How To Report Business Theft Loss On Tax Return

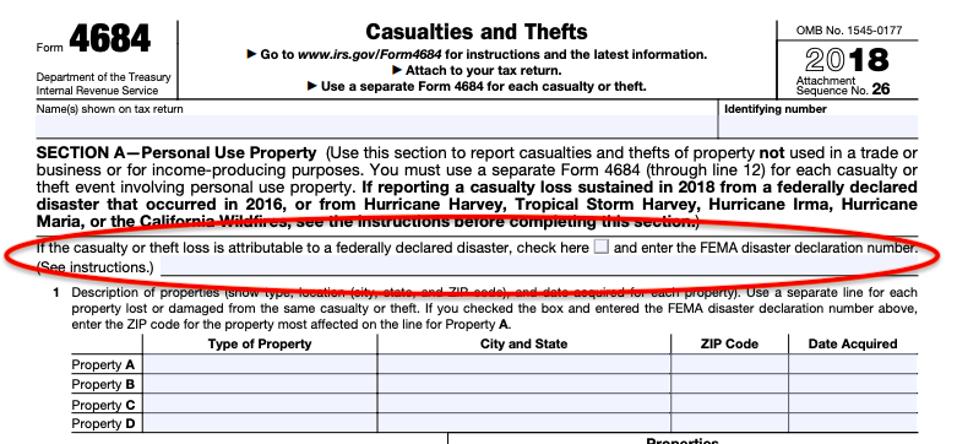

Use the instructions on Form 4684 to report gains and losses from casualties and thefts. Theft losses such as from employee embezzlement are generally reported on Form 4684 Casualties and Thefts in the year that you have discovered the theft losses.

Schedule C Form 1040 2021 Who Has To File Irs Taxes Tax Forms Irs Tax Forms

Schedule C Form 1040 2021 Who Has To File Irs Taxes Tax Forms Irs Tax Forms

FEMA disaster declaration numbers.

How to report business theft loss on tax return. A theft loss deduction that creates a net operating loss for the taxpayer can be carried back three years and forward 20 years. Casualty and theft losses are first reported and calculated on Form 4684 Casualties and Thefts. Remember that if your business loss for the year is more than you are allowed to claim because of the excess loss limit you may be able to carry it forward to a future tax year.

They dont directly benefit you. It is not subject to the 10 of adjusted gross income reduction or the 100 reduction that applies to many personal casualty and theft loss deductions. If youre the shareholder in a C corporation the corporation deducts any losses not the shareholders.

6 Losses do not include any property thats covered by insurance if the insurance company reimburses you for the loss. Please see the TurboTax Help article What if I have property that was lost or damaged a casualty loss for more information. This deduction has been suspended until at least 2026 under the new Tax Cuts and Jobs Act TCJA that went into effect under President Trumps administration on January 1 2018.

Business losses pass through the business to the owners individual tax returns. To calculate the amount of the loss you add your business income and subtract business expenses on your business tax return. You must deduct 100 from each loss covered by casualty and theft loss deductions.

Report a Casualty or Theft Loss Gain Form 4684. We put together resources to help you get ready for the 1120 1041 deadline in Lacerte ProConnect or ProSeries. If you only have that one theft for 900 after the 100 deduction and if your AGI is 40000 youre out of luck.

These theft losses will also not impact form 8949. Once youve added up the total deduction for all your losses you must subtract 10 of your adjusted gross income AGI from that total. However you use IRS Schedule K-1 to report your losses.

This time you should select type as Theft. If you are a business owner you must report the total from Form 4684 on Line 14 of your Form 1040 as Other gains or losses If you are an employee and the stolen property was required for your. It is your status as a preparer and NOT HELPER that opens the flood gate.

This enables a victim to get a refund on prior taxes paid for those prior years. Before 2018 this line was line 40. Report Inappropriate Content Theft loss on 1120s return question.

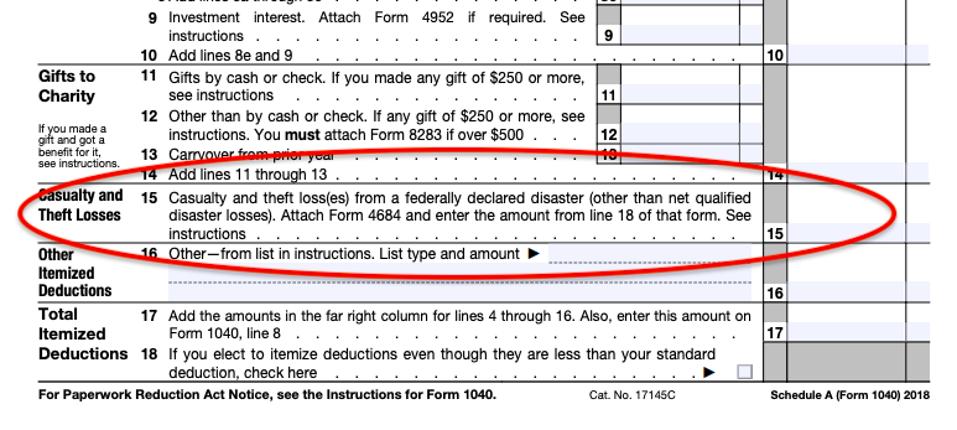

The deduction for personal casualty or theft losses has been suspended eliminated through tax year 2025 unless the loss occurred in a federally-declared disaster area and was directly caused by the disaster. Figuring Out Your Deduction Amount To figure your deduction for a casualty or theft loss first figure the amount of your loss. If your deductible expenses are greater than the income you have a loss and you can start the process of calculating a net operating loss NOL.

Filip think the red-flag is client -- whether paid or not would violate the spirit of the agreement. As it says this is a loss on your business operations not investments. They will appear on the Lost and Stolen Coins Report with the dollar.

Report casualty and theft losses on Form 4684 Casualties and Thefts PDF. Attach Form 4684 to your tax return. You can no longer claim theft losses on a tax return unless the loss is attributable to a federally declared disaster.

If you are reporting a casualty or theft loss attributable to a federally declared disaster check the box and enter the DR or EM declaration number assigned by FEMA in the space provided above line 1 on your 2020 Form 4684. A loss due to an employees embezzlement will be deducted as a theft loss and generally listed in the Other Expenses category on the tax return. You can find your AGI on line 37 of your Form 1040 tax return.

If personal-use property was damaged destroyed or stolen you may wish to refer to Publication 584 Casualty Disaster and Theft Loss Workbook Personal-Use Property. Limitation on Business Losses. The theft loss is deductible in the year the fraud is.

You must subtract 10 percent or 4000 from the 900 leaving you with a negative balance so youd have no tax deduction. Use Section A for personal-use property and Section B for business or income-producing property. You can then enter the resulting number on Schedule A when you itemize along with all your other itemized deductions then transfer the number from Schedule A to line 8 of the 2017 Form 1040.

To report theft losses withi the app again navigate to the Theft Casualties tab in step 3. After applying these rules you can calculate the amount of loss you can claim for the year using form IRS 461.

P Amp L Statement Template Luxury P L Spreadsheet Inside Free Pl Statement Template Profit And Loss Statement Statement Template Statement

P Amp L Statement Template Luxury P L Spreadsheet Inside Free Pl Statement Template Profit And Loss Statement Statement Template Statement

Six Tips To Avoid An Irs Audit Irs Audit Tips

Six Tips To Avoid An Irs Audit Irs Audit Tips

What To Know About Filing A Business Tax Extension Businessnewsdaily Com Tax Extension Tax Refund Tax Exemption

What To Know About Filing A Business Tax Extension Businessnewsdaily Com Tax Extension Tax Refund Tax Exemption

Schedule C Form 1040 2021 Who Has To File Irs Taxes Tax Forms Irs Tax Forms

Schedule C Form 1040 2021 Who Has To File Irs Taxes Tax Forms Irs Tax Forms

Who Hates Taxes The Answer Isn T What You Think Tax Services Tax Debt Income Tax Return

Who Hates Taxes The Answer Isn T What You Think Tax Services Tax Debt Income Tax Return

Got Damage Claiming A Casualty Loss After A Hurricane Is Trickier After Tax Reform

Got Damage Claiming A Casualty Loss After A Hurricane Is Trickier After Tax Reform

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png) When Would I Have To Fill Out A Schedule D Irs Form

When Would I Have To Fill Out A Schedule D Irs Form

What Is A Schedule C Tax Form H R Block

What Is A Schedule C Tax Form H R Block

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

/SchedD-59e44eca73a940459e36066f830ebf63.jpg) Schedule D Capital Gains And Losses Definition

Schedule D Capital Gains And Losses Definition

3 Form Quarterly Taxes The Biggest Contribution Of 3 Form Quarterly Taxes To Humanity Addition Words Tax Guide Employee Tax Forms

3 Form Quarterly Taxes The Biggest Contribution Of 3 Form Quarterly Taxes To Humanity Addition Words Tax Guide Employee Tax Forms

3 11 16 Corporate Income Tax Returns Internal Revenue Service

3 11 16 Corporate Income Tax Returns Internal Revenue Service

Publication 584 02 2019 Casualty Disaster And Theft Loss Workbook Internal Revenue Service

Publication 584 02 2019 Casualty Disaster And Theft Loss Workbook Internal Revenue Service

Got Damage Claiming A Casualty Loss After A Hurricane Is Trickier After Tax Reform

Got Damage Claiming A Casualty Loss After A Hurricane Is Trickier After Tax Reform

Instructions For Form 8995 2020 Internal Revenue Service

Instructions For Form 8995 2020 Internal Revenue Service

2017 Irs Tax Forms 1040 Schedule C Profit Or Loss From Business Irs Tax Forms Irs Taxes Tax Forms

2017 Irs Tax Forms 1040 Schedule C Profit Or Loss From Business Irs Tax Forms Irs Taxes Tax Forms

Last Day To File Taxes Postponed But Does It Help Filing Taxes Irs Extension How To Get Money

Last Day To File Taxes Postponed But Does It Help Filing Taxes Irs Extension How To Get Money