Is A Single Member Llc A Separate Legal Entity

Choosing the disregarded entity tax designation means that the LLC does not pay taxes on its profits and losses as a business entity but they instead pass through to the members individual taxes. It is no longer attached to and identified with the owner for tax or liability purposes.

How To Create Private Limited Company Private Limited Company Limited Liability Company Company

How To Create Private Limited Company Private Limited Company Limited Liability Company Company

Courts in a variety of states have pierced the veil of a single-member LLC from the outside and have held that it is not a separate entity and thus may not be used to protect the assets of the LLC from the creditors of the member.

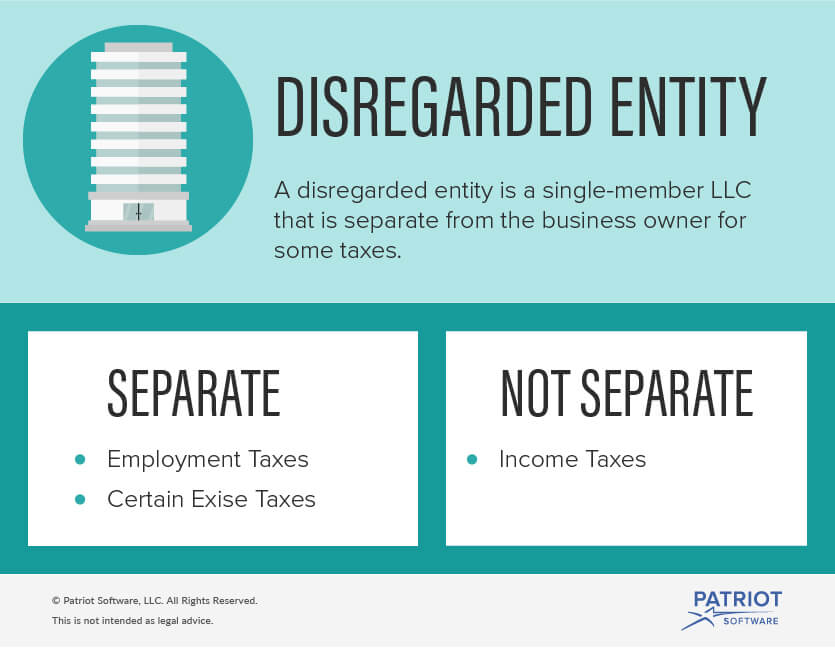

Is a single member llc a separate legal entity. Disregarded Entity is a term used by the IRS for Single-Member LLCs meaning that the LLC is ignored for tax purposes. For wages paid after January 1 2009 the single-member LLC is required to use its name and employer identification number EIN for reporting and payment of employment taxes. This means that you and the business are combined for income taxes.

The IRS says that for income tax purposes an LLC with only one member called a single-member LLC SMLLC is a disregarded entity as long as has not elected to be a corporation or S corporation. The Single-Member LLC is a separate legal entity but it is taxed through the owners personal tax return using Schedule C for business income. An LLC is typically considered as a separate entity from the owners.

By Christine Mathias Attorney A single-member limited liability company SMLLC is a single-owner business entity that gives the owner limited liability protection and tax benefits. The LLC will remain a separate entity for employment taxes and certain excise taxes. This is just for federal taxes though.

For example assume you get into a car accident texting and you get sued in excess of your insurance policy. Overview If your LLC has one owner youre a single member limited liability company SMLLC. The IRS default classification is to treat the single member LLC as a disregarded entity.

The SMLLC is now a separate business entity from its owner. We require an SMLLC to file Form 568 even though they are considered a. A single-member LLC that is classified as a disregarded entity for income tax purposes is treated as a separate entity for purposes of employment tax and certain excise taxes.

The LLC formation which is different from its taxation separates the member from certain business debts or lawsuits creating a separate entity and giving the member personal liability protection. However an LLC with only one member is disregarded as separate from its owner for income tax purposes. You obtain the tax code disregarded entity status with single-member LLCs owned by corporations partnerships and other LLCs and.

If you are married you and your spouse are considered one owner and can elect to be treated as an SMLLC. While both the single-member LLC and the sole proprietorship are solo business entities there are some advantages to having a sole proprietor business become a single-member LLC. In other words all of its income and loss are reported on the sole members schedule c.

The beauty of the single-member LLC for your rental real estate is tax simplicity with corporate-style liability protection. A single member llc withou a manager is a disregarded entity for federal tax purposes. Limited liability protection means that if the business is sued or owes money your personal assets will.

The IRS simply treats the LLC and its owner as the same person. If in a non-community property state a husband and wife hold the relinquished property jointly but wish to hold the replacement property in an LLC they must form two separate single member LLCs. For legal purposes the LLC and its owner are still separate and the LLC still protects the personal assets of its owner.

