Small Business Entity Formation Costs

New York NY 10038. In many cases businesses initially start as a sole proprietorship with lower start-up costs and eventually opt-in for more sophisticated structures that protect personal assets from business liabilities.

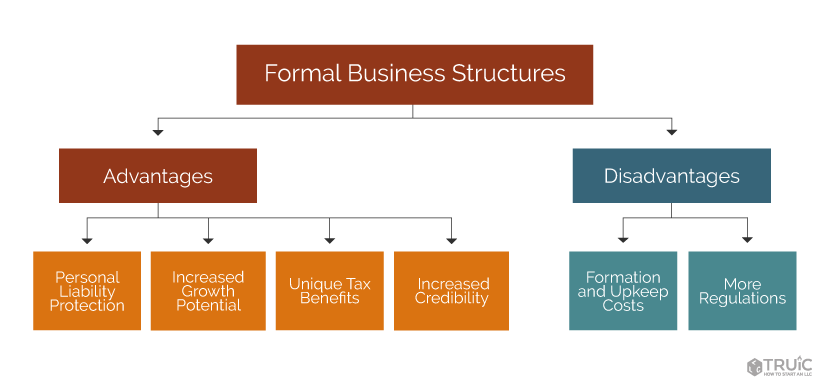

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic

1263a-4 and - 5 require a taxpayer to capitalize certain amounts that would ordinarily fall under the definition of startup costs.

Small business entity formation costs. The business structure you choose when starting a business will determine. These costs are generally capital expenses. Does not carry on a business and does not control and is not controlled by an entity carrying on a business in the relevant income year that is not an SBE in that income year.

State Programs 11 Financing. Selecting the right type of company or corporation for your new business helps maximize your chances of financial and operational success. Manhattan SBDC Business Entity Formation.

A small business entity SBE for that income year or. Organizational costs are those costs involved in forming a corporation partnership or limited liability company not a sole proprietorship and they would include legal fees and other expenses for registering your business legal type and creating agreements with co-owners. INTERACTIVE TOOLS Compare Business Types Business License Wizard Incorporation Wizard Business Plan Software.

Federal Programs - Small Business Administration 13 Financing. Small Business Taxes Mean Keeping Up with Estimated Payments A major misstep many new business owners make when starting. Costs of expanding an existing business or beginning a new business if a new entity is used.

To get the most out of your small business it is essential to create the appropriate legal structure. 195 requires that a startup cost be otherwise deductible Regs. Small businesses can access a range of concessions including payment and reporting options.

As a business owner its important to understand your federal state and local tax requirements. You can opt to change the business structure of your company over time. Business Entity Forms and Fees.

If there is no link on a particular document then there is no official Office form. Your business is not locked down to a certain entity type forever. 292021 - 292021 300 PM - 400 PM.

Your business start-up costs will depend on the type of business you are starting. This applies to sole traders partnerships companies or trusts. RESOURCES GUIDES Industry Guides Business Structure Webinar Podcasts Estimated State.

Federal Programs 14 Business Entity Formation Registration 20 Guide to Status Terminology Used by the Secretary of State. 5 Small Business Resources 6 Guide to Writing a Business Plan 8 Access to Finance. IRS Form 2553 Election by a Small Business Corporation informs the IRS that your corporation is forming as an S corp.

This applies to businesses that estimate 50000 or less in startup costs. Some of the documents below do not have official forms supplied by our Office. 10 Steps to Starting a Business Small Business Survey 2020 Complete Incorporation Guide S Corp vs C Corp S Corp vs LLC LLC vs Inc How to Form an LLC.

The entity that incurred the expenditure is either. The SBA connects entrepreneurs with lenders and funding to help them plan start and grow their business. The S corporation will also file annual tax Form 1120-S for information purposes and provide Schedule K-1s to shareholders.

OFFICIAL OFFICE FORMS MUST BE USED IF SUPPLIED. These include legal fees filing fees and other costs directly related to the formation of partnership or corporation business entity. We support Americas small businesses.

If you are requesting Expedited Services for your new entity filing then there will be an additional Expedited Fee for your Status requests. These costs must be incurred before the end of the first tax year the company is in business. Most startup costs must be amortized spread out over time but you can deduct up to 5000 of startup costs and 5000 of organizational costs in your first year of business.

