human Resource Management

Hr Business Partnership Model Http Itz My Com Human Resources Business Partner Human Resource Management

Business Partnership Agreement Template Approveme Free Contract Templates

Business Partnership Agreement Template Approveme Free Contract Templates

Business Partnership Proposal Template Lovely Sample Business Proposal Letter Template Proposal Letter Business Proposal Letter Business Proposal Sample

Business Partnership Proposal Template Lovely Sample Business Proposal Letter Template Proposal Letter Business Proposal Letter Business Proposal Sample

Sole Proprietorship Vs Partnership Top 9 Differences With Infographics

Sole Proprietorship Vs Partnership Top 9 Differences With Infographics

Shamir Kumar Nandy Why Business Activities Requires Finance Finance Investing Money Finance Debt

Shamir Kumar Nandy Why Business Activities Requires Finance Finance Investing Money Finance Debt

4 Types Of Partnership In Business Limited General More

4 Types Of Partnership In Business Limited General More

Business Blog Funding The Family Limited Partnership Limited Partnership How To Get Money Fund

Business Blog Funding The Family Limited Partnership Limited Partnership How To Get Money Fund

:max_bytes(150000):strip_icc()/shutterstock_318541115-5bfc3d8446e0fb00260f9c1c.jpg)

/shake-on-it-3240098-c3e83f2455b7409ca9a5d6ae5ce0e673.jpg)