Is An Llc A Separate Legal Entity Corporate Direct

Is An Llc A Separate Legal Entity Corporate Direct

What Is A Disregarded Entity Single Member Llc

What Is A Disregarded Entity Single Member Llc

What Is A Disregarded Entity Llc Llc University

What Is A Disregarded Entity Llc Llc University

What Is An Llc Limited Liability Company How To Find Out About Me Blog

What Is An Llc Limited Liability Company How To Find Out About Me Blog

Ellie Photography Business Structure Business Ownership Business

Ellie Photography Business Structure Business Ownership Business

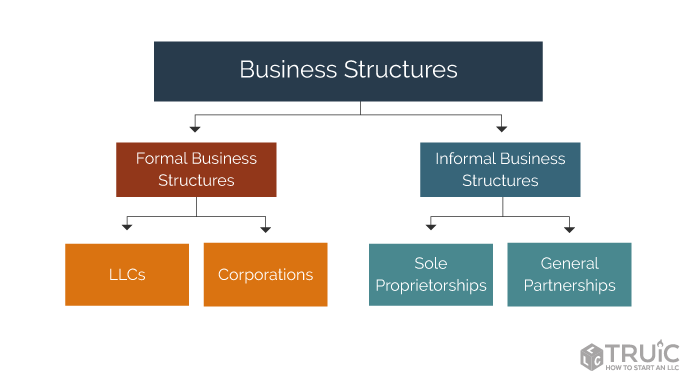

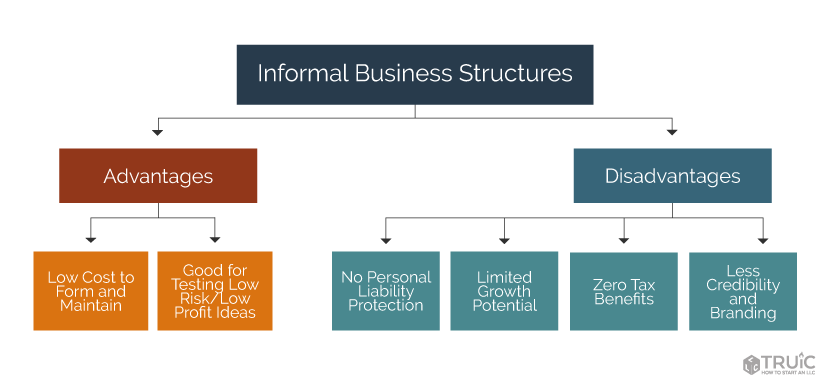

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic

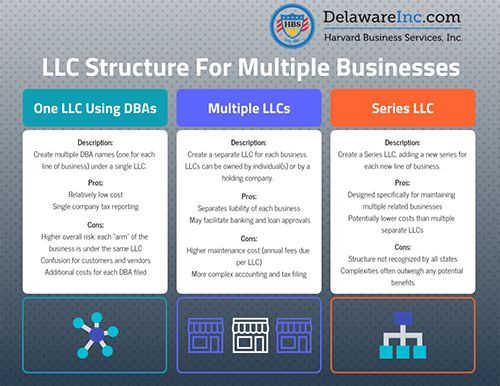

Operate Multiple Businesses Under One Llc Holding Company Harvard Business Services

Operate Multiple Businesses Under One Llc Holding Company Harvard Business Services

How To Create An Llc Limited Liability Company Requirements For Online 45 Personal Savings Business Structure Divorce Help

How To Create An Llc Limited Liability Company Requirements For Online 45 Personal Savings Business Structure Divorce Help

Advantages And Disadvantages Of Limited Liability Company Limited Liability Company Liability Raising Capital

Advantages And Disadvantages Of Limited Liability Company Limited Liability Company Liability Raising Capital

C Corporation Vs S Corporation Vs Llc Bookkeeping Business C Corporation S Corporation

C Corporation Vs S Corporation Vs Llc Bookkeeping Business C Corporation S Corporation

Is An Llc A Separate Legal Entity Corporate Direct

Is An Llc A Separate Legal Entity Corporate Direct

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

4 Most Common Business Legal Structures Pathway Lending

4 Most Common Business Legal Structures Pathway Lending

Business Entity Comparison Harbor Compliance

Business Entity Comparison Harbor Compliance

Corporate Entity Types Table Bookkeeping Business C Corporation S Corporation

Corporate Entity Types Table Bookkeeping Business C Corporation S Corporation

How To Form An Llc In Any State Business Checklist Llc Business Starting A Business

How To Form An Llc In Any State Business Checklist Llc Business Starting A Business

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic

Llc Vs S Corp Which Is The Best For Freelancers Freelance Business Business Tips Sole Proprietorship

Llc Vs S Corp Which Is The Best For Freelancers Freelance Business Business Tips Sole Proprietorship

How To Create An Llc Limited Liability Company Requirements For Online 45 Limited Liability Company Liability Company

How To Create An Llc Limited Liability Company Requirements For Online 45 Limited Liability Company Liability Company