Lucky for you Pace Small Business Development Center SBDC has partnered with City Bar Justice Center to explain the different forms of business structure to help you choose the right one for your business. Small business entity concessions. The fee is 5000 per certificate for a Short Form Certificate of Status states name and status of entity or 17500 for a Long Form Certificate of Status states status and all documents ever filed on entity.

Types of start-up costs for which an immediate deduction is. These costs must be paid before the date when your business begins so its important to establish that date. They may include costs for advertising travel surveys and training.

Overview Lenders 10 Financing. To qualify for these concessions youll need to determine if your business is a small business entity. Looking for guidance on how to form a company.

This will help you file your taxes accurately and make payments on time.

Registered Agent Colorado Registered Agent Business Advice Starting A Business

Registered Agent Colorado Registered Agent Business Advice Starting A Business

Apply Online Business Incorporation Start A S Corporation Now Business Format Raising Capital Online Business

Apply Online Business Incorporation Start A S Corporation Now Business Format Raising Capital Online Business

Easy Llc Formation Create An Llc Business Incorporation Business Entity Formation Business Forms Llc Business Starting An Online Boutique Online Boutique Business

Easy Llc Formation Create An Llc Business Incorporation Business Entity Formation Business Forms Llc Business Starting An Online Boutique Online Boutique Business

Intuit Official Blog Business Finance Start Up Business Business Tips

Intuit Official Blog Business Finance Start Up Business Business Tips

S Corporation S Corporation Money Management Advice Learn Accounting

S Corporation S Corporation Money Management Advice Learn Accounting

Tips For Small Business Owners Bookkeeping Business Small Business Bookkeeping Business Basics

Tips For Small Business Owners Bookkeeping Business Small Business Bookkeeping Business Basics

Want To Save Money On Your Small Business Taxes Forming An S Corp Might Be Your Answer To Self Emplo Business Tax Small Business Accounting Savings Calculator

Want To Save Money On Your Small Business Taxes Forming An S Corp Might Be Your Answer To Self Emplo Business Tax Small Business Accounting Savings Calculator

Photography Business Formation Business Format Photography Business Business

Photography Business Formation Business Format Photography Business Business

C Corporation Formation Services Ez Incorporate C Corporation Corporate Business Expense

C Corporation Formation Services Ez Incorporate C Corporation Corporate Business Expense

Partnership Vs Corporation Vs Sole Proprietorship Pesquisa Google Sole Proprietorship Corporate Flexibility

Partnership Vs Corporation Vs Sole Proprietorship Pesquisa Google Sole Proprietorship Corporate Flexibility

How Turn Your Small Business Into An Llc Volusion Small Business Business Strategy Success Business

How Turn Your Small Business Into An Llc Volusion Small Business Business Strategy Success Business

C Corporation Formation Services Ez Incorporate C Corporation Corporate Business Names

C Corporation Formation Services Ez Incorporate C Corporation Corporate Business Names

Llc Filing Business Formation Start Your Company Today Hobbies Quote Llc Business Business Format

Llc Filing Business Formation Start Your Company Today Hobbies Quote Llc Business Business Format

Comparison Of Business Entities Startingyourbusiness Com

Comparison Of Business Entities Startingyourbusiness Com

Llc Vs S Corp Which Is The Best For Freelancers Freelance Business Business Tips Sole Proprietorship

Llc Vs S Corp Which Is The Best For Freelancers Freelance Business Business Tips Sole Proprietorship

Llc Vs S Corp How To Choose The Best Small Business Entity Business Checklist Small Business Bookkeeping Small Business Accounting

Llc Vs S Corp How To Choose The Best Small Business Entity Business Checklist Small Business Bookkeeping Small Business Accounting

C Corporation Formation Services Ez Incorporate C Corporation Corporate Legal Separation

C Corporation Formation Services Ez Incorporate C Corporation Corporate Legal Separation

Can Help You Create An Llc S Corp C Corp Or A Non Profit For As Low As 49 They Can Also Act As The Registere Registered Agent Business Tax Corporate Law

Can Help You Create An Llc S Corp C Corp Or A Non Profit For As Low As 49 They Can Also Act As The Registere Registered Agent Business Tax Corporate